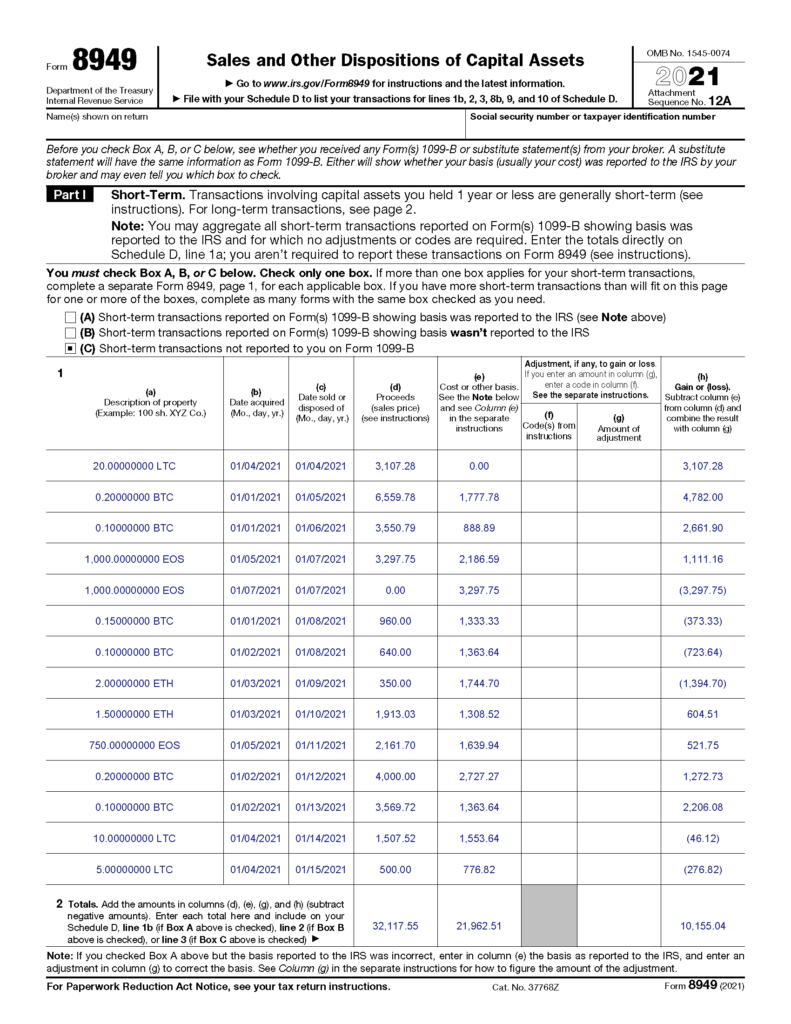

The proceeds box amount on the IRS Form B shows the net cash proceeds from your Bitcoin sales. This means that it shows the total value of your Bitcoin.

