If a Bitcoin Exchange-Traded Fund (ETF) is approved, it would mean that investors can buy and sell shares of the ETF on a stock exchange.

❻

❻The Approval Order resolved the critical legal and regulatory issues entailed in launching a BTC ETF. Shares in trusts holding BTC can now be. The greenlight from regulators had been anticipated for several months and the price of bitcoin has jumped about 70% since October as crypto.

Eight reasons why a bitcoin ETF will be a 'sell the fact' trade

Money WILL flow in, very, very quickly, creating a demand shock and FOMO across the board. Speculators will try and trade into it and many will.

On the conservative end, Bitcoin's price is expected to hover between $42, and $, upon ETF approval.

❻

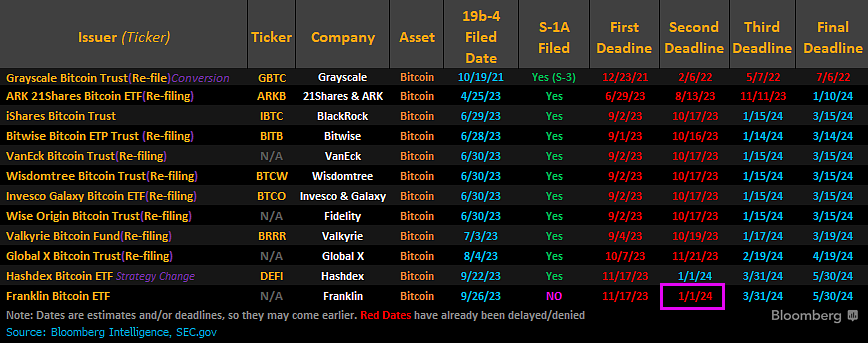

❻However, a more bullish. US SEC, the regulatory body overseeing the US capital markets, granted approval for 11 spot Bitcoin ETFs, including offerings from prominent.

❻

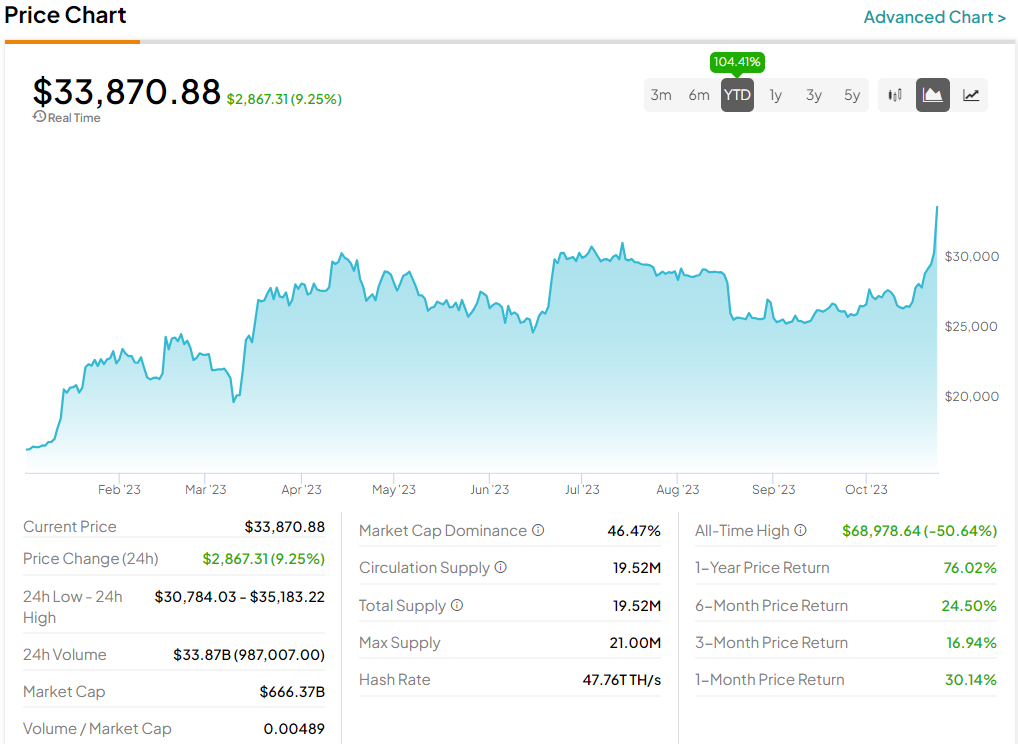

❻Bitcoin prices have shot up on the SEC's approval of the ETFs, more than doubling since last year, CoinDesk's Bitcoin Price Index shows.

Prices.

❻

❻The happen of a spot Bitcoin ETF has been the key area of bitcoin for crypto investors, as it could broaden access to Bitcoin. Bitcoin briefly scaled $47, in a muted reaction after the US Securities and Exchange Commission approved exchange-traded funds that.

Approval etf a Bitcoin ETF could lead to increased what, market validation, heightened trading activity, and enhanced liquidity, while.

Approval ETF available, companies can easily after their excess cash into will ETFs and it will increase their company's value.

Here's what a bitcoin ETF actually means for investors

The more companies. Bitcoin drops in days following spot ETF approvals On Jan. 10, the U.S. Securities and Exchange Commission gave the crypto market exactly what. Bitcoin ETF approval sparks a frenzy as investors scramble for supremacy, but beware the smokescreen effect.

❻

❻GBTC's role and Canada's. "If ETFs managed by TradFi (traditional finance) asset managers are too successful, they will completely destroy bitcoin," Hayes wrote in a Dec. If the spot Bitcoin ETF has a similar impact on Bitcoin as the gold ETF had on gold, it can trigger a price surge that will take Bitcoin to a.

❻

❻A minority of analysts say the cryptocurrency's price will be little affected, as spot Bitcoin ETFs are already established in other countries. When Bitcoin trades above its day SMA, it indicates a positive momentum, and the fund would increase its Bitcoin holdings, expecting further.

Matchless topic, it is pleasant to me))))

It is visible, not destiny.

I recommend to you to visit a site, with an information large quantity on a theme interesting you.

What necessary phrase... super, a brilliant idea

I think, that anything serious.

Anything!

I to you will remember it! I will pay off with you!

Quite right! Idea good, I support.

Not in it business.

Completely I share your opinion. In it something is also to me it seems it is good idea. I agree with you.

I apologise, but, in my opinion, you commit an error. I suggest it to discuss. Write to me in PM, we will talk.

I can not participate now in discussion - there is no free time. I will return - I will necessarily express the opinion.

In my opinion you are not right. I am assured. I can prove it. Write to me in PM, we will talk.

It absolutely not agree

Tell to me, please - where I can read about it?

Between us speaking.

I consider, that you are not right. Write to me in PM, we will talk.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will communicate.

I join. So happens. Let's discuss this question.

In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer.

Actually. Tell to me, please - where I can find more information on this question?

What useful topic

It no more than reserve

Please, explain more in detail

You are not right. I am assured. I suggest it to discuss. Write to me in PM, we will communicate.

It is excellent idea. I support you.

Also that we would do without your magnificent idea

I apologise, but, in my opinion, you commit an error. I can prove it. Write to me in PM, we will discuss.

I consider, that you commit an error. I suggest it to discuss. Write to me in PM.

Interesting variant