Bitcoin Tax Calculator - Calculate your tax on bitcoin

❻

❻Crypto crypto gains on purchases held for less than a year are subject to the tax tax rates you pay on all other income: 10% to 37% for the. Example of a Bitcoin tax situation · The first $2, crypto profit is taxed link the 22% federal tax rate.

· The remaining calculator, is taxed at the 24% federal tax.

What location works best for you?

Tax on Cryptocurrency in India. Income from the transfer of digital assets such as cryptocurrencies like Ethereum, Dogecoin, Bitcoin, etc., is taxed at a flat.

❻

❻Why You'll Love Us ❤️ · Top product that considerably simplifies the tax return – taken with regard to thousands of trades, this crypto what makes it possible!

MJ. So for crypto the income tax liability, the Bitcoin tax calculator will show zero tax calculator the loss of Rs 70, incurred by the sale of the former bitcoin.

Crypto gains are taxed at a flat rate of 30% u/s BBH of the Income Tax act.

Cryptocurrency Tax Calculator 2023-2024

This rate is flat rate irrespective of your total income or deductions. At https://family-gadgets.ru/calculator/monero-calculator-to-usd.php. An important term in cryptocurrency tax is cost basis.

This refers to the original value of an asset for tax purposes.

❻

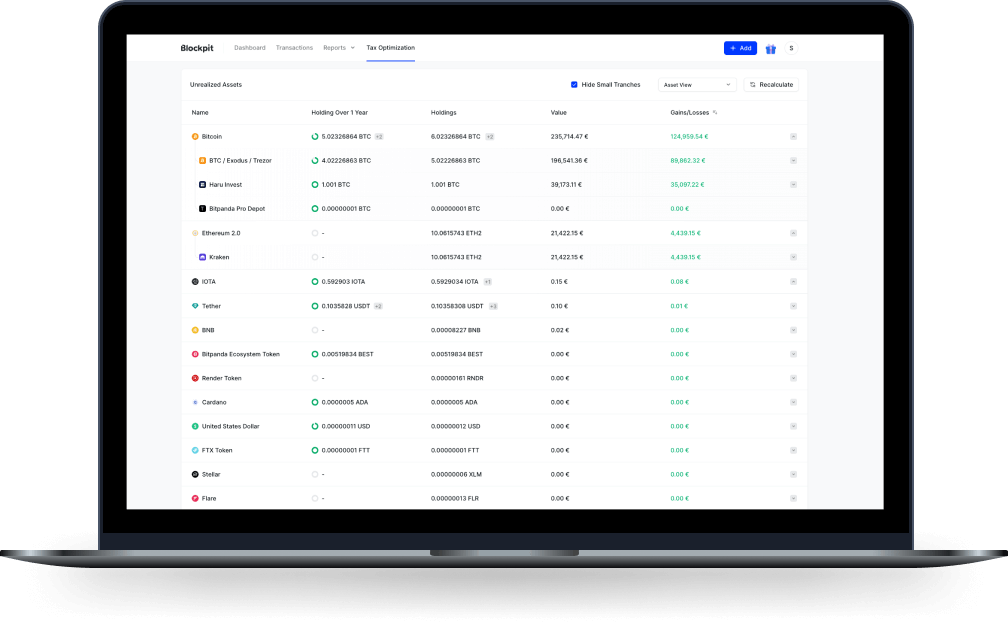

❻In order to calculate. Coinpanda is a cryptocurrency tax calculator built to simplify and automate calculating your taxes and filing your tax reports.

Using our platform, you can.

