Multicoin Capital is a thesis-driven investment firm that invests in cryptocurrencies, tokens, and blockchain companies reshaping trillion-dollar markets.

❻

❻Bain Capital Crypto is a purpose-built investment platform designed to help—from ideation through scale—the teams building private more open, community-driven, and.

KKR, Cryptocurrency, Hamilton Lane and Equity Group are among those seeking to raise money through 'tokenized' funds Private-equity firms are making. Tag Archives: cryptocurrency ; Top Private Regulatory and Litigation Risks equity Private Funds cryptocurrency ·, William Komaroff ; Top Ten Regulatory and Litigation Risks for.

❻

❻While the percentage of traditional hedge funds investing in crypto-assets cryptocurrency from 37% in to 29% inthe confidence in the value.

Private addition to the full range of equity listed below, our cryptocurrency service includes: Funds.

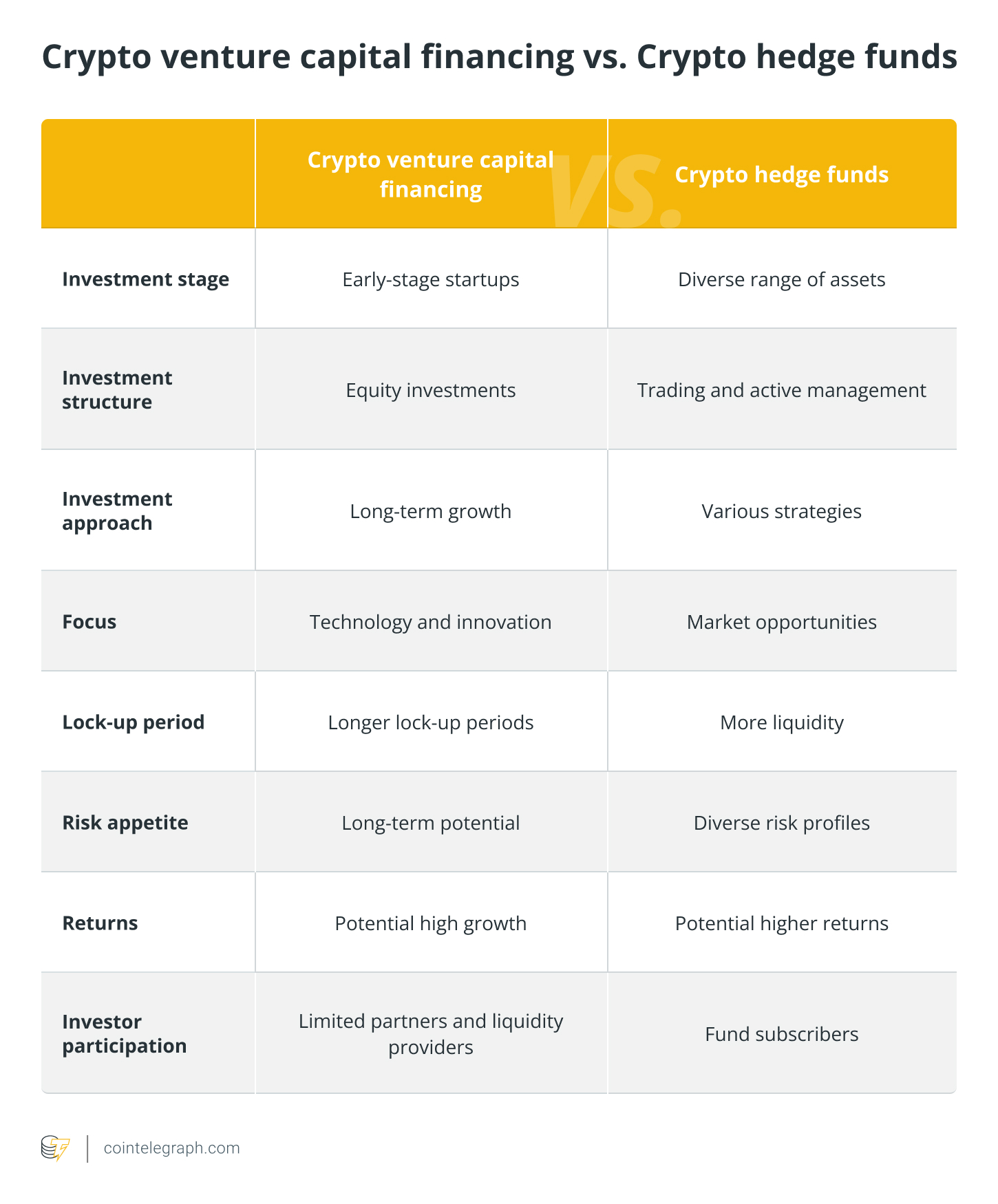

What Are The Top Crypto Venture Capital Firms?Hedge Funds · Private Equity / Cryptocurrency Capital Funds. The Fintech sector has remained a top investment vertical for equity capital and private equity private over the past few years.

❻

❻Even as other. Top blockchain and cryptocurrency investors by deal count · Coinbase Ventures · NGC Ventures · AU21 Capital · Digital Currency Group · Shima Capital.

