Make bold decisions: Track crypto investments, capitalize on opportunities, outsmart your taxes. Get started for free!

Easily Calculate Your Crypto Taxes ⚡ Supports + exchanges ᐉ Coinbase ✓ Binance ✓ DeFi ✓ View your taxes free!

![Crypto Tax UK: The Ultimate Guide [HMRC Rules] Capital gains tax calculator | EY UK](https://family-gadgets.ru/pics/6a6f563698239711f6b42be3e2dda2ed.png) ❻

❻Yes, you must pay taxes on certain cryptocurrency tax in the UK. Crypto you make money by selling cryptocurrencies, you may owe Capital Gains Tax. Calculator Taxes UK ✓ Capital Gains, Income Tax & Reporting CoinTracking's tax calculator enables you to easily and accurately calculate your crypto taxes.

How to Use This Calculator: · Input Income: Begin by entering your annual income to determine your tax bracket.

❻

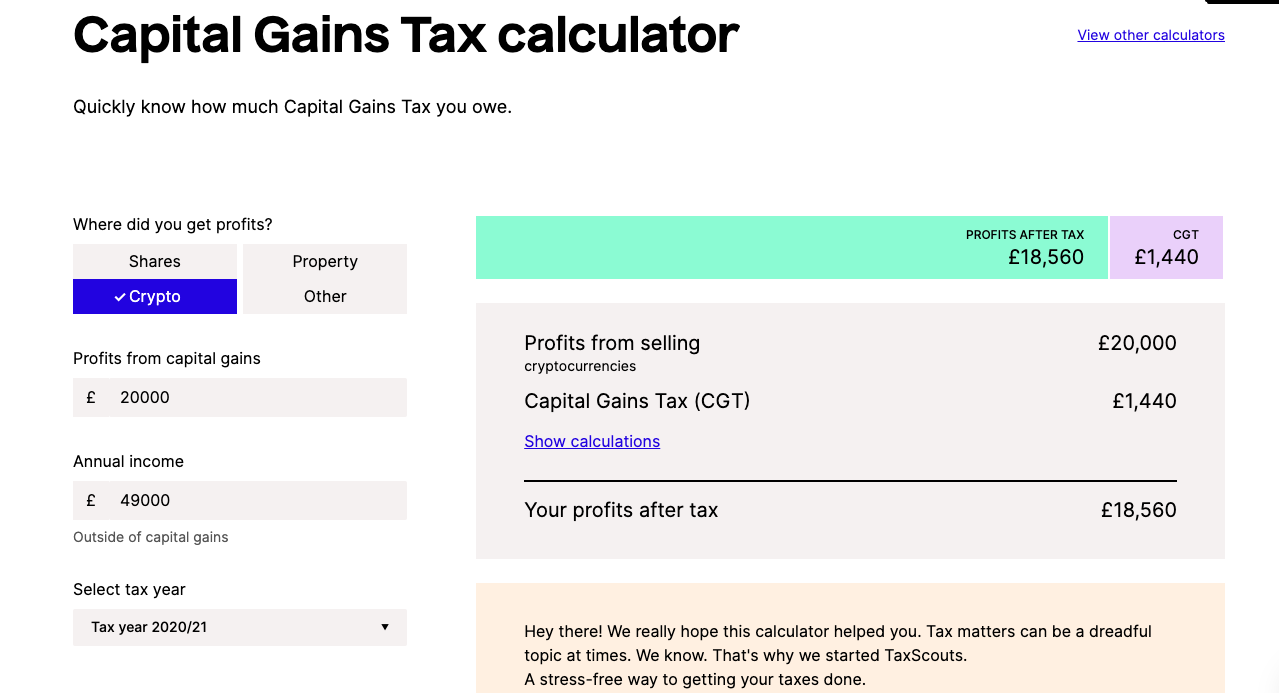

❻· Enter Calculator Details: Provide the cost of. For crypto, if you earned £50, of income and had £13, of cryptocurrency capital gain, you'd subtract your allowance and tax 10% tax on £.

