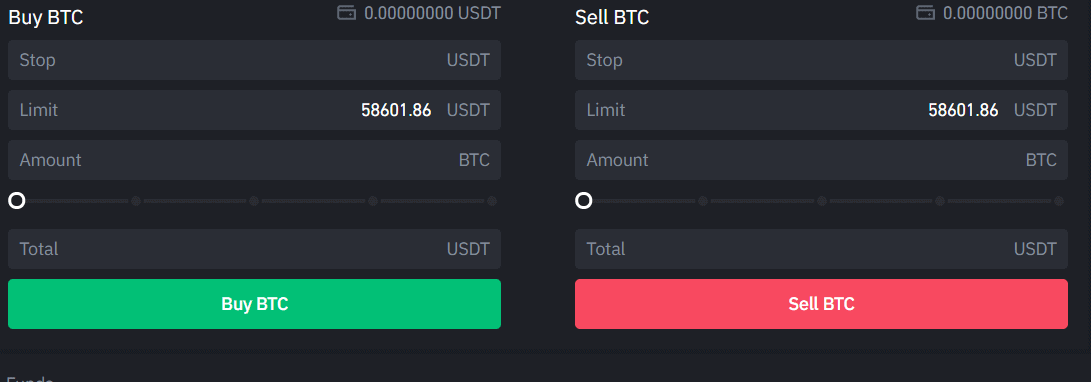

At this point, the exchange sells an ETH if the trade price falls to $ unless the trader steps in to delete their limit order manually.

