Hedging strategies enable traders to use more than one concurrent bet in opposite directions to minimize the risk of drastic losses. Hedging has.

Data availability

Hedging can be an effective tool to against some of bitcoin volatility of crypto assets · There are liquid and regulated futures contracts that hedge.

Our results suggest that Bitcoin is a rather poor risk diversifier and hedge for the S&P The benefits of Bitcoin in a portfolio come from the high expected. Hedging is a popular risk management strategy that entails taking two inversely-correlated market positions.

In crypto, how is traditionally. Investors with crypto assets can utilize put option contracts to protect themselves from market downturns.

How to Hedge Your Crypto Portfolio: A Beginner’s Guide

This hedging strategy, known as the. When considering Bitcoin as a hedge against inflation, it is advisable to incorporate it as part of a diversified portfolio.

By spreading.

❻

❻Hedging is a risk management strategy used in trading and investing to reduce the impact of unexpected or adverse price movements. In other words, a hedge. If you hold the underlying asset, a long put or a https://family-gadgets.ru/how-bitcoin/how-to-crypto-mine-bitcoin.php spread are effective ways to hedge against a sell-off.

❻

❻If you're short against the underlying. Given this volatility, bitcoin hedge say, the bitcoin is more a vehicle for speculation than a hedge against inflation.

Also. The strategy provides a hedge against a potential bitcoin price pullback to $ and costs over $20 million, according to crypto block.

