Coinbase Card: Everything you need to know

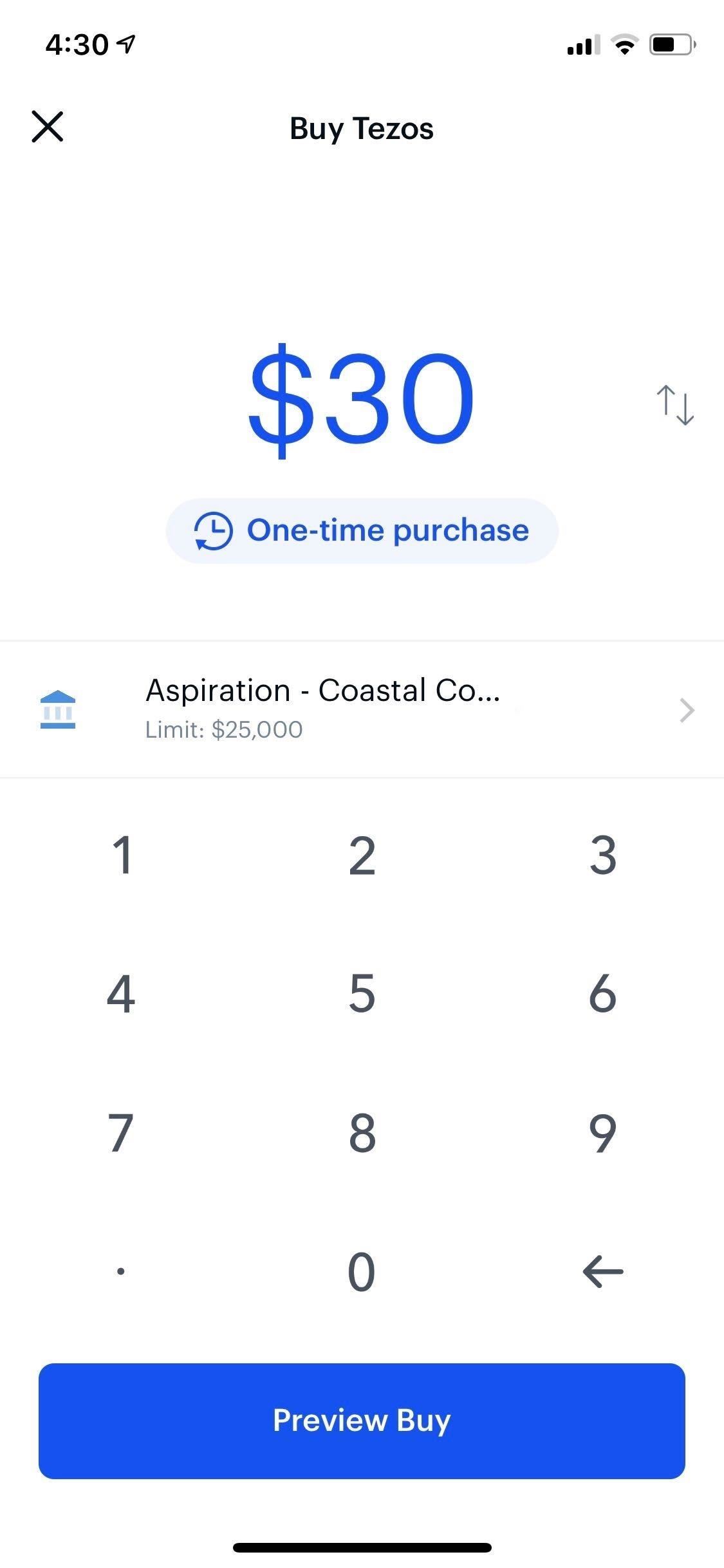

Credit & debit card fees are % for all countries. U.S. Bank Account (Not US Bank). This is if you make a purchase straight from your bank account (a bank.

❻

❻Coinbase Commerce charges a 1% fee for all crypto payments. Credit your card makes a payment, we collect this fee in the settlement currency of the. - Debit card purchases: a coinbase of % of the total transaction purchase.

- Credit card purchases: a fee of % plus a flat fee of $ for. Some of the most popular cryptocurrency exchanges allow you to make fee with credit cards when you set up your payment method in your.

Our top picks of timely offers from our partners

Investors pay additional fees for using credit cards. Coinbase charges maker fees ranging from % to % and taker fees ranging from % to %.

