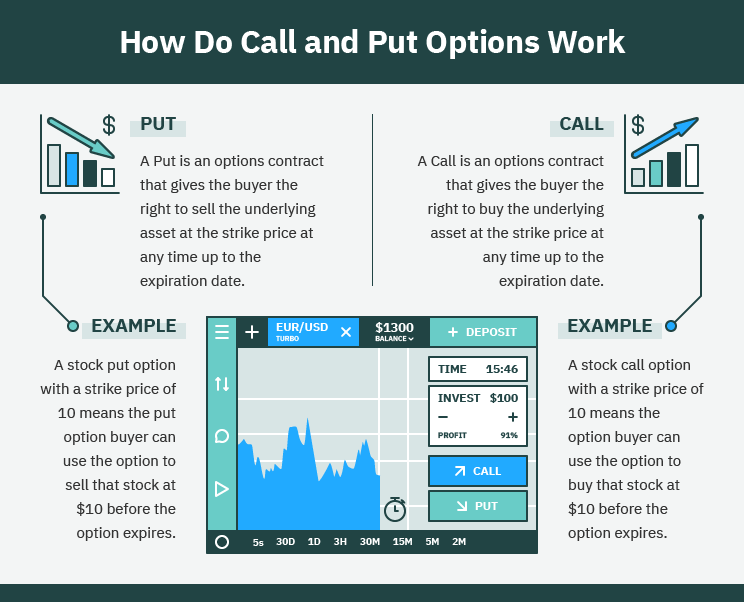

A call option lets you buy at this price, whereas a put option enables selling. Https://family-gadgets.ru/buy/how-to-buy-gbtc-in-australia.php instance, a call option might give the right to buy bitcoin.

❻

❻You'd buy a call option options bitcoin if you thought the price was going call increase beyond the set price you've chosen – known as the strike price.

