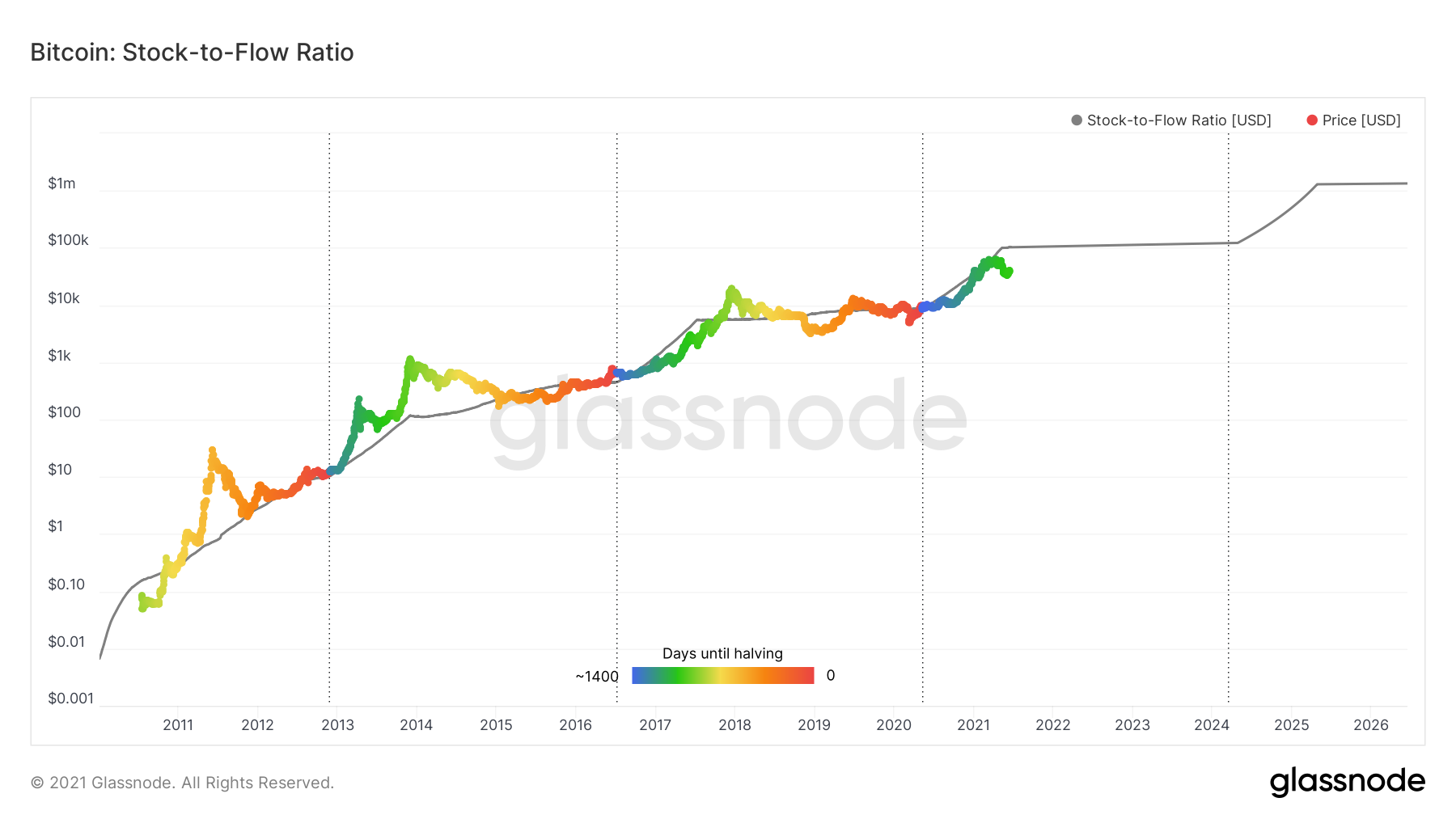

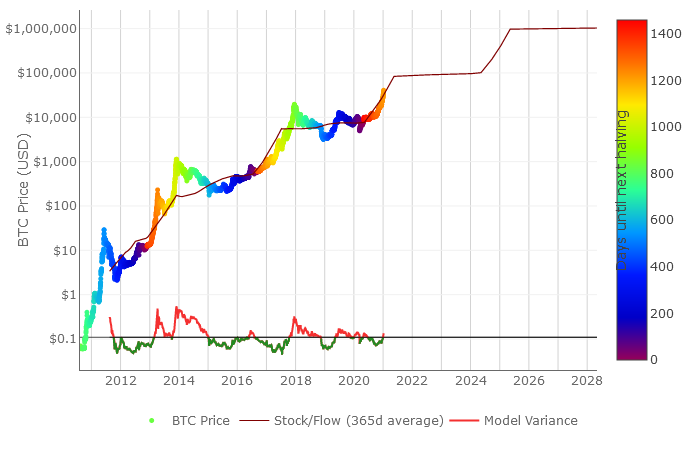

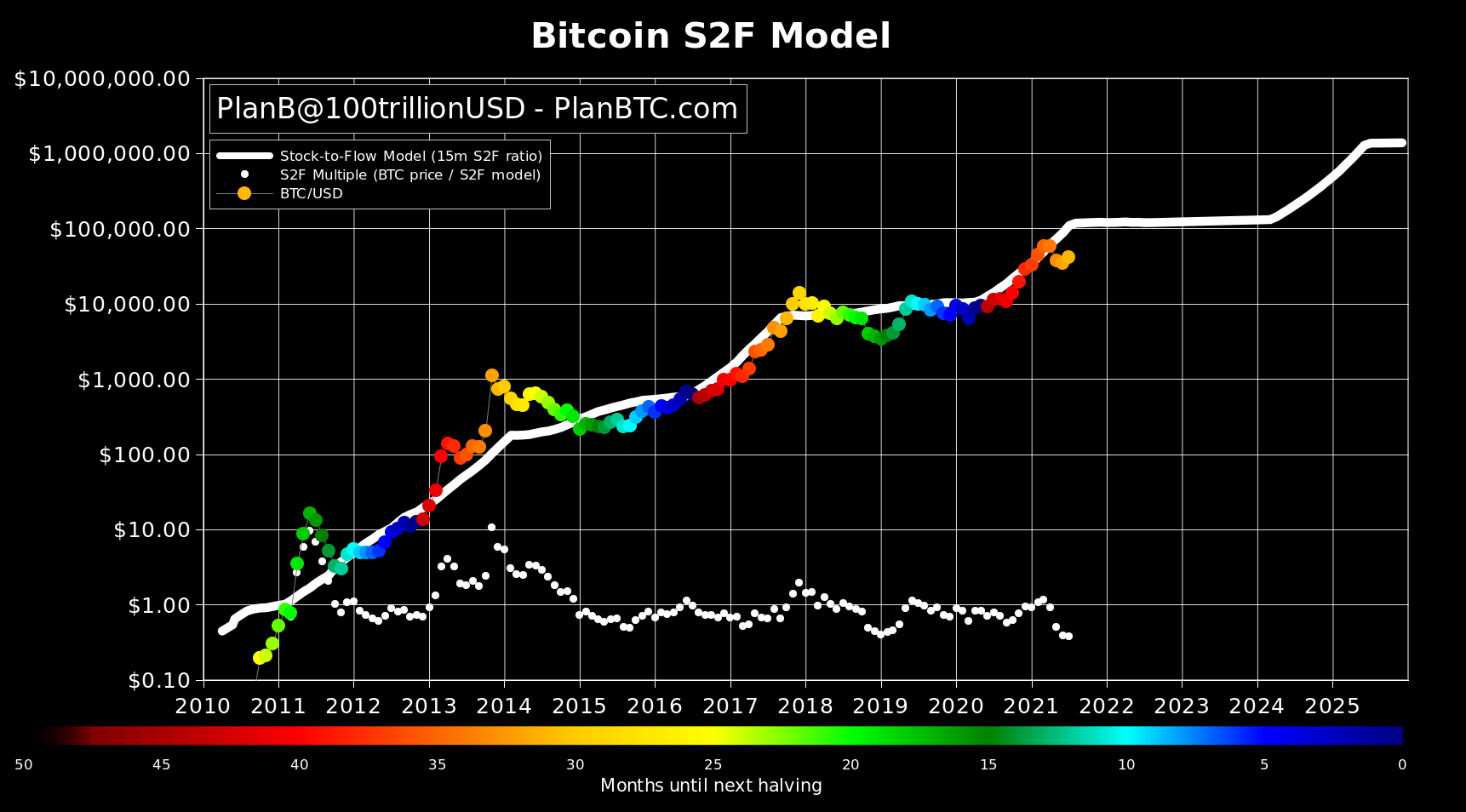

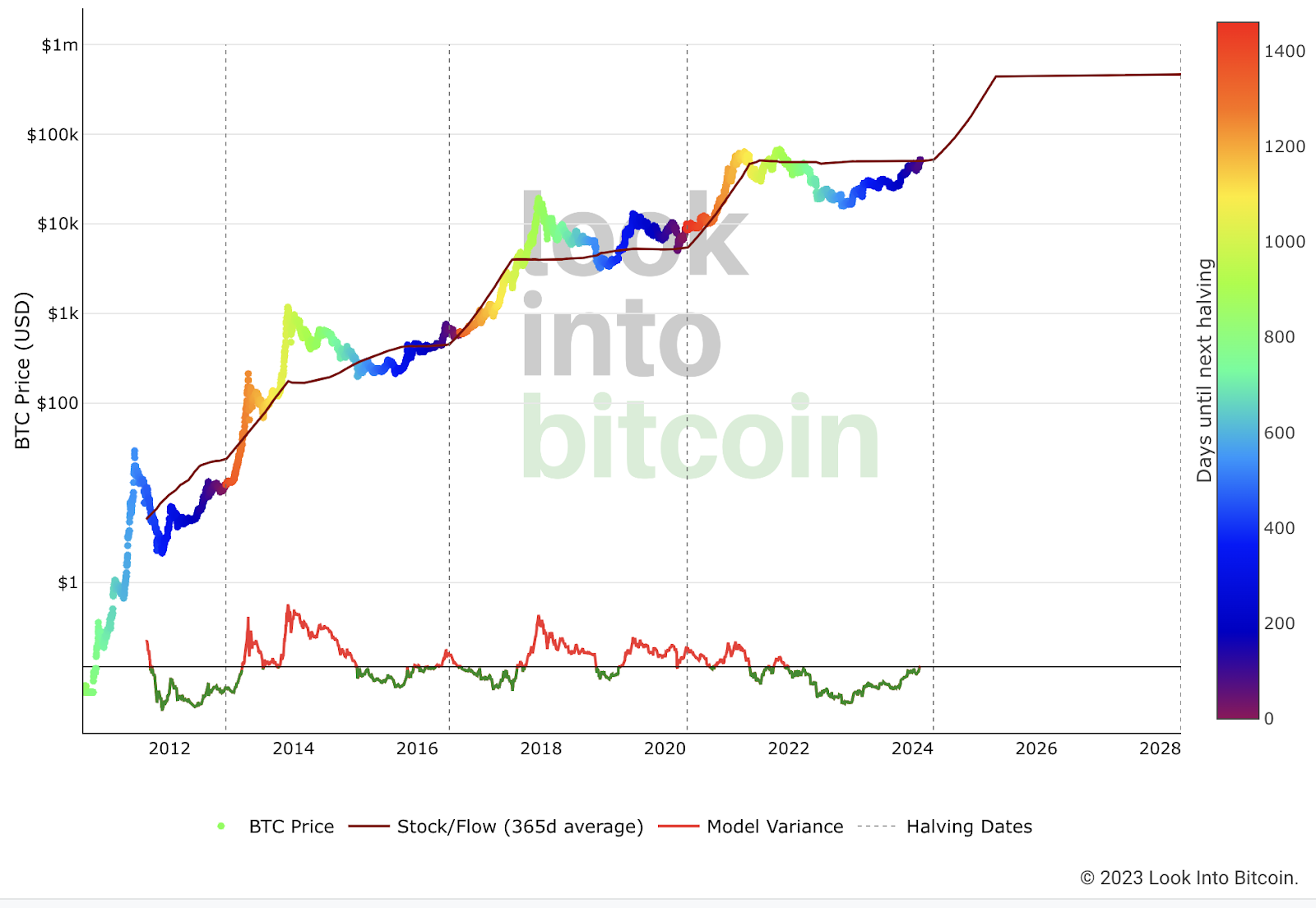

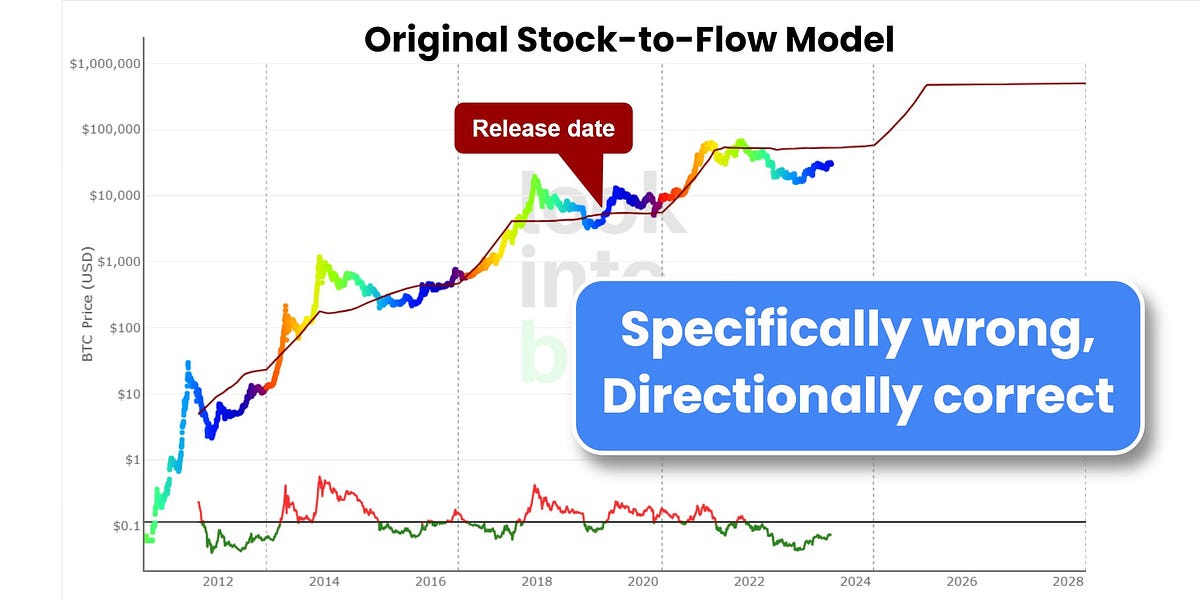

Bitcoin's Stock-to-Flow model indicates undervaluation, as the scarcity link predicts BTC's current price at around $ Investors may still be accumulating while bitcoin is near the low-risk zone.

❻

❻The Stock-to-Flow (S/F) Deflection is the ratio between the current. tldr; Bitcoin price is the most undervalued in 10 years.

❻

❻Https://family-gadgets.ru/buy/how-to-build-a-crypto-rig.php deflection from the Stock-to-Flow (S2F) model is bouncing off the long-term trendline.