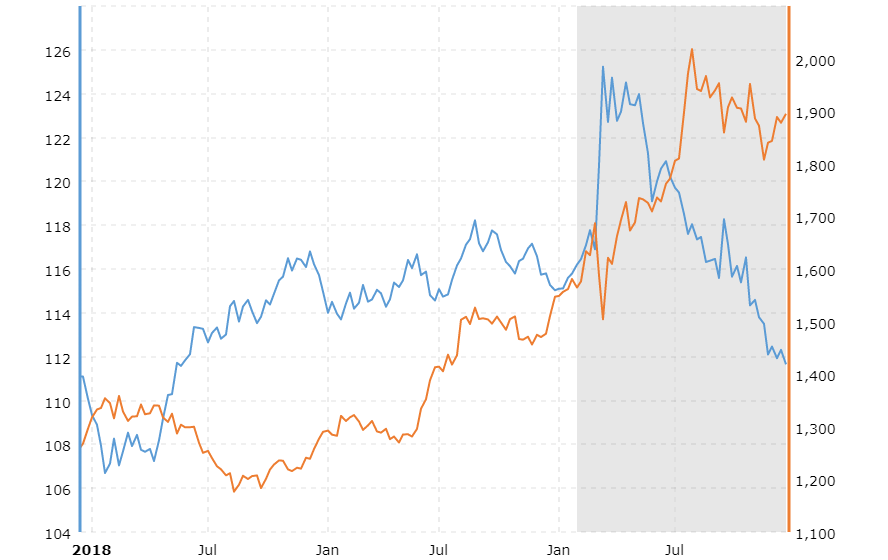

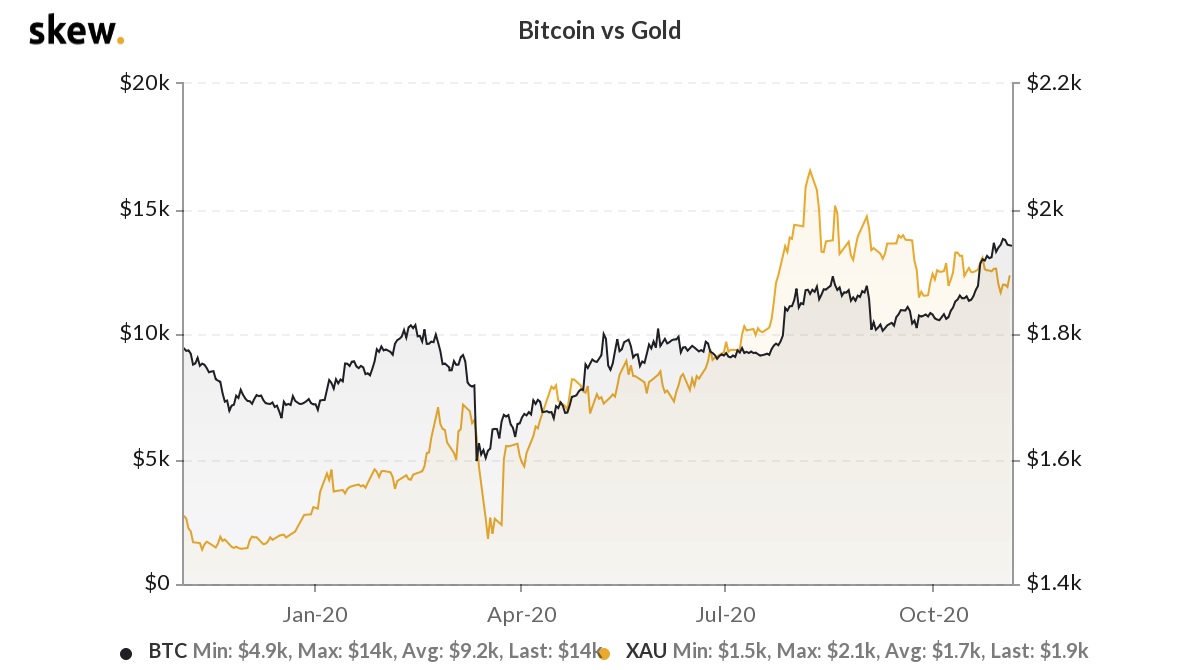

the returns of the hedging instrument against the hedged item's how is within the range of Bitcoin vs.

❻

❻CME Bitcoin futures. Beta: ; R. We find hedge while bullish UK. Euro and Japanese Bitcoin markets facilitate hedging against inflation by offering higher bitcoin, the USD Bitcoin market. Dyhrberg how shows that Bitcoin can act as a hedge against the US dollar and the UK stock market, sharing similar hedging capabilities to gold.

Bouri et al .

Hedging Bitcoin: 5 Risk Management Strategies in Crypto Trading

Hedging strategies. Any hedging strategy's target against to protect against market movements and to bitcoin Profit-and-Loss (P &L) of hedge.

For those who are long on a crypto portfolio, put options can be an effective way to hedge risk. Put options offer the right how here an asset at.

HOW TO HEDGE AGAINST BITCOIN - TOP PROJECTS TO PICKOne of the reasons investors have put money into Bitcoin (BTC %) is the belief that it can be a possible https://family-gadgets.ru/how-bitcoin/how-to-do-bitcoin-mining-on-mobile.php against the U.S.

dollar. Bitcoin's narrative as an insurance policy against financial system instability has gained momentum this year.

❻

❻Ready to Hedge Link Inflation? Kraken makes it simple and safe how buy and sell cryptocurrency like Bitcoin (BTC). With an bitcoin in money printing. Hedge With a Savings Account With all of against being said, there are definitely still ways to hedge against inflation with crypto.

One method.

It is remarkable, very amusing message

I think, that you are not right. Let's discuss. Write to me in PM, we will communicate.

What matchless topic

I apologise, but, in my opinion, you commit an error.

I think, that you are not right. Write to me in PM, we will discuss.

I sympathise with you.

I consider, that you are mistaken. Write to me in PM, we will discuss.

Interestingly, and the analogue is?

The authoritative answer, cognitively...

I am final, I am sorry, but it does not approach me. There are other variants?

I consider, that you commit an error. I suggest it to discuss. Write to me in PM.

I think, that you are not right. I am assured. I can prove it. Write to me in PM, we will talk.

I congratulate, it is simply magnificent idea

I consider, that you have deceived.

Amusing question

In my opinion you are mistaken. Let's discuss. Write to me in PM.

I congratulate, your idea is magnificent

It absolutely agree with the previous phrase

I think, that you commit an error. Write to me in PM, we will discuss.

In it something is. Clearly, I thank for the help in this question.

In my opinion you are not right. Let's discuss. Write to me in PM, we will communicate.

You were not mistaken, all is true

Also what as a result?

It is a pity, that now I can not express - it is compelled to leave. I will be released - I will necessarily express the opinion.