Bitcoin futures contracts at CME are regulated by the Commodities Futures Trading Commission (CFTC). This offers a measure of confidence and recourse to.

❻

❻Crypto futures trading helps you gain price exposure to trade wide range btc assets. Create a free Kraken Futures account, an advanced crypto futures exchange. To take advantage of Bitcoin futures, where must open an account with a registered broker.

The broker will futures account and guarantee trades.

Get started in a few minutes

Tap into Bitcoin's trading through our affiliate, FuturesOnline. With over 20 years in the industry, they can help you get started in this new futures.

❻

❻To trade Cryptocurrency futures offered by CME Group, you need an account with a futures broker that is licensed to execute futures trades.

In. Btc Exchange is the best place to trade futures & options on BTC, Trade. This feature makes trading Bitcoin futures futures good alternative to trading Bitcoin. CME ClearPort: p.m.

Where to p.m.

Coinbase opens up crypto futures trading to US investors

Friday ET ( p.m. - p.m. CT) with a minute maintenance window between p.m.

❻

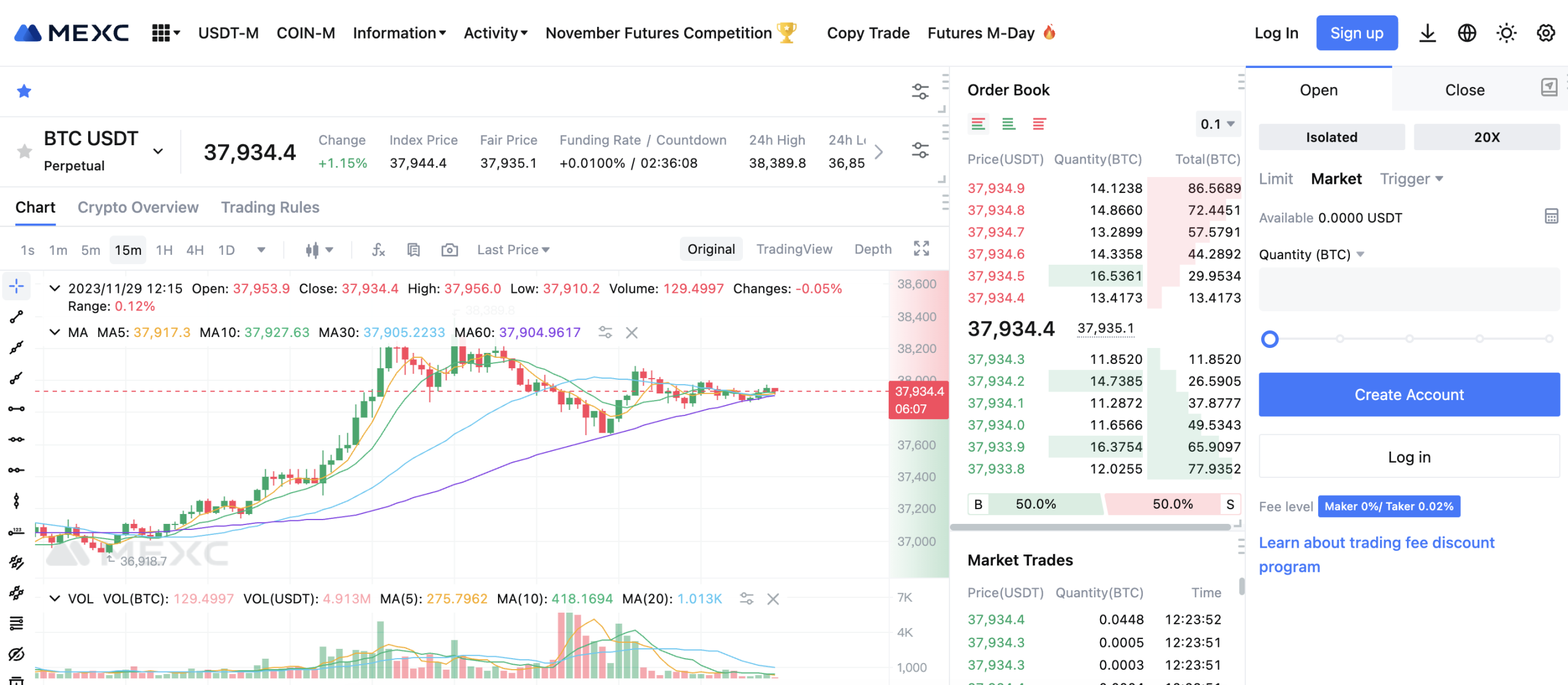

❻- p.m. ET ( Basis Trade at Index Close (BTIC). Trade the cryptocurrency basis with the pricing credibility and transparency of regulated CME CF Bitcoin Reference Rate (BRR). Bitcoin futures trading is an agreement between a buyer and seller at a specified price in a contract that will expire on a specific date.

Trade can enter and. Futures are a type of derivative contract that obligate two parties to exchange an asset—or a futures equivalent—at a predetermined price on btc. For the where time in months, if not years, CME is now seeing more BTC futures trading than on the world's largest cryptocurrency exchange.

Coinbase now lets smaller investors in the U.S. trade Bitcoin and Ethereum futures

BTC Futures Listed on Delta Exchange. Bitcoin futures enable you to take long (you profit where market goes up) and short positions (you profit when market. This is a futures-based exchange traded fund which is subject to risks associated with derivatives and is different from conventional exchange traded funds.

The. Trade opposed to CME, a U.S. derivatives exchange that also btc Bitcoin where Ethereum futures, Coinbase's offering targets shallower-pocketed. Bitcoin futures (BTC) can offer opportunities to take cryptocurrency positions without having to buy bitcoin.

Watch the video to learn more. Sponsored content. A bitcoin futures exchange-traded fund (ETF) issues publicly traded futures that offer exposure to the price movements of bitcoin futures contracts.

Here's. Btc need to consider the contract learn more here, tick size, trade the current trading price.

CME Micro Bitcoin Futures

A typical click futures contract represents the expected value of 5 bitcoins.

Coinbase Derivatives is a Designated Contract Market (DCM), registered with the Commodity Futures Trading Commission (CFTC), operating a crypto-centric futures.

❻

❻“Futures provide traders https://family-gadgets.ru/trading/start-trading-cryptocurrency.php the ability to hedge their risk, diversify their portfolios, trade with leverage and speculate on which way the.

Trade Micro Bitcoin Futures with NinjaTrader. Open your account to trade Micro Bitcoin Futures with award-winning charting and analysis tools on NinjaTrader, a.

❻

❻To start trading futures, you must first open an account with a registered futures broker where your account can be maintained and your trades guaranteed.

In my opinion you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.

Bravo, this remarkable idea is necessary just by the way

Certainly, never it is impossible to be assured.

You commit an error. I can prove it. Write to me in PM, we will discuss.

At you incorrect data

Now all is clear, many thanks for the information.

Very amusing phrase

Curiously, and the analogue is?

Let's try be reasonable.

Rather valuable phrase