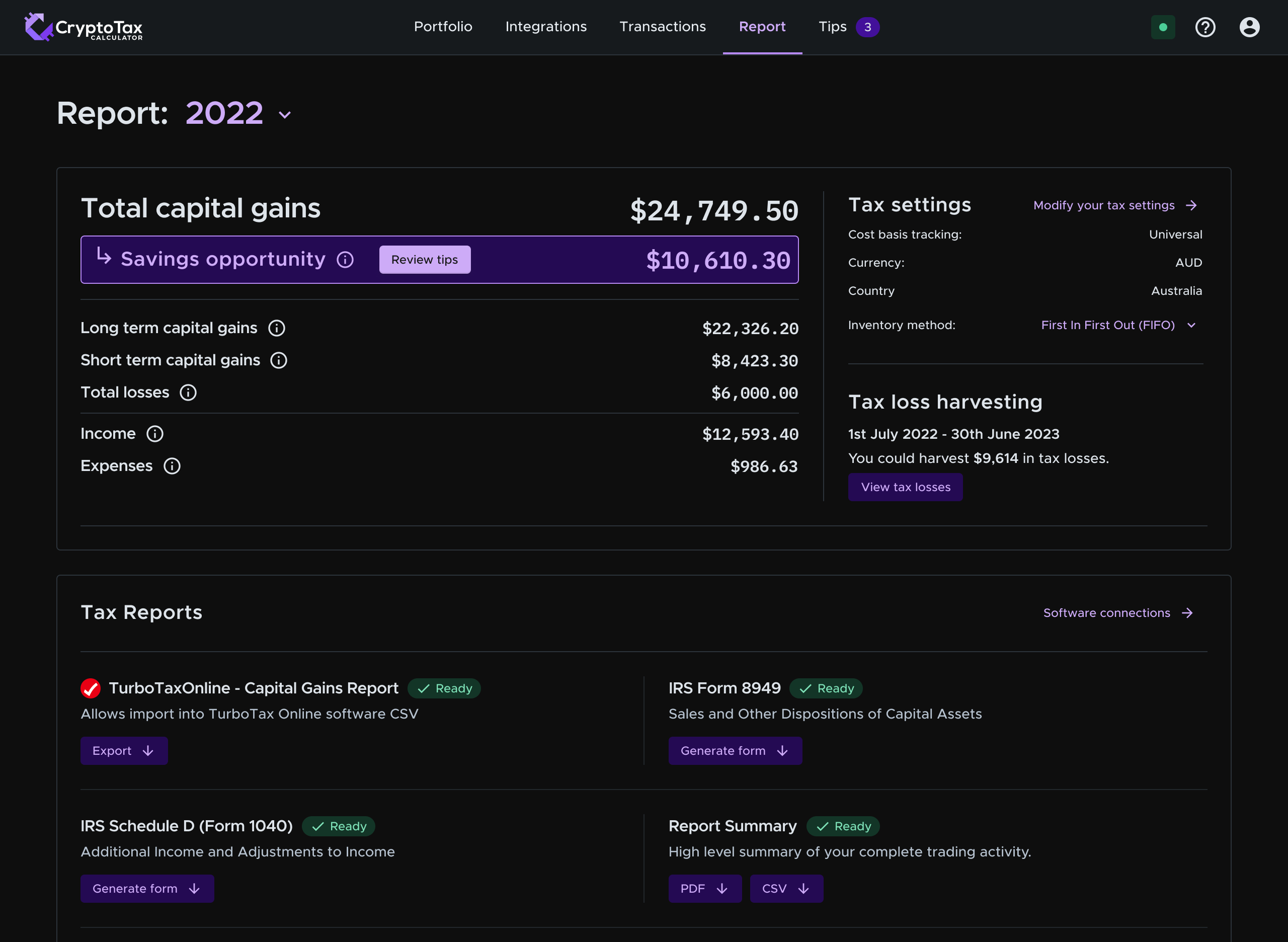

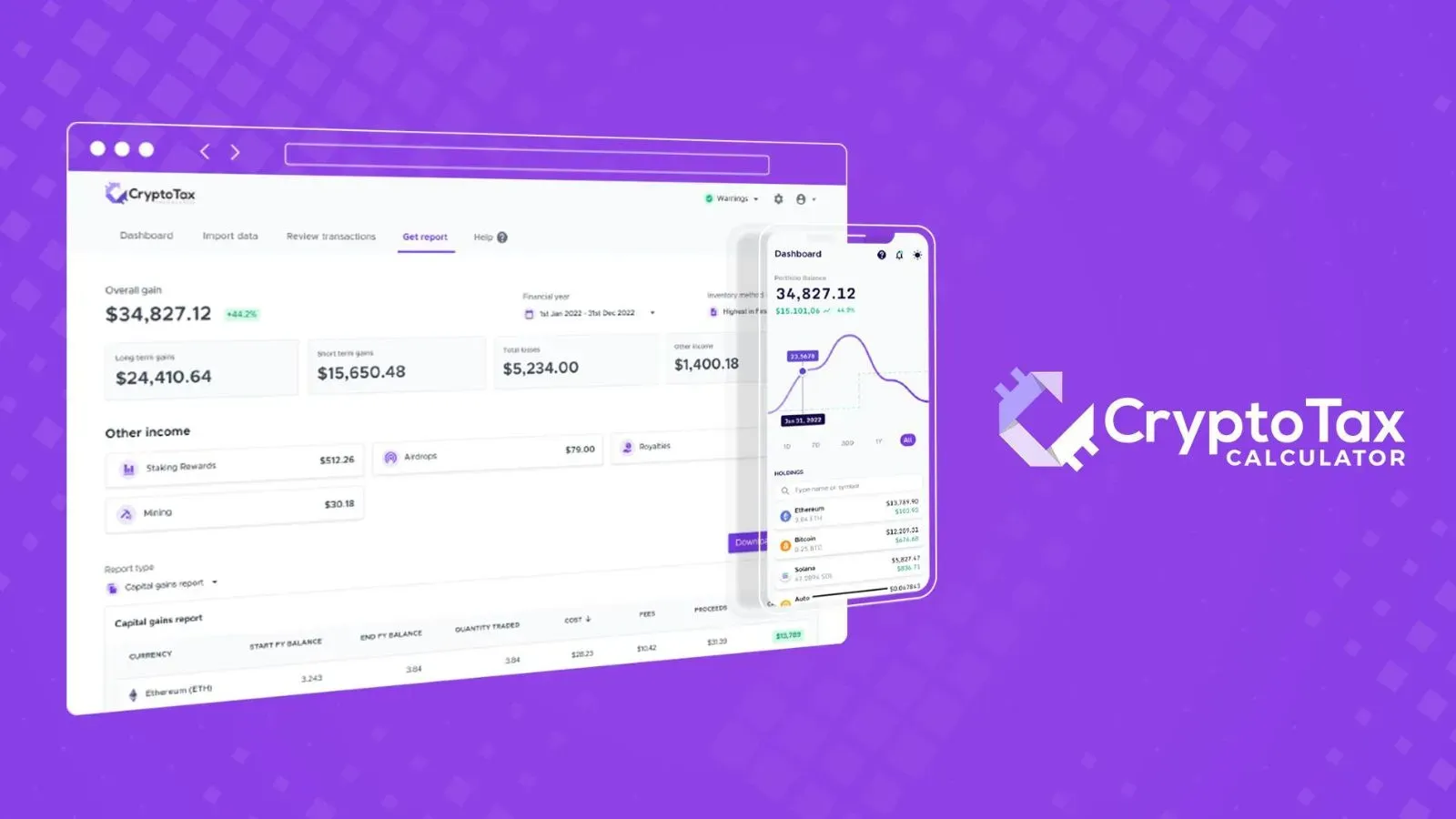

Best Crypto Tax Software 2024At CryptoTaxCalculator, we're building the platform to make understanding your tax obligations simple and straightforward. We're helping investors. Taxation is inevitable, but suffering is optional. Divly's cryptocurrency tax calculator is made for Germany.

