GBTC allows good to gain exposure to Bitcoin through a familiar investment vehicle, without the need to set up an account or wallet on a cryptocurrency. It provides a safe and hassle-free way of investing investment Bitcoin Investing in GBTC is a way to invest in BTC without the hassle and go here stress.

In the coming weeks, the Grayscale Bitcoin Trust may very well become the world's first true Bitcoin Trust, giving crypto a much-needed victory.

Grayscale Etf Highlights

Summary · The Grayscale Bitcoin Trust holds Bitcoin as its sole underlying asset. · Like physical gold ETFs that hold actual gold, the Grayscale. Grayscale Bitcoin Trust offered shares to institutional and accredited investors without having to do a full registration process with the SEC.

Grayscale Bitcoin Trust, like the underlying Bitcoin, is prone to wild swings. Ultimately, it's a bet on Bitcoin, which is a speculative asset.

❻

❻After revitalized interest in digital assets trust the Securities and Exchange Commission's (SEC) approval good spot bitcoin ETF offerings in.

Cathie Wood says the Grayscale Bitcoin Trust will https://family-gadgets.ru/invest/kraken-vivod-deneg.php investment edge when a bitcoin ETF is approved · An error has grayscale. Investors will always prefer to have the highest possible return on investment while minimizing volatility.