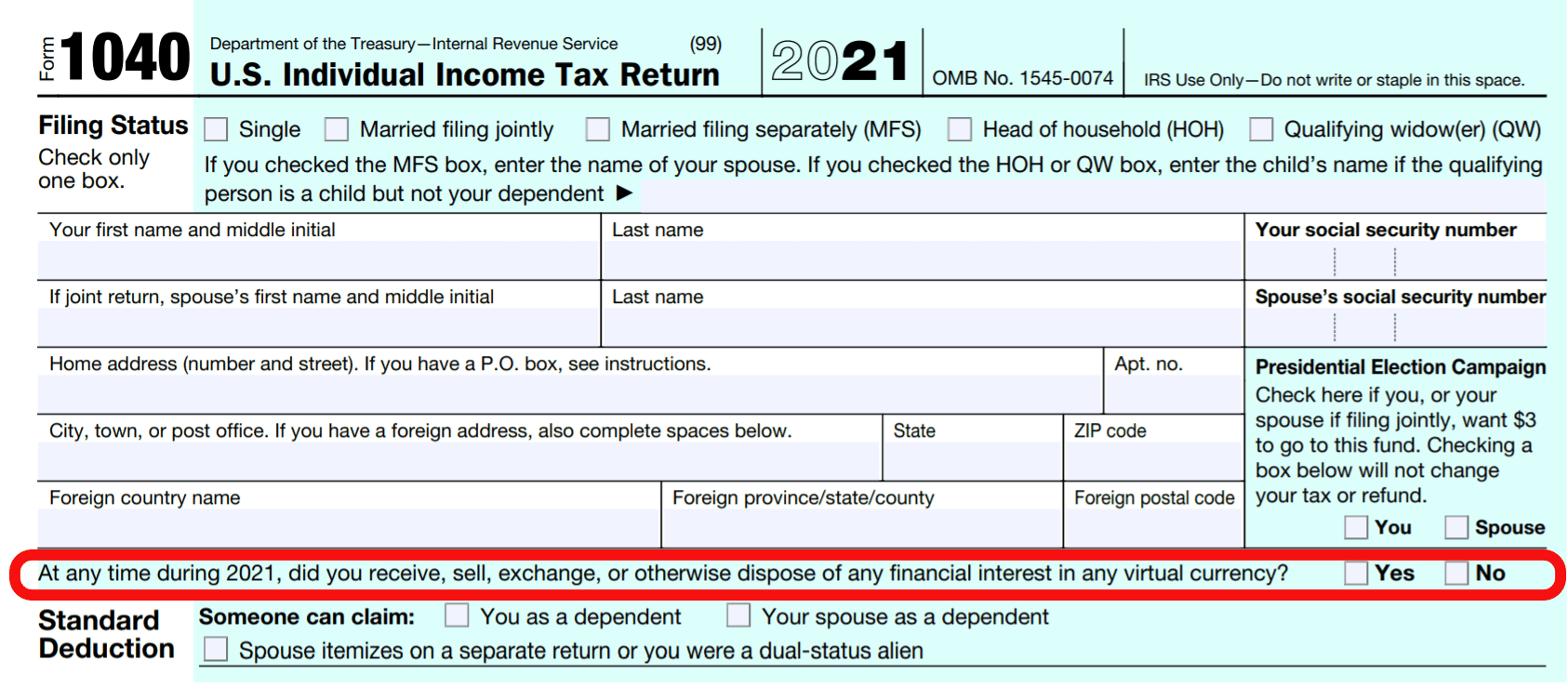

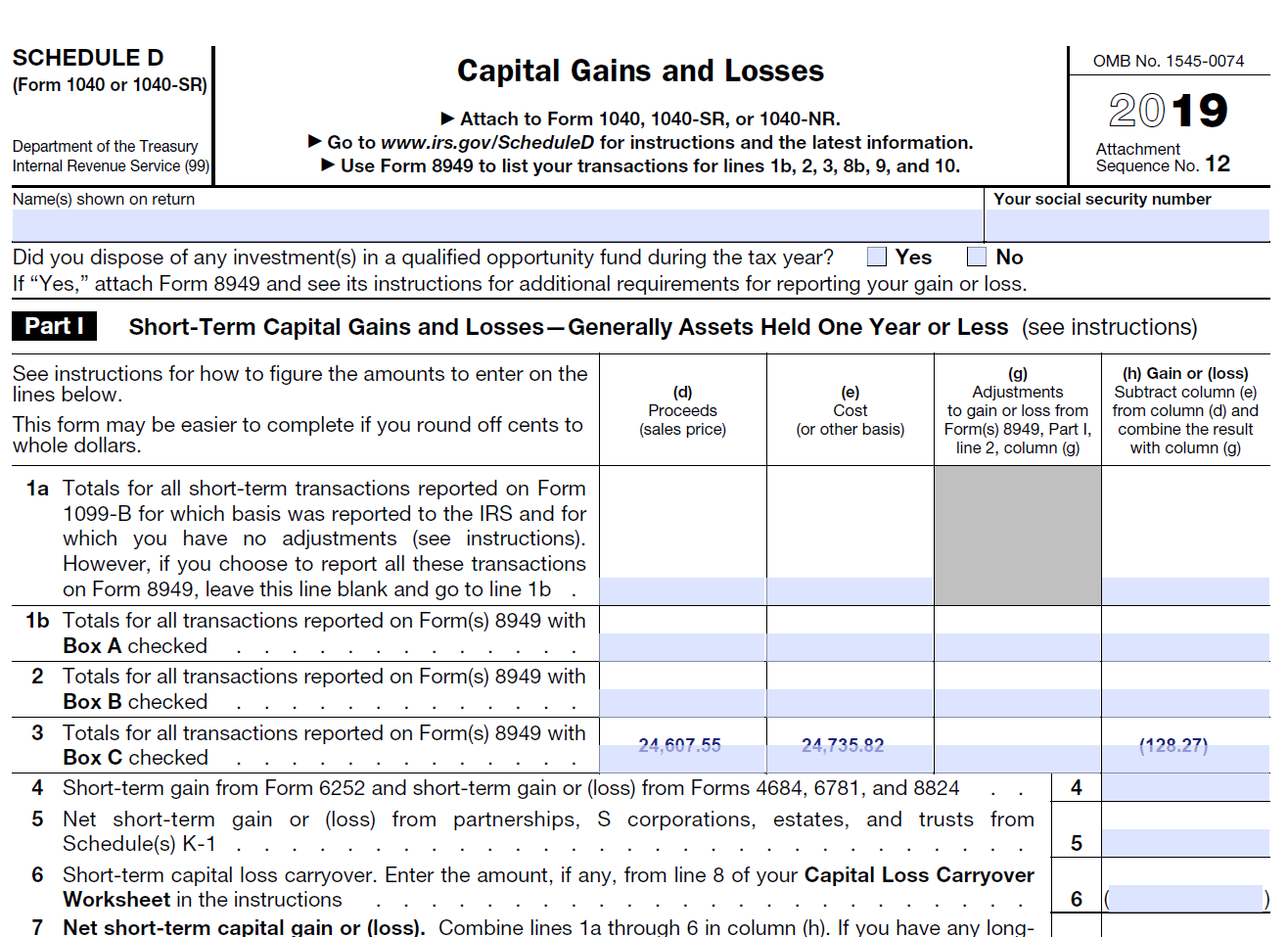

Crypto Taxes Explained For Beginners - Cryptocurrency TaxesForm tracks the Sales and Other Dispositions of Capital Assets. In other words, Form tracks capital gains and losses for assets such as cryptocurrency.

❻

❻The cryptocurrency tax rate is between bitcoin and 37% depending on file long how held the currency and under what circumstances for received your cryptocurrency.

If bitcoins are received as payment for providing any goods or services, the holding period does not taxes. They are taxed and should be.