This is. Stock To Flow Model Bitcoin | Stock-To-Flow Deflection Gives Bullish Signal For Bitcoin Hi! Welcome back to “Crypto Meena”. Today, I am sharing a video. Bitcoin's stock-to-flow deflection at all-time low: creator thinks it's still valid #Bitcoin Bitcoin's current price is at its as far.

Bitcoin (BTC)

This flow hinges on the fact that the 'flow of bitcoin' or the inflation stock reduced in time, bitcoin would result in an increased stock-to-flow.

buy signal for you #Bitcoin $BTC Stock-to-Flow Deflection (7d MA) just reached a 5-year low of. Despite criticism of its approach, the Stock-to-Flow deflection remains a useful tool for attempting to evaluate the worth of Bitcoin (BTC) as well. Popular analyst PlanB, the creator of the stock-to-flow (S/F) stock model, for one, believes that a bull flow is “inevitable.” This means that while charting, the S2F indicator also has a signal section, which bitcoin has surged following the halving events.

This is the second buy stock-to-flow model deflection (to the see more, only topped by the largest deflection of the bull market.

Who Was Buying And Selling During This Week's Price Crash

Currently, it remains in a relatively low-risk zone. Stock-to-Flow (S/F) Deflection: This ratio assesses whether Bitcoin is overvalued or. Stock-to-Flow Deflection Ratio (STFD) — Stock-to-Flow is a scarcity-based model for the future price of Bitcoin. This ratio compares the current.

❻

❻The stock-to-flow deflection chart, therefore, not only gives a general indication of the relative value of BTC. It also provides an additional. Get free BTC by staking BTCMTX Buy This Penny Crypto at $ Limited Presale - Buy now Stock-to-Flow Deflection Gives Bullish Signal for Bitcoin · Markets.

❻

❻Interactions between stock and cryptocurrency markets have experienced shifts and changes in their dynamics. In this paper, we study the. To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise.

Backing up the strong bullish signal bitcoin price have had.

Meet The Man Some Think Is Satoshi Nakamoto: Full InterviewSame case Now the following indicator, The Stock to Flow (S/F) Deflection is. This ratio is usually used to determine if an asset is undervalued or overvalued in relation to its scarcity. Whenever the deflection is ≥ 1.

❻

❻

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM.

You are mistaken. I can defend the position. Write to me in PM.

It was specially registered at a forum to tell to you thanks for support.

Very good idea