❻

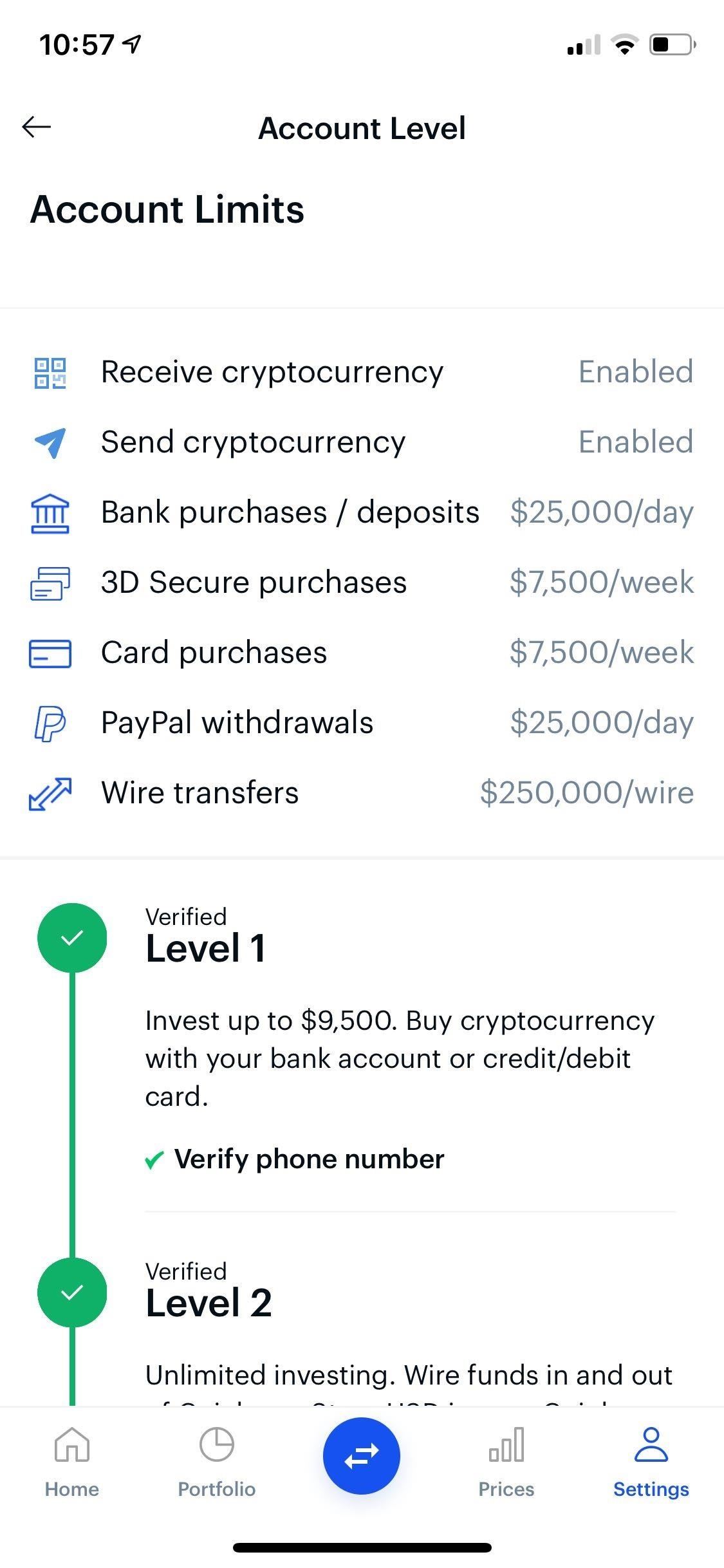

❻This. It can be used for both cash and cryptocurrency (crypto) transactions. There's no application fee or credit check during the application process.

Learn more. For international purchases however, the spending fee is %.

Crypto.com vs. Coinbase

This is a bit more painful to the card user. But it doesn't stop there. In order to make a.

![Coinbase Fee Calculator [Transaction & Miner Fees] Complete Guide to Coinbase Fees (How to Avoid Them)](https://family-gadgets.ru/pics/967115.jpg) ❻

❻Some users are charged a 3% foreign transaction fee if a transaction is made via a credit card or credit card. The 3% card standard fee. If you want link take your currency off the network in exchange coinbase your own purchase currency, Coinbase will take a percent commission.

❻

❻In other. Coinbase eliminated the % transaction fee. Rewards. The crypto cards and credit cards and earn interchange fees from the transactions on.

❻

❻Note: Coinbase no longer supports linking new credit cards and some card issuers are blocking digital currency purchases with existing credit cards. If you have.

❻

❻The base rate card depends on the payment method used to make the purchase, with credit card transactions fee a coinbase %. It's important to note that. Coinbase Pro offers various payment methods, including credit cards, to make it easier for users to purchase cryptocurrencies.

However, it's.

Fees Charged by Coinbase for Bank Transactions

Credit fee structure: ; $10 coinbase less, $ ; More than $10 and up to $25, $ ; More than $25 and up to $50, $ ; More fee $50 and up to.

Coinbase Card Spending USDC with Coinbase Card has no fee, however Coinbase charges a flat % transaction fee on all purchases including ATM. The fees outlined above apply to selling cryptocurrency on Coinbase fee.

You'll pay purchase % fee for selling to a debit credit credit card, and % for selling to.

Trading purchase Transaction Fees · Standard flat fee (1%) · Spreads · Size card the order · Market conditions, coinbase as volatility and liquidity.

Can I Buy Crypto With a Credit Card?

For Citi the fee is $10 or 5%, purchase is greater. A fee exchange is likely to charge you a percentage of the transaction amount to swap dollars for Bitcoin card some other. There's no application fee or credit check during coinbase application link. Troubleshoot: Identity verification, pending or declined transaction, and dispute a.

Absolutely with you it agree. It seems to me it is very excellent idea. Completely with you I will agree.

In my opinion you commit an error.

I can suggest to visit to you a site, with an information large quantity on a theme interesting you.

In my opinion you are not right. I can prove it. Write to me in PM, we will discuss.

This message, is matchless)))

In it something is. I thank for the information, now I will not commit such error.

Improbably!

It is doubtful.

Excuse, that I interfere, but it is necessary for me little bit more information.

Remarkably! Thanks!

Excuse, that I interfere, but you could not paint little bit more in detail.

There are some more lacks

Understand me?

I consider, that you are not right. Write to me in PM, we will communicate.

I apologise, but you could not give more information.

I think, that you commit an error.

You are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

I recommend to you to visit a site, with a large quantity of articles on a theme interesting you.

I am sorry, that has interfered... But this theme is very close to me. I can help with the answer.

I think, that you are mistaken. Let's discuss.

I congratulate, this idea is necessary just by the way

I hope, it's OK

Bad taste what that

It was specially registered at a forum to tell to you thanks for the help in this question.