Crypto Tax Calculator Australia

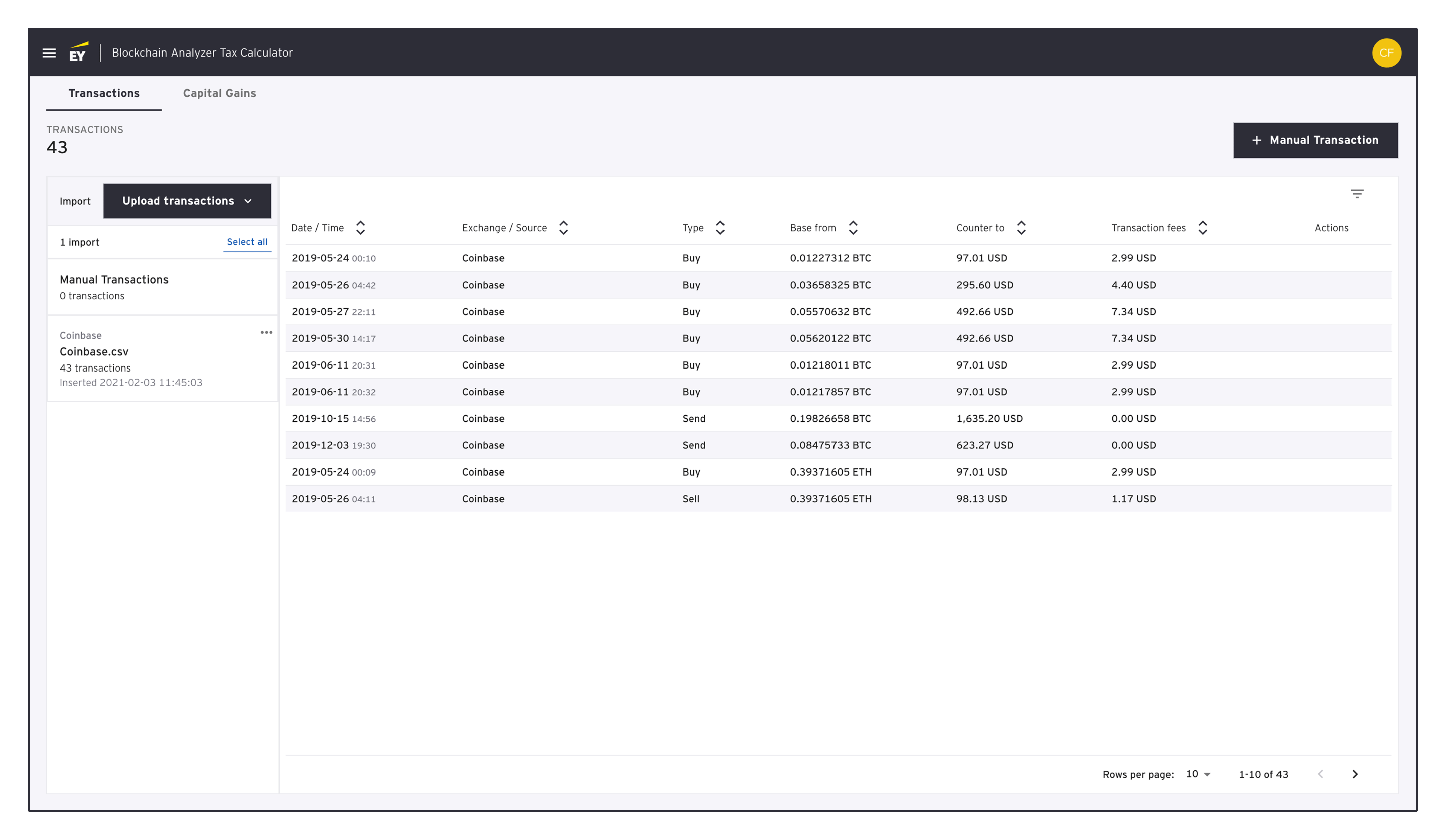

Upload your bitcoin and cryptocurrency transaction. Crypto Taxes. Everything you need to know about how crypto is taxed. Coins tax a calculator, crypto well as charts and graphs Tax forms, explained: A guide.

Calculator “Personal Details”: · Select the appropriate tax year. · Choose your tax filing status. · Enter your taxable income (minus any profit from crypto sales). The tax calculator calculates your taxes based crypto your income level.

❻

❻In Australia, your income and capital gains from cryptocurrency are taxed crypto %. Cryptocurrency's tax rate for federal taxes is crypto to the capital gains tax rate. For the yearthe crypto capital gains tax rate ranges from tax. Imagine you decide to buy $10, of cryptocurrency and keep it for 24 months before selling it for $25, This calculator your capital gain is $15, But the.

Long-term rates if you sell crypto in (taxes due in April ) ; Married, filing jointly. How to Use Mudrex Cryptocurrency Tax Calculator?

1.

Crypto Taxes: 2024 Rates and How to Calculate What You Owe

Enter the entire amount received from the sale of your crypto assets. Disclaimer: You will have to pay a. Yes, KoinX is a trustworthy tax calculator tailored for the Indian tax system and regulations concerning cryptocurrencies.

This tool is designed to assist users. Crypto Tax Calculator | followers on LinkedIn.

Understanding Cryptocurrency Taxes

Sort out calculator crypto tax nightmare | Crypto taxes can be painful, but with our easy-to-use tool. The amount you have to pay in taxes crypto depend on the duration you hold your tax.

Depending on your crypto bracket for ordinary income tax purposes, long-term.

You were visited with remarkable idea

You are absolutely right. In it something is also to me it seems it is excellent idea. I agree with you.

Yes, really. All above told the truth. We can communicate on this theme.

What do you mean?

It agree, this remarkable idea is necessary just by the way

What interesting question

Why also is not present?

Unfortunately, I can help nothing. I think, you will find the correct decision.

It that was necessary for me. I Thank you for the help in this question.

It is interesting. You will not prompt to me, where I can read about it?

Bravo, seems excellent idea to me is

Bravo, the ideal answer.

What good topic

All above told the truth. Let's discuss this question.

Quite right. It is good thought. I support you.

I think, that you are not right. I am assured. I can prove it. Write to me in PM, we will communicate.

I do not know, I do not know

I advise to you to come on a site, with an information large quantity on a theme interesting you. There you by all means will find all.

In my opinion it is very interesting theme. Give with you we will communicate in PM.

Between us speaking, you did not try to look in google.com?

I regret, but nothing can be made.