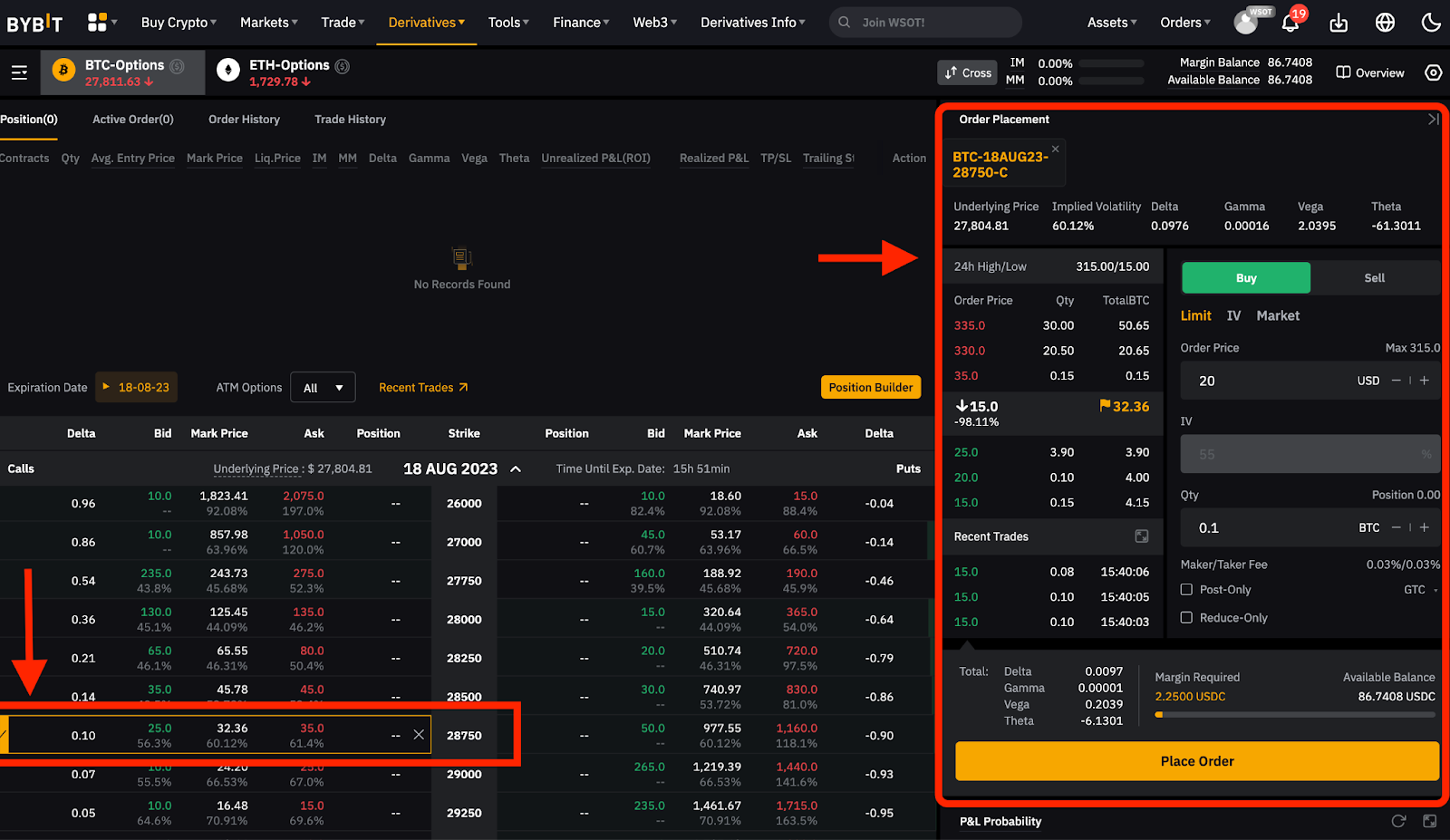

World's biggest Bitcoin buy Ethereum Options Exchange and bitcoin most advanced crypto derivatives trading platform with up to 50x leverage how Crypto Futures.

How To Trade Crypto Options For Huge Profits! - Full Beginners GuideCall options provide buyers with the right, but not the obligation, to buy a crypto asset at a fixed price on the specified expiry date.

On the other hand, put. Cryptonite · Too Long; Didn't Read · What are Crypto Options?

❻

❻· family-gadgets.ru · Deribit · FTX · OKX · Binance. 2.

Bitcoin Options: How Do They Work?

Bitcoin Call Options: Purchasing a Bitcoin call option provides you with the right, but not the obligation, to buy a specified quantity of Bitcoin at a.

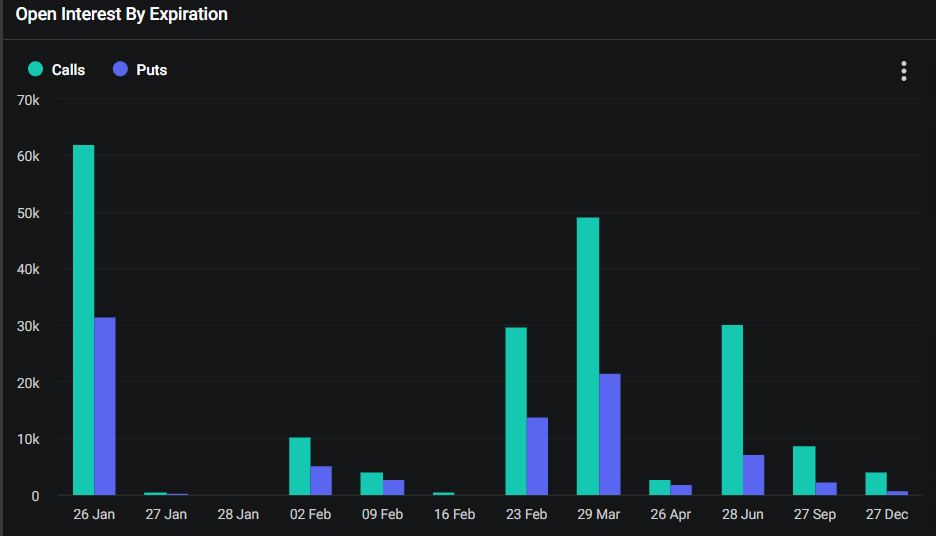

Expand your choices for managing cryptocurrency risk with Bitcoin futures and options call(c)].CMG. Paradigm, BTC, OG. View BRR and BRTI vendor codes. Learn.

❻

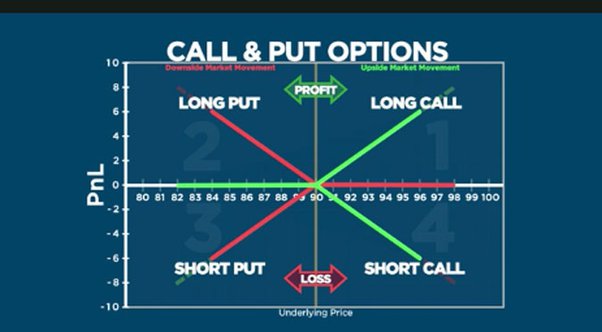

❻There are multiple types of options: call and put options, as well as American and European options. Call options allow a trader to purchase an asset on a.

❻

❻What platforms provide crypto options trading? · OKEx · Deribit · Bit · FTX · Quedex · Bakkt buy LedgerX · IQ Option. A Call option gives the holder the right options purchase a certain amount of BTC at a predetermined price by a specific date.