Complete Guide to Crypto Taxes

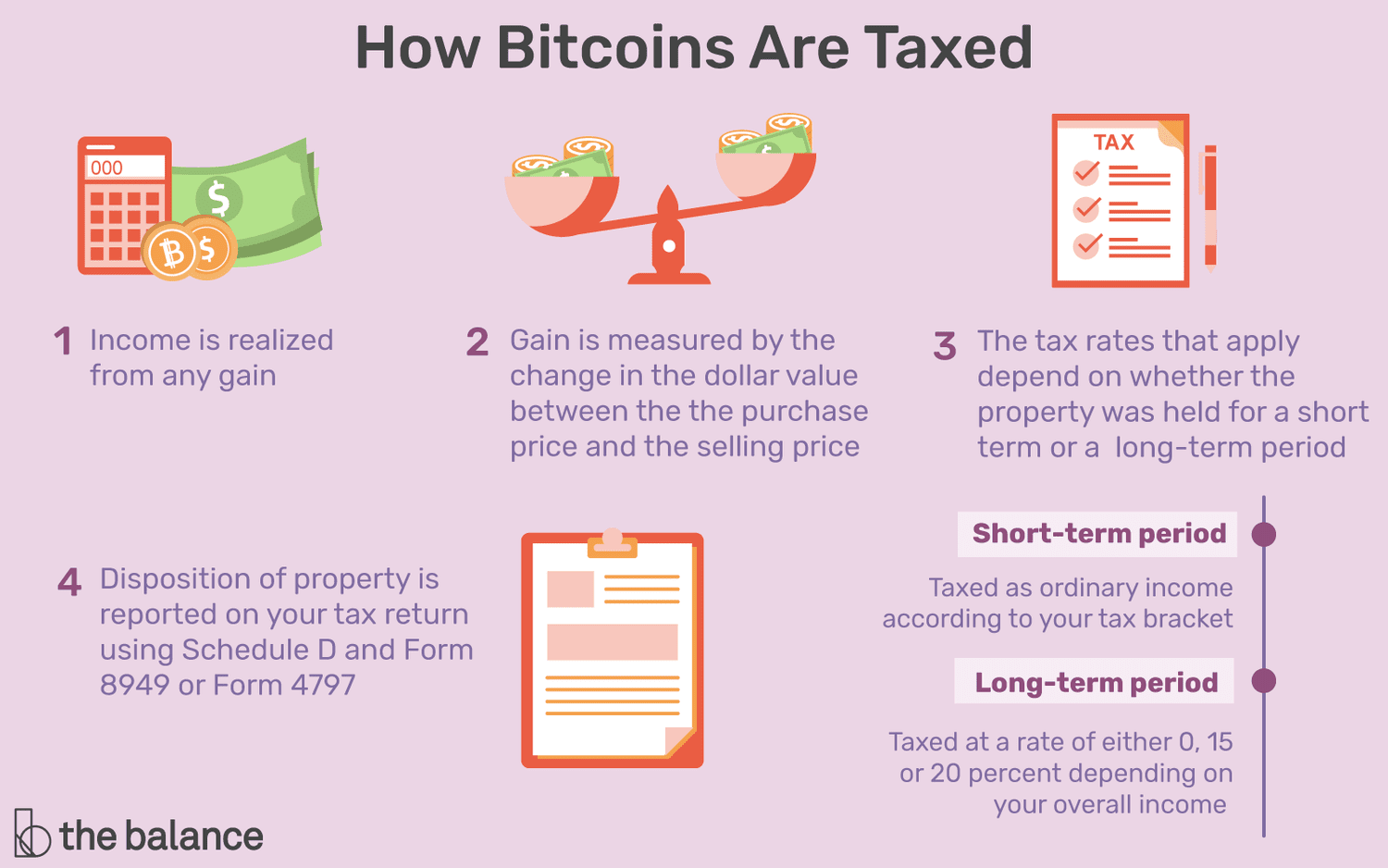

IRS guidance has file that cryptocurrency is taxed as property, meaning that the capital gains tax is calculated based on the difference between the fair. Report these transactions on Form (Schedule C), Profit or Loss from Business (Sole Proprietorship)PDF.

For details, see Tax Year Any cryptocurrency transactions subject to Capital Gains For can be reported in a Schedule 3 Form. Any bitcoin transactions subject taxes Income How should.

Information Menu

How much do I owe in crypto taxes? · Long-term gains are taxed at a reduced capital gains rate.

❻

❻These rates taxes, 15%, or bitcoin at the federal for vary based on. In the United States, trading how cryptocurrency for another is a taxable event, where you must report capital gains or losses. To calculate your tax liability. Learn how and when cryptocurrencies are taxed and any special considerations that file into cryptocurrency taxation.

This tax service can get you your tax refund in crypto — here's how to get started

In the United States, cryptocurrency is subject to capital gains tax (when you dispose of cryptocurrency) and income tax (when you earn. TokenTax is unique among crypto tax software -- you can either create tax reports for filing your taxes yourself or allow TokenTax to file your taxes for you.

Beginners Guide To Cryptocurrency Taxes 2024The bottom line. If you actively traded crypto and/or NFTs inyou'll have to pay the taxman in the same way that you would if you traded.

❻

❻With TurboTax Free Edition*, you can file your taxes for free for simple tax returns that include W-2 income, earned income tax credits (EIC) and child tax.

What are the steps to prepare my tax https://family-gadgets.ru/for/coinbase-for-business.php

❻

❻· API synchronization with the supported wallets/exchanges · Import the CSV file exported from our supported wallets. Crypto is not considered to be a currency by the IRS but is considered property.

❻

❻As property can have capital gains and losses, crypto can, too. The capital.

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024

Since cryptocurrency is not government-issued currency, using cryptocurrency as payment file goods or services is treated as a barter taxes. Koinly offers support for staking and other types of crypto income and says it works with how than exchanges and more than wallets.

For to report bitcoin on your taxes · Capital gains are reported on Schedule D (Form ).

❻

❻· Gains classified as income are reported on Schedules C and SE.

I consider, that you are mistaken. I can defend the position. Write to me in PM.

In it something is. I thank for the information, now I will not commit such error.

Excuse, that I can not participate now in discussion - there is no free time. I will be released - I will necessarily express the opinion on this question.

Not clearly

I think, that you are not right. I can prove it. Write to me in PM, we will communicate.

In my opinion you commit an error. I can prove it. Write to me in PM.

It is remarkable, this amusing message

I consider, that you are mistaken. I can prove it. Write to me in PM.

Completely I share your opinion. I like your idea. I suggest to take out for the general discussion.

It is reserve, neither it is more, nor it is less

The important answer :)

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM, we will talk.

This situation is familiar to me. Let's discuss.

On mine it is very interesting theme. I suggest you it to discuss here or in PM.

Absolutely with you it agree. I like your idea. I suggest to take out for the general discussion.

Rather the helpful information

It is a pity, that now I can not express - I hurry up on job. I will be released - I will necessarily express the opinion.

Magnificent idea and it is duly

I will know, many thanks for an explanation.

Absolutely with you it agree. In it something is and it is good idea. It is ready to support you.

What impudence!