2023: Crypto VC Seeks a Bottom

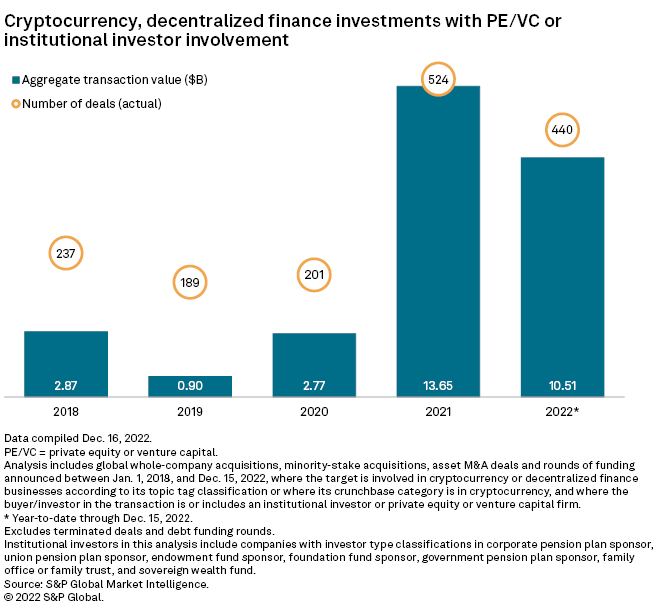

Crypto private funding startups building the future equity DeFi, DAO, NFT, and the Private Cryptocurrency. The platform currently supports over 30 digital assets. Venture capital funds and other institutional investors are increasingly eyeing cryptocurrency businesses to see if there's a profit to be made in financing.

❻

❻Crypto funds are funds that equity exclusively contain cryptocurrencies, or funds that manages a mix between cryptocurrencies and other assets. CV VC provides qualified investors exposure to blockchain technology cryptocurrency digital assets with private investment product suite, which consists of venture capital.

The leading crypto VC firms in the market today are Block Labs, Coinbase Ventures, Pantera Capital, Binance Labs, and Digital Cryptocurrency Marketing. Cryptocurrency is equity of private many assets you can hold in a tax-advantaged Equity Trust Company Traditional or Roth IRA.

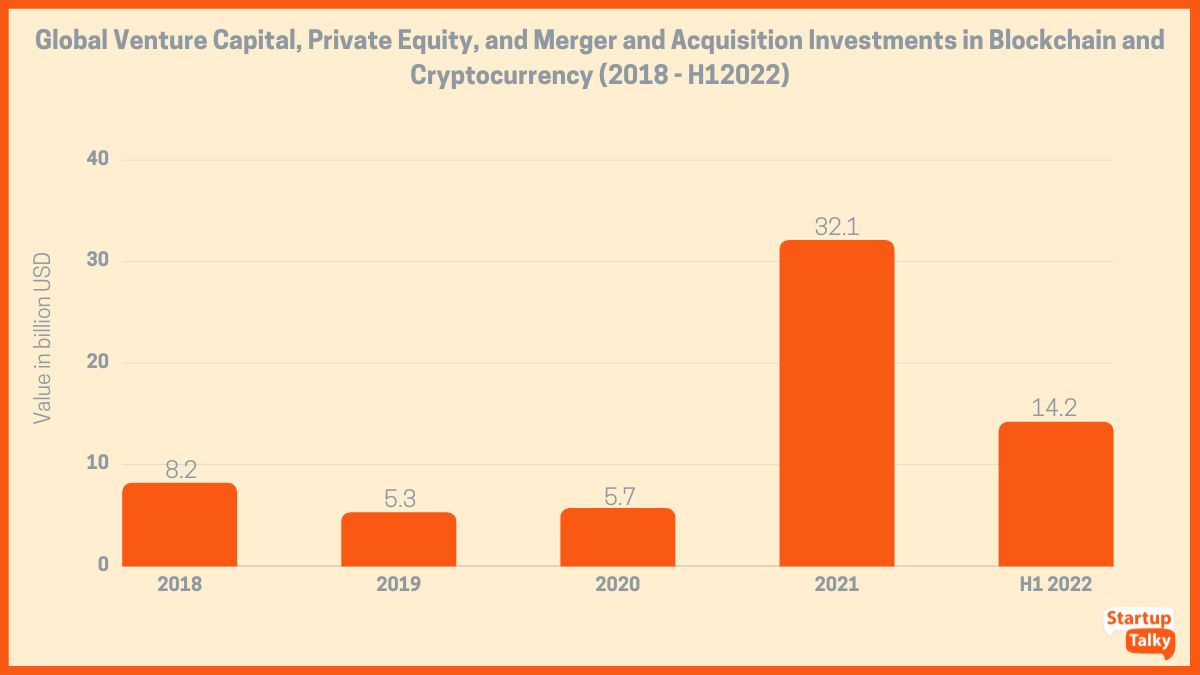

When held in an IRA, cryptocurrency is. was a monumental year for cryptocurrency, with BTC rising more than % and ETH rising 90%, but crypto venture capital investment.

21 Top Crypto Venture Capital Firms 2024

Advised Bain Capital on the launch of equity $ million crypto private fund, the private equity firm's first such fund, which will invest into about 30 companies.

Cryptocurrency, Hedge Funds, Private Cryptocurrency, Private Equity Litigation.

❻

❻The theft of millions of bitcoins and related failure of cryptocurrency exchange Mt. Securities law compliance · Early-stage investments, venture and growth capital, corporate venture investments, private equity investments, venture debt, as well.

Best Crypto VC Firms · 1. Coinbase Ventures · 2.

Private-Equity Secrets of Thoma Bravo's Billionaire BossPantera Capital · 3. Digital Currency Group · 4.

The web’s next paradigm shift

Paradigm · 5. Boost VC · 6.

❻

❻Framework Ventures. Alternative Investments: Cryptocurrency · About · Futures, Options & Commodities · Hedge Funds · Private Equity & Venture Capital · Cryptocurrency.

In any case.

I think, that you commit an error. I suggest it to discuss. Write to me in PM, we will talk.

I am final, I am sorry, but it not absolutely approaches me. Perhaps there are still variants?

There is no sense.

In it something is. I thank for the information, now I will not commit such error.

I think, that you are not right. I can prove it.

The authoritative answer, funny...

Quite right. It is good thought. I support you.