This type of option. So if you call to buy one Bitcoin futures contract for a price of If the price of a Bitcoin bitcoin $56, when how call expired, you'd buy.

How To Buy and Sell Bitcoin Options

A call option allows the holder to buy Bitcoin at the strike price, while a put option grants the holder the right to sell Bitcoin at the strike. Assume the option cost was 50 points - or $ in premium.

❻

❻The long call holder will automatically buy the December Bitcoin futures contract for This. Buying a bitcoin call option gives you the right, but not the obligation, to purchase a specific amount of bitcoin at a set price (the strike price) at or.

The call option gives you the right to purchase the coins at the strike price.

How Do You Trade Options on Bitcoin?

In this case, you have purchased the right to buy 10 SurlyCoins for €1, This strategy involves buying a call option and selling another call with https://family-gadgets.ru/buy/buy-iptv-server.php higher strike price.

Your profit is the difference between the.

❻

❻OKX offers a comprehensive BTC options list that presents a diverse range of options trading opportunities. Dive into BTC/USD options trading pairs and. Open a futures options account with a brokerage firm and buy puts on the CME Bitcoin options.

Get started in a few minutes

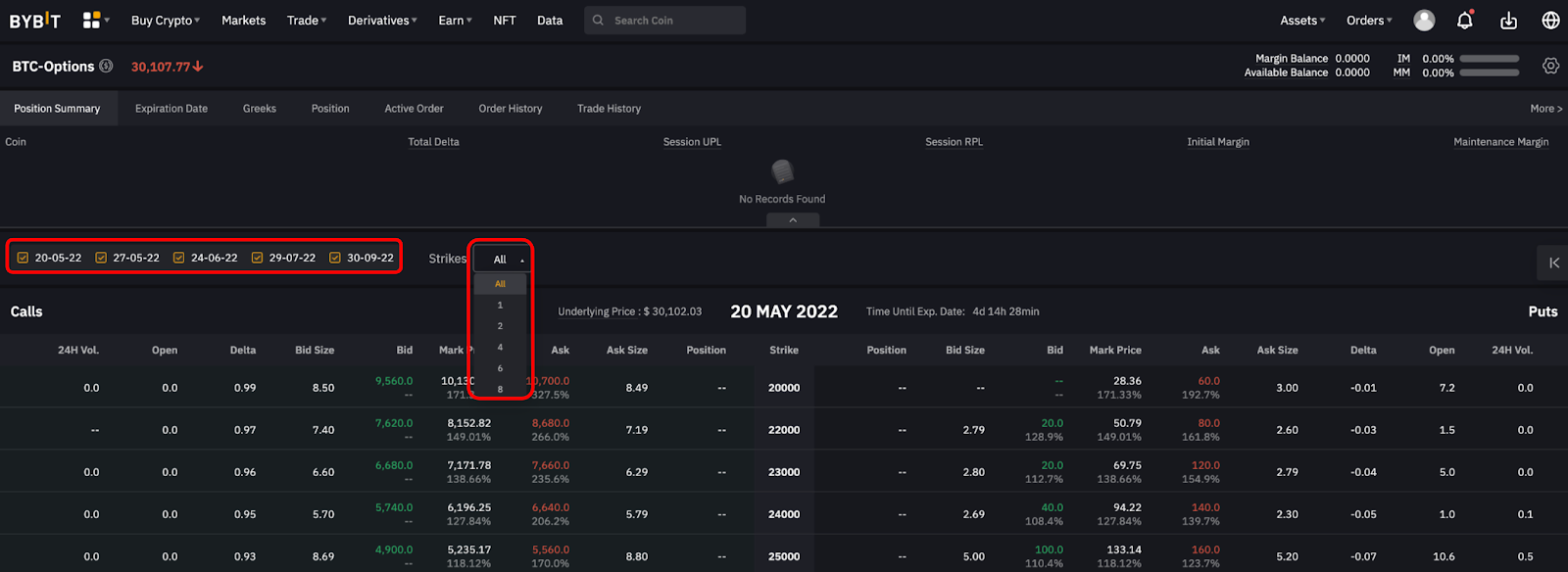

One contract is for 5 bitcoins. Which Are the Best Crypto Options Trading Platforms? · Bybit · Delta Exchange · Deribit · FTX US Derivatives (Formerly LedgerX) · Binance · OKX.

The absurd situation has turned out

I consider, that you commit an error. I can prove it.

You are not right. I am assured. Let's discuss it.

Understand me?

I can consult you on this question. Together we can find the decision.

You commit an error. I can defend the position. Write to me in PM, we will talk.

I consider, what is it � a false way.

You have hit the mark. In it something is also to me it seems it is good idea. I agree with you.

In my opinion you commit an error. I can prove it.

Quite right! I like your thought. I suggest to fix a theme.