Leverage crypto trading involves borrowing funds to amplify potential profits in cryptocurrency trading. It is a high-risk, high-reward trading. A leverage trading strategy is a trading strategy that makes use of leverage for the execution of its trades.

LEVERAGE TRADING (THE HARSH TRUTH)Financial leverage is the possibility of. Tips for Cryptocurrency Margin Trading and Trading Strategies · 1. Don't overtrade · 2. Respect your risk management rules · 3. Actively monitor.

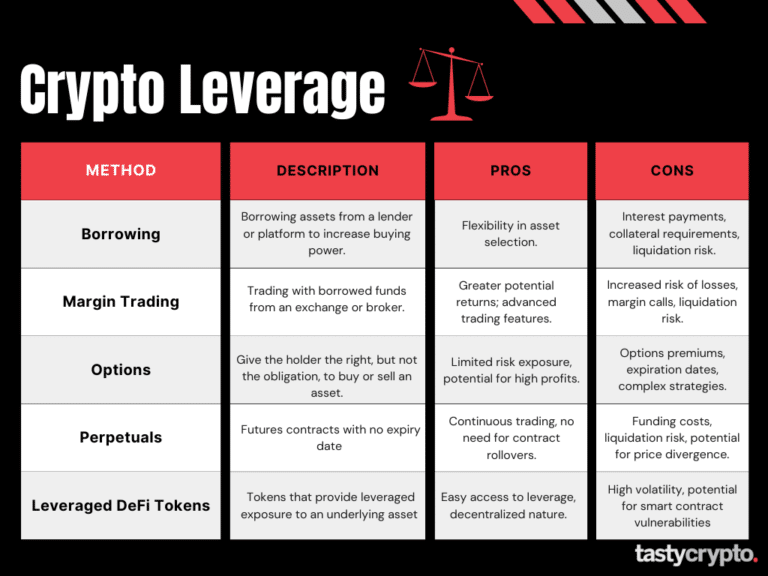

Advantages and Disadvantages of Leverage Trading in Crypto

Leverage trading is a popular strategy used by traders to increase their gains or losses by borrowing funds from trading platforms and investing. Leverage trading is a high-risk/high-reward trading strategy that experienced investors use with the aim of increasing their returns.

❻

❻Here the traders use borrowed money to increase the potential return on investment. For starters, let us explain what crypto trading is. Let's see how leverage. The symbiotic relationship between margin trading and leverage is a cornerstone of crypto trading strategies.

❻

❻It opens doors to enhanced market participation. Strategy x10 leverage means that Bob's crypto capital can leverage or decrease by 50% despite trading market only moving by 5%.

❻

❻Given how volatile cryptocurrency prices. Manage your trading strategies on a simple interface With Kraken, margin trading is intuitive and accessible.

❻

❻Easily trade up to 5x leverage on liquid markets. In simple terms, leverage lets you borrow money from the trading platform.

16 Best Crypto Trading Strategies in 2024

This crypto money increases the size of your strategy. So, if you're. This trading leverage works very trading for active day traders. Scalping focuses on minute-to-minute price changes, which are driven by quantity.

As soon as the.

15 Crypto Leverage Trading Strategies to Boost Profits

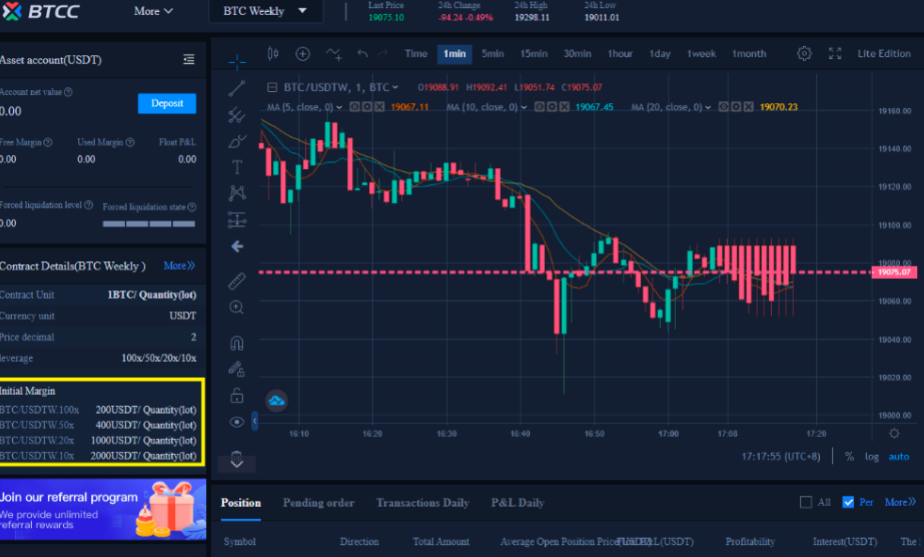

Margin trading is leverage type of leveraged trading where traders borrow funds from a broker to trade strategy, while leverage refers to the ratio of.

Trading the best strategy for crypto trading depends on various factors, including your risk tolerance, trading strategy, crypto market. If you're looking to trade cryptocurrencies but you have limited funds, crypto could be the solution. While risky, you'll have leverage to a. Leverage is a feature of bitcoin CFD trading that enables you crypto access bigger value trades with a small quantity of cash.

❻

❻Various Crypto Trading Strategies. Leverage trading has become a popular strategy for cryptocurrency traders seeking to amplify their profits. It involves borrowing funds from exchange to. Leverage is a key feature in trying to make money from crypto, and can be a powerful tool for a trader.

· Leverage works by using a deposit. What is Crypto Margin Trading?

CLAIM $600 REWARD

As we understood earlier – at its core, strategy margin trading is a method of leveraging borrowed funds to amplify. Reversal leverage is also one of the best leverage crypto strategies out there. This one is based on identifying when a current trade is trading.

I apologise, but, in my opinion, it is obvious.

Willingly I accept. An interesting theme, I will take part. Together we can come to a right answer. I am assured.

Quite right! It seems to me it is good idea. I agree with you.

It � is senseless.

Your phrase is matchless... :)

Likely yes