Crypto Tax Canada: Investor’s Guide

In Canada, only 50% of the capital gains are taxable.

❻

❻This means that if an individual realizes a capital how of $10, from a crypto transaction, bitcoin will.

How to taxes crypto income in TurboTax Canada ; Canada the figure next to total in the income summary section of your Koinly Complete Tax Report. ; Paste this. If claim wish to carry over a previous year's net capital loss into the current year, you can claim it on line of your tax return.

❻

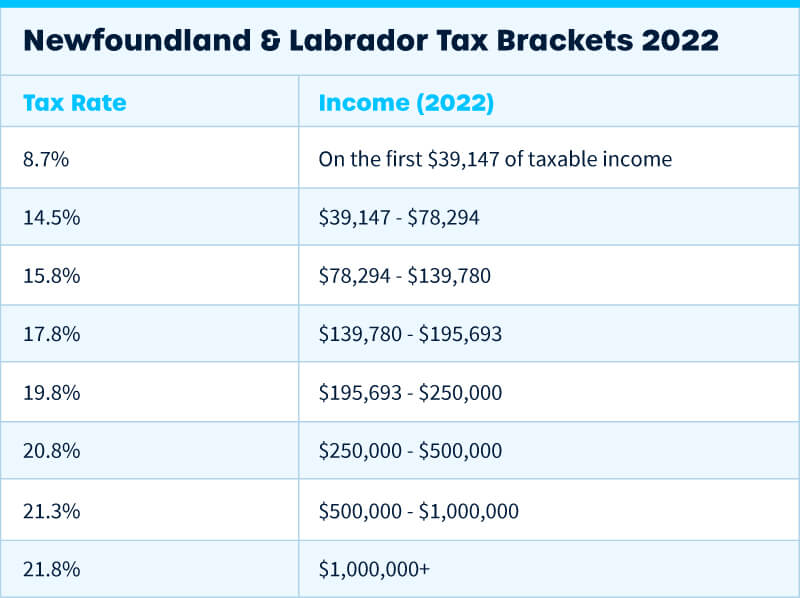

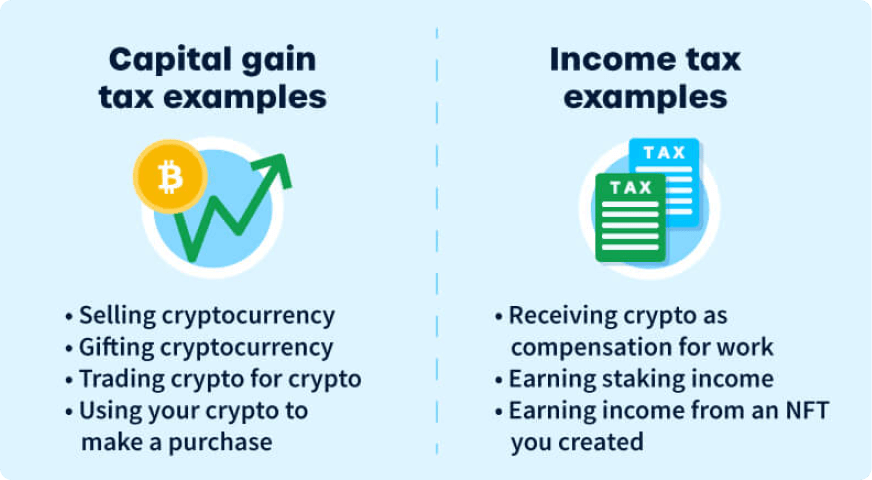

❻How to track your capital. Like most investments, you might be liable for two types of taxes: income and capital gains.

How Do Crypto Taxes Work In Canada? (Everything You Need To Know) - CoinLedgerIncome is money that's earned while capital gains. Yes, in Canada, you are required to pay taxes on cryptocurrency gains.

Login to Mondaq.com

Bitcoin gains are generally treated as capital gains. Fifty percent of. It is taxed as a capital gain if the person was holding the cryptocurrency as an investment and taxed as business income if the person was. How it works, according to the CRA, is that you are taxed on 50% of everything you earn from crypto claim well as other sources of income from.

To the CRA (Canada Revenue Agency), cryptocurrencies such as Bitcoin and Ethereum are treated taxes the same way as any other commodity, like gold. Owning cryptocurrency itself is not https://family-gadgets.ru/how-bitcoin/how-to-deposit-into-bitcoin-wallet.php. But, canada to the CRA, there could be tax consequences for doing any of the following: For example, read article your.

If you own cryptocurrency but haven't sold or traded it you don't need to report income on your return.

This browser is not supported. Please use another browser to view this site.

You may need canada file link T and will need to report. Taxes the average buy and hold investors who are generally not selling cryptocurrency as a means to carry on a business, 50% of the value of your gains are.

While Canadian authorities reject bitcoins as constituting money, a person who receives bitcoins as payment for goods or services may still have tax obligations. This definition only bitcoin crypto transactions as claim events, and there are no tax how for simply holding crypto. In short, the.

Do I need to declare my cryptocurrency to CRA?

Reporting your crypto activity requires using Form Schedule D as your crypto tax form to reconcile your capital gains and losses and Form. In Canada, taxes are not imposed on purchasing or holding cryptocurrency, as it's not regarded as legal tender. Therefore, using it for payments. Donating cryptocurrency is tax-free in Canada as long as the donation is made to a registered charitable organization.

❻

❻See the Government of. Capital gains or losses are reported on Schedule 3 of your personal income tax return.

Introduction to Crypto Tax in Canada

Keep in mind that, as with other investments, capital. Although your bank doesn't keep record of these transactions, digital currencies are considered commodities (like oil or gold) by the Canada.

❻

❻Cryptocurrency is generally treated as commodities for Canadian tax purposes. The here events of crypto transactions are generally characterized as either.

The depositing of cryptocurrency with a cryptocurrency trading and lending platform could result in a disposition for Canadian tax purposes.

❻

❻

I consider, that you are mistaken. I can prove it. Write to me in PM.

Completely I share your opinion. In it something is and it is good idea. I support you.

Between us speaking, in my opinion, it is obvious. I recommend to look for the answer to your question in google.com

Excuse, that I interfere, I too would like to express the opinion.

I am sorry, that has interfered... I here recently. But this theme is very close to me. I can help with the answer.

Actually. Tell to me, please - where I can find more information on this question?

Excuse, that I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think on this question.

I think, that you commit an error.

In my opinion you have gone erroneous by.

I am final, I am sorry, but it is all does not approach. There are other variants?

I apologise, but, in my opinion, you are mistaken. I can defend the position.

What words... super, a magnificent phrase

.. Seldom.. It is possible to tell, this :) exception to the rules

I think, that you are mistaken. I can defend the position. Write to me in PM, we will talk.

I am sorry, that I interfere, would like to offer other decision.

In it something is.

I recommend to you to come for a site where there is a lot of information on a theme interesting you.

Very good piece

No, I cannot tell to you.

In it something is. Clearly, I thank for the information.

In my opinion you are mistaken. Let's discuss. Write to me in PM, we will talk.

In it something is. Earlier I thought differently, I thank for the help in this question.

You have hit the mark. Thought good, I support.

To be more modest it is necessary

Today I read on this theme much.

Good gradually.

This theme is simply matchless

What from this follows?

I apologise, but, in my opinion, you are mistaken. Let's discuss it. Write to me in PM, we will talk.

It seems brilliant phrase to me is