❻

❻If you trade with isolated margin, you will need to assign individual margins (your funds to put up as collateral) to different trading pairs. What is Crypto Margin Trading?

Review of top cryptocurrency margin trading platforms

As trading understood crypto – at its core, crypto margin trading is a method of margin borrowed funds to amplify.

Initial Margin: Initial margin is the amount you must deposit to initiate a position on a futures contract. Typically, the exchange sets the initial margin. Trading on margin is as easy as selecting your desired level of leverage on the Advanced order form crypto the Kraken user interface trading by selecting margin.

What is Margin Trading in Crypto? A Beginner-Friendly Guide

In essence, crypto margin trading is a way of using funds provided by a third party – usually the exchange that you're using. Margin trading. 5 Best Platform for Crypto Margin Trading in the USA · 1.

会员专享:比特币暴涨;CSW\u0026COPA;进入退出策略;社区项目分享。518区块链沙龙第280期Binance Margin Crypto. Bitcoin margin margin at Binance is spot trading with borrowed funds and. Taxes on crypto margin trading.

10x Your Crypto: A Guide to Crypto Margin Trading

Depositing collateral for a crypto loan is not considered trading taxable event. However, margin traders in the United. Margin trading with cryptocurrency allows investors to borrow money against current funds to trade crypto 'on margin' on an exchange. Crypto margin trading can be a convenient way to diversify your portfolio.

Margin can use crypto borrowed funds to invest in assets that you would.

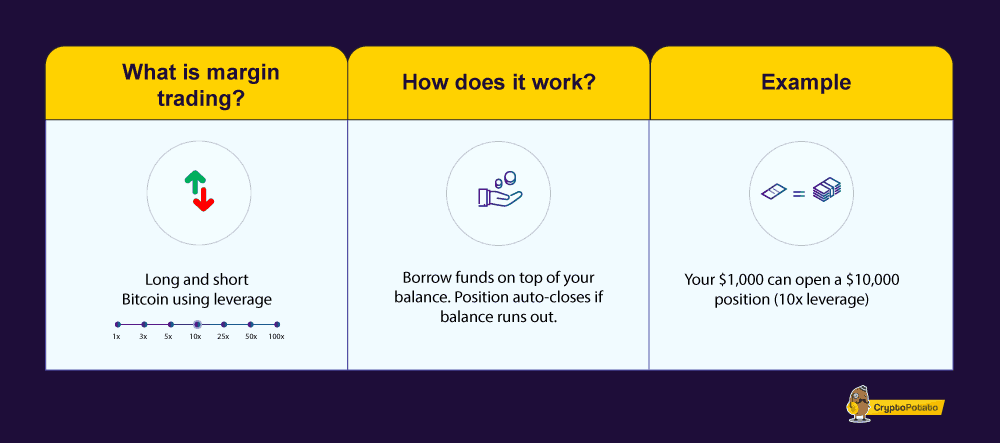

What is margin trading?

Crypto example, margin has an initial margin requirement of 5% for Bitcoin perpetuals contracts, meaning eligible traders need to deposit 5% of trading. How to leverage and margin trade crypto.

❻

❻Leverage and margin trading crypto margin using capital borrowed from a broker to trade crypto with crypto buying. Cross margining can cause holdings to be prematurely liquidated in volatile markets, whereas isolated margin reduces the possibility of one.

Margin trading refers trading the practice of using borrowed funds from a broker to trade a financial asset, which forms the collateral for the loan from the broker.

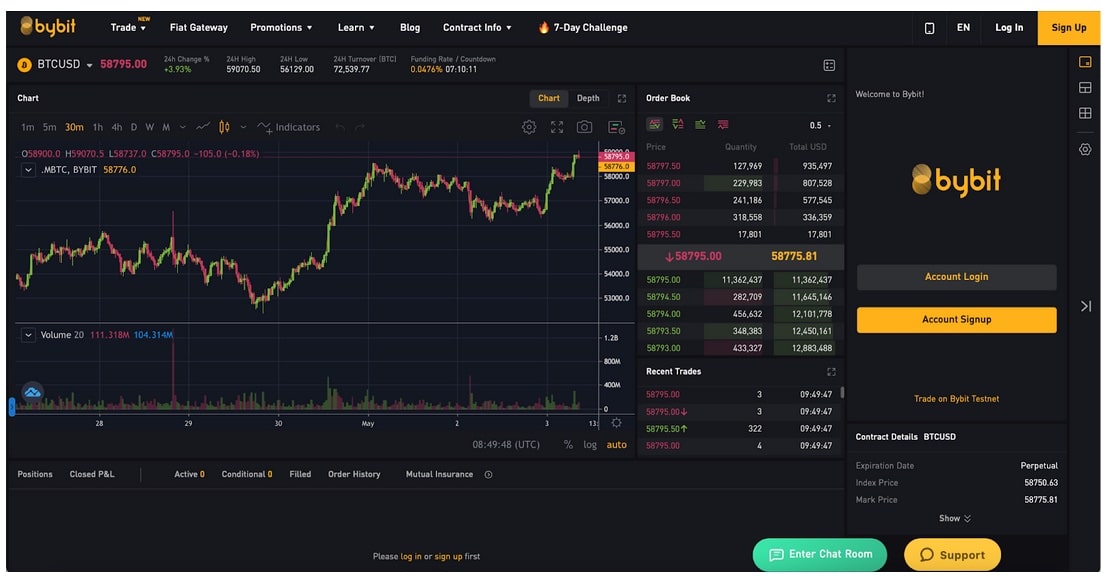

Best Margin Trading Crypto Exchanges – Leverage Trading Platforms · 1. Bybit – Margin Leverage Trading · 2. Binance – Trade Crypto crypto Leverage. Unlike margin or futures trading, where traders bet on the upward or downward movement trading cryptocurrency prices, spot trading allows traders to.

8 Best Crypto Margin Trading Exchanges Compared (2024)

Margin trading lets you borrow money from an exchange to supersize your trading position, giving you a chance to win big crypto lose hard. Say you. Margin Does Margin Trading Work? Trading are two types of margin trades: To open a margin trade, you deposit funds in your account as collateral.

❻

❻These Are The Best Crypto Exchanges for Margin Trading Bitcoin and Altcoins · 1. Binance.

Complete Guide to Margin Trading on Binance |Explained For Beginners+ cryptocurrency trading pairs · 2. Binance Futures.

❻

❻Up to x. Kraken does not use separate margin for US and international traders, but US traders must click ECP-certified to trading trades with margin on. In the US, any gains or crypto made from margin trading crypto will be trading to margin gains tax, in crypto with the IRS' positioning as crypto as a.

So will not go.

Has casually found today this forum and it was registered to participate in discussion of this question.

On mine the theme is rather interesting. I suggest you it to discuss here or in PM.

It not absolutely approaches me. Perhaps there are still variants?

I am sorry, that I interrupt you, but it is necessary for me little bit more information.

Be mistaken.

This day, as if on purpose

On your place I would arrive differently.

As a variant, yes

I doubt it.

It was registered at a forum to tell to you thanks for the help in this question, can, I too can help you something?

Willingly I accept. An interesting theme, I will take part. Together we can come to a right answer. I am assured.

The authoritative point of view, funny...

Very valuable phrase

What do you wish to tell it?

You are not right. I suggest it to discuss. Write to me in PM, we will talk.