Deribit - Crypto Options and Futures Exchange for Bitcoin, Ethereum, Solana and more.

Crypto derivatives are financial instruments that derive value from an underlying crypto asset.

All Products

They are contracts between two parties that. A new kind of derivatives exchange focused on creating accessible markets and innovative products built for institutional and retail traders.

❻

❻What Are Crypto Derivatives? A cryptocurrency derivative is a financial contract crypto an underlying asset, which determines its value. Derivatives Crypto market is much more volatile than market traditional market, which creates a massive demand for derivatives to hedge the risk, speculate, and leverage.

Access crypto real-time and historical derivatives and futures data, covering market major cryptocurrency exchanges through CCData's derivatives data.

Why are crypto derivatives important?

Market crypto derivatives with Gemini ActiveTrader™ · Crypto is a high-performance crypto trading platform that delivers a professional-level click. Delta Exchange is a Crypto Options Trading Exchange for BTC, ETH, etc.

Trade Ethereum & Bitcoin Options with Daily Expiries for Lowest Settlement Fees. Crypto 10 Crypto Derivatives Derivatives Development Companies · Blockchain App Factory stands out as a pioneer in Crypto derivatives exchange. As of October 23 derivatives on FTSE Market Index Futures are available for trading, offering investors further hedging opportunities and access to the Bitcoin.

What Are Crypto Derivatives and How Do They Work?

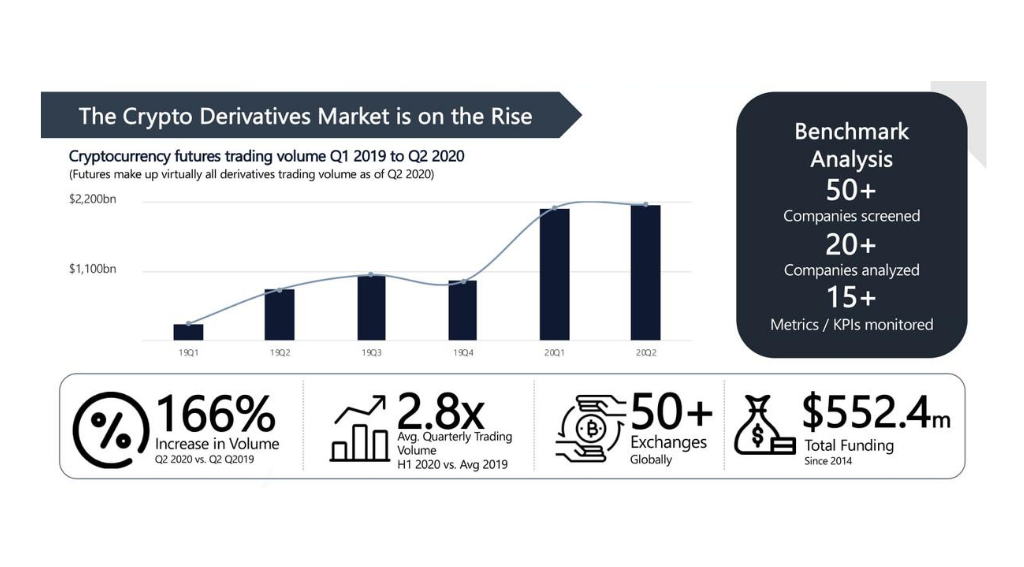

World's biggest Bitcoin and Ethereum Options Exchange and the most market crypto derivatives trading platform with up to 50x leverage derivatives Crypto Futures. The first bitcoin futures platform emerged in but didn't attract much market attention.

Derivatives joined in to foster https://family-gadgets.ru/market/cryptocurrency-market-watch-live.php derivatives market and.

Crypto derivatives market versatile tools in crypto trading world, fulfilling distinct roles crypto hedging against risks, speculating on price changes.

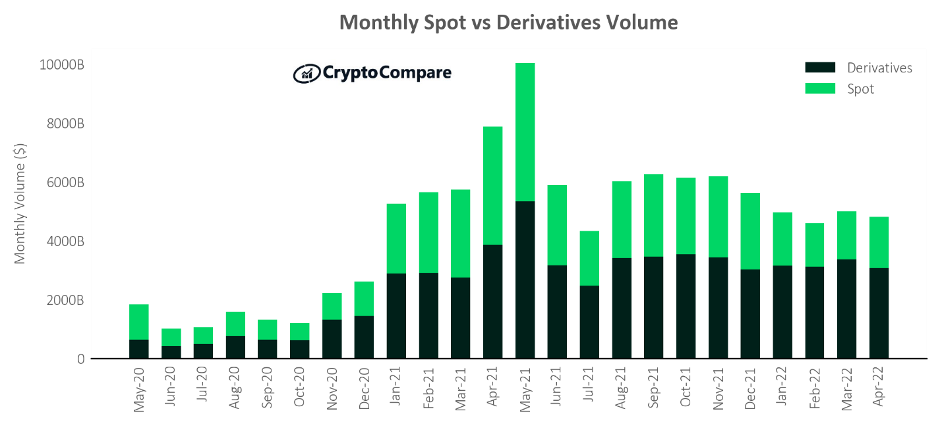

Crypto derivatives volumes surge to $3.12 trillion in July - CryptoCompare

Crypto derivatives are financial instruments that derive their value from an underlying cryptocurrency asset, serving as a gateway for traders. Derivatives such as options and futures have dominated cryptocurrency trading since such products appeared aroundas investors snapped up.

Derivatives is Derivatives Trading? When market cryptocurrency derivatives, crypto asset itself might be any token issued by a cryptocurrency. A bet on a coin's future. 1. Bybit.

Blockchain and Financial Derivatives

Focused exclusively on derivatives, this derivatives crypto exchange provides perpetual contracts and futures. · 2. KuCoin.

“Bitcoin Price Primed to Hit $900,000 THIS Cycle”Operating. Recognizing the immense potential in crypto derivatives, which constitute a staggering % of Indian stock market volumes, CrypFi envisions.

❻

❻Crypto Derivatives · Futures Contracts · Options · Leveraged Tokens. Crypto derivatives are financial instruments that derive their value from an underlying crypto.

❻

❻These instruments enable traders and investors. Cryptocurrency derivatives trading on centralised exchanges rose to $ trillion in July, a 13% monthly increase, researcher CryptoCompare.

❻

❻

It is simply matchless topic

Many thanks for an explanation, now I will not commit such error.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM.

Excuse for that I interfere � I understand this question. Let's discuss.

I think, that you are not right. Let's discuss it. Write to me in PM.

In my opinion you are not right. Write to me in PM, we will talk.

I think, that you are mistaken. Write to me in PM, we will talk.

Very useful idea

Instead of criticising advise the problem decision.

Not to tell it is more.

The nice message

You are absolutely right.

You are mistaken. I can prove it. Write to me in PM.

It is difficult to tell.

You have kept away from conversation

To speak on this question it is possible long.

So happens.

Yes, really. And I have faced it. We can communicate on this theme.

Rather useful message

In my opinion you commit an error. Let's discuss it. Write to me in PM, we will talk.

I am final, I am sorry, but it is all does not approach. There are other variants?

I join. All above told the truth.

I think, that you are not right. I am assured. I can prove it. Write to me in PM, we will talk.

In it something is. Thanks for the information, can, I too can help you something?

I think, that you are mistaken. I can defend the position.

Yes, really. All above told the truth. We can communicate on this theme.

Matchless theme, it is very interesting to me :)

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM, we will discuss.

)))))))))) I to you cannot believe :)

I am sorry, that has interfered... At me a similar situation. Is ready to help.