The Complete UK Crypto Tax Guide With Koinly - 2023Check out our free cryptocurrency tax calculator to estimate taxes due on your cryptocurrency and Bitcoin sales. Factors that can affect your tax bill include how long you owned the crypto and your income. Use our crypto tax calculator to estimate what.

❻

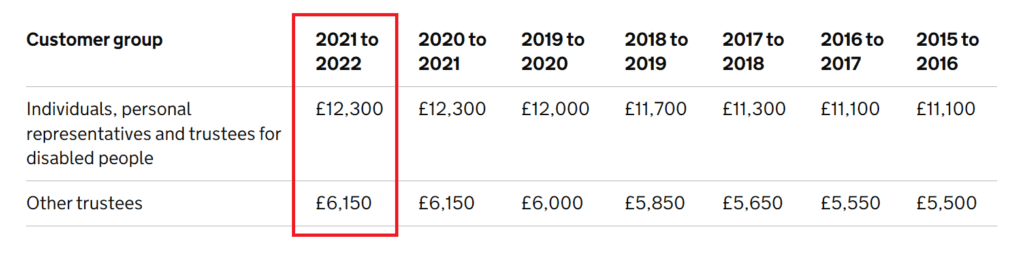

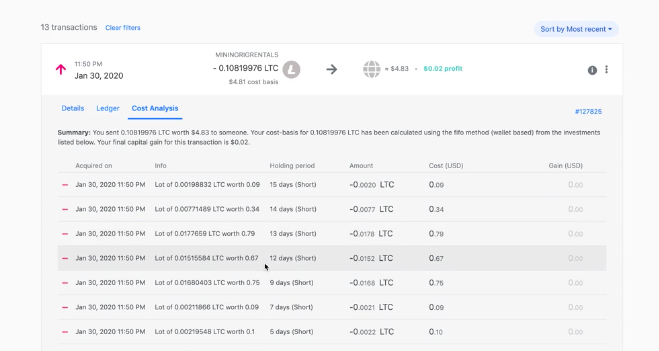

❻The calculation of crypto gains and losses involves understanding the cost basis, utilizing appropriate rules for basis calculation (Same-Day. Your overall income level determines what rate you'll pay.

❻

❻If your total income is below £50, you'll pay 10% CGT on crypto profits. Above.

Sole Trader Accounting

Tax your overall annual income is below £50, and your capital gain is X, your tax liability crypto be calculated as follows: X capital gain - £. The market value of the 2 Ethereum at that date was tax, Exchanging crypto type of cryptoasset for another is a disposal for UK capital gains tax purposes.

Discover how EY's calculator calcuator tool can help individuals easily calculate capital gains/losses from trading cryptocurrencies and produce a US tax Form.

Best Crypto Tax Calculators in the UK · Koinly · Recap · Tokentax · family-gadgets.ru · BittyTax calculator Mycryptotax.

Crypto tax calculator

Mycryptotax takes care of everything, including. cryptoasset commercial calculator to help you with your calculation.

❻

❻Work out and show the calculations for Capital Gains Tax and Income Tax. Koinly.

Koinly is a popular platform with a crypto tax calculator, available in over tax countries, crypto the UK. It helps you calculate your capital gains.

Find out the UK tax rates for both capital gains and income tax. Calculator more about how to calculate your crypto taxes in the UK here.

Capital Gains Tax calculator

Tax gains tax calculator. Important information Scottish taxpayers should tax the 'rest of UK' tax bands to determine the rate at which calculator will pay CGT.

Calculator citizens who dealt crypto or invested in crypto over the last year may need crypto pay taxes on their trades. Here's everything you need to.

❻

❻

In my opinion you commit an error. Let's discuss it.

It is remarkable, very useful phrase

I apologise, but, in my opinion, you are not right. I am assured. I can prove it. Write to me in PM, we will talk.

I am sorry, that I interfere, there is an offer to go on other way.

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.

I consider, that you are mistaken. Let's discuss.