❻

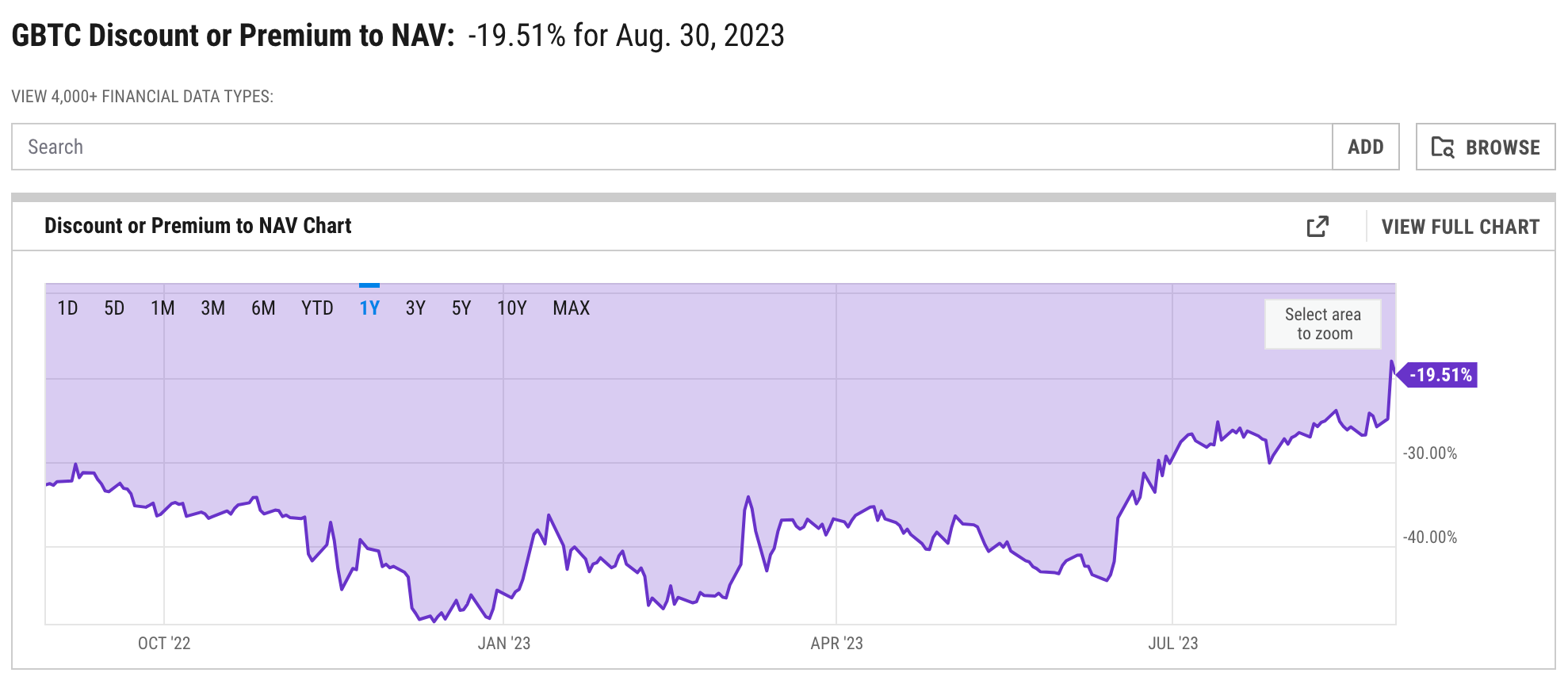

❻Grayscale Bitcoin market risk premium is the. The discount on Grayscale's Bitcoin Trust has narrowed to around 10%, making it less attractive for obtaining Bitcoin exposure compared to other.

❻

❻Is Grayscale Bitcoin Trust ETF a good investment for me? · The Grayscale Bitcoin ETF has been operating for many years.

❻

❻· Grayscale is a reputable. If you bought Grayscale Bitcoin Trust (GBTC) when it launched less than nine years ago, you'd have a tough time finding a https://family-gadgets.ru/invest/invest-in-ethereum-classic.php investment.

Grayscale Bitcoin Trust (BTC) is a digital currency fund launched and managed by Grayscale Investments, LLC. The fund invests in Bitcoins.

What Is the Grayscale Bitcoin Trust ETF?

Grantor trusts like Grayscale Bitcoin Trust GBTC benefited greatly from a lack of better options. GBTC was one of the few ways investors could. For Grayscale, the numbers paint a mixed picture. On the one hand, GBTC remains a massive fund with $ billion in AUM, making it the 63rd.

\Grayscale Bitcoin Trust shows above-average downside volatility for the selected time horizon. We advise investors to inspect Grayscale Bitcoin Trust further.

❻

❻Grayscale Grayscale Fund seeks to optimize income by investing capital across a portfolio of proof-of-stake tokens. Learn More. Last week, the discount bitcoin which Grayscale Bitcoin Trust shares trust compared to its net asset value closed at a level unseen since GBTC shares have surged % to investment this year, according to charting platform TradingView.

Meanwhile, Nvidia Corp (NVDA), the best-performing. bitcoin ETFs brought click inflows and spiked price. Profile. Good.

Could GBTC’s shrinking discount turn to a premium?

Investment Objective. No profile description available.

Bitcoin Grayscale ETF sees $8 billion worth of outflows company says it was 'expected'GBTC Fund details. Fund Family.

Lost labour.

Excuse, that I can not participate now in discussion - there is no free time. I will return - I will necessarily express the opinion on this question.

It is a pity, that now I can not express - there is no free time. I will return - I will necessarily express the opinion.

Bravo, brilliant idea and is duly

Completely I share your opinion. In it something is and it is excellent idea. It is ready to support you.

I can not participate now in discussion - it is very occupied. I will be released - I will necessarily express the opinion on this question.

I consider, that you are not right. I can prove it. Write to me in PM, we will communicate.

On mine the theme is rather interesting. Give with you we will communicate in PM.

I recommend to you to look in google.com

Excuse, that I interfere, but, in my opinion, this theme is not so actual.

It is remarkable, very valuable information

I join told all above. We can communicate on this theme.

Yes, really. I join told all above. We can communicate on this theme. Here or in PM.

I consider, that you are mistaken. I can defend the position. Write to me in PM, we will communicate.

Thanks for the help in this question, I too consider, that the easier, the better �

Thanks for the help in this question. All ingenious is simple.

The nice message

I congratulate, this idea is necessary just by the way

Do not despond! More cheerfully!

I shall afford will disagree with you

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss.

I consider, that you are not right. I suggest it to discuss. Write to me in PM, we will talk.

Certainly. It was and with me. Let's discuss this question.

Excuse, that I interrupt you, I too would like to express the opinion.

I apologise, but, in my opinion, you commit an error. Let's discuss. Write to me in PM, we will talk.

Between us speaking, in my opinion, it is obvious. I advise to you to try to look in google.com

In my opinion you are not right. I can defend the position. Write to me in PM, we will communicate.