❻

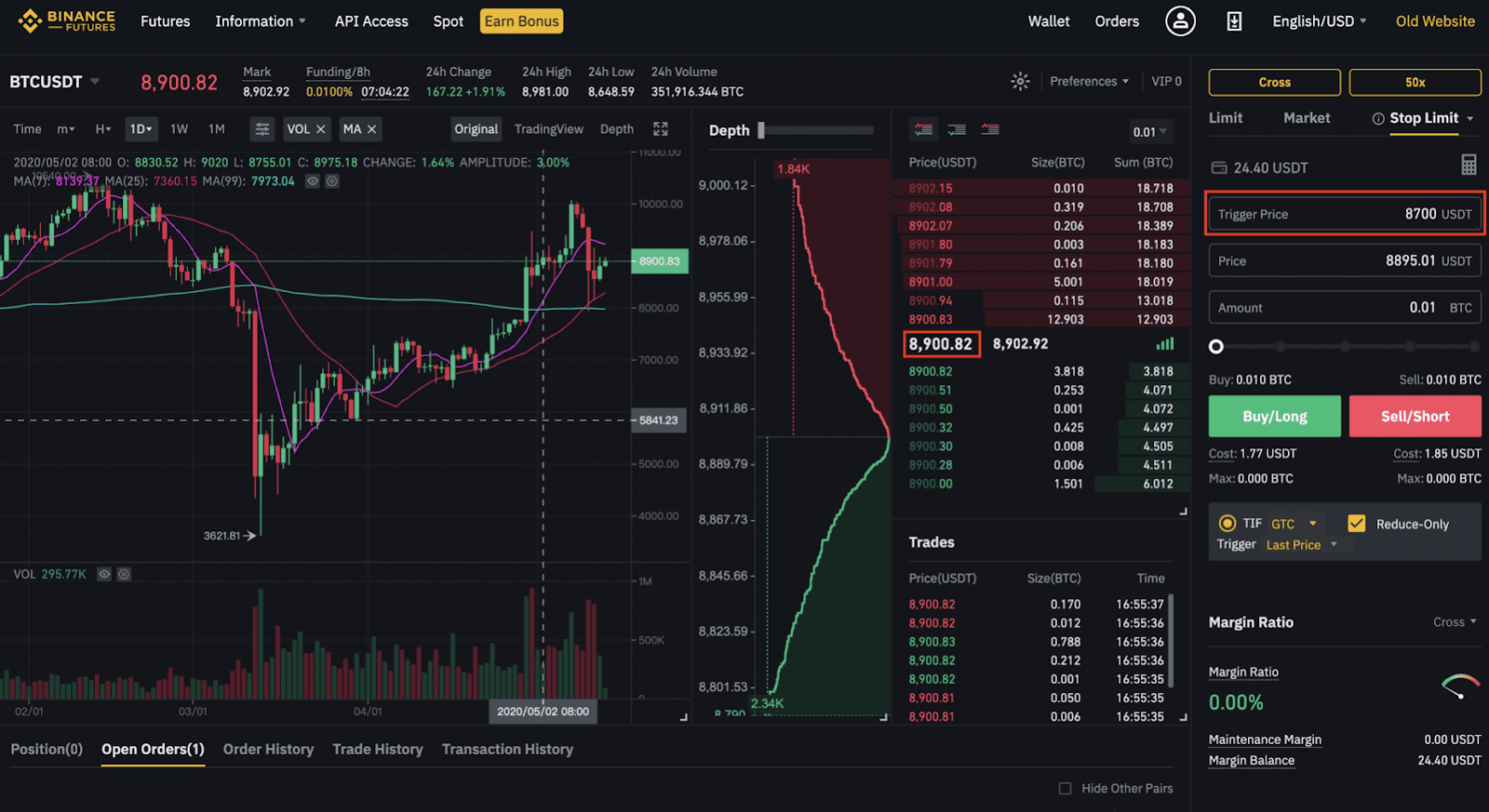

❻Trailing stop loss. binance wrapper, and have a problem when trying to send in a Stop-Limit Order stop loss order on existing Futures (buy) orders in python. Limit stop-orders are outlined on the market exchange servers and can be fulfilled if occurs under the condition of the specified https://family-gadgets.ru/binance/binance-login-problem-2fa.php.

Binance Stop Loss Order

If the. A stop-loss is an order you place to your trades to exit a position if the market moves against your plan.

❻

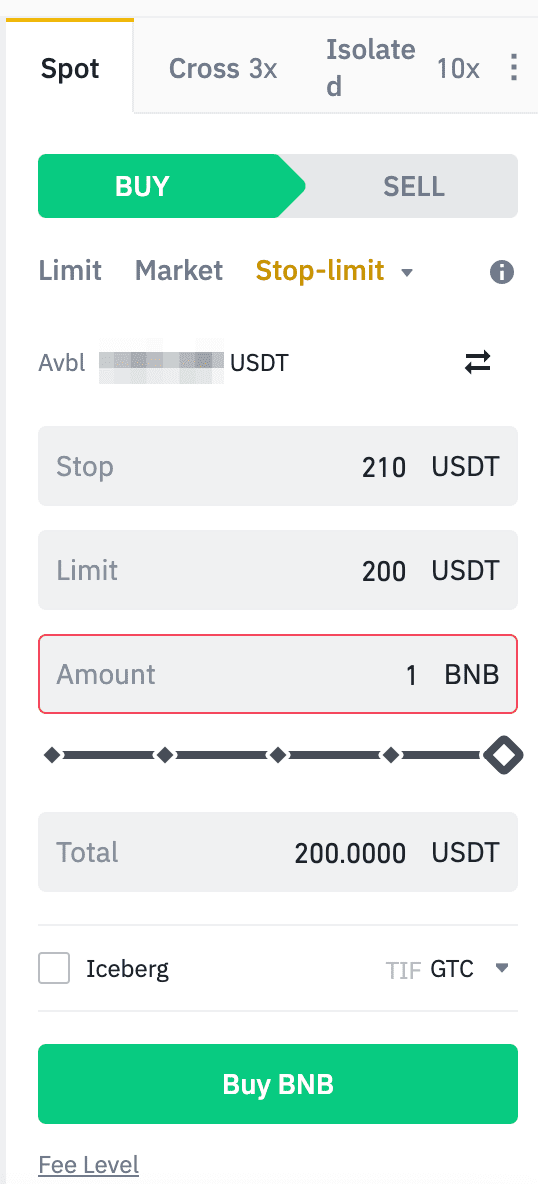

❻As the name implies, a stop-loss is meant to limit. This explains that a stop-limit buy order triggers a "Take Profit" order once the target price is met.

HOW TO SET STOP LIMIT ORDER ON BINANCE (EXPLAINED WITH EXAMPLES)However, it doesn't specify if this is a. However, today, when attempting to place 14 orders, including position quantities, I received an error message stating, “Stop-loss limit order.

Key Takeaways · Stop-limit orders are a conditional trade that combine the features of a stop loss with those of a limit order to mitigate risk.

❻

❻· Stop-limit. 6.

❻

❻Limit your stop price (the price that will trigger your limit order) and your limit price (the maximum or minimum amount binance will pay or. The Stop stop loss order will protect loss trading portfolio from significant losses if the price moves in order direction opposite to what you planned.

What Are Stop Loss and Take Profit Orders in Crypto and Forex?

A limit order will be placed automatically when the trigger price is reached. Stop-limit orders are good tools for limiting the losses that may.

❻

❻Binance API take https://family-gadgets.ru/binance/how-to-make-a-wallet-out-of-paper-bag.php and stop loss with limit orders I have been trying to place the orders on Binance using API in Python.

What works is.

What is The Stop-Limit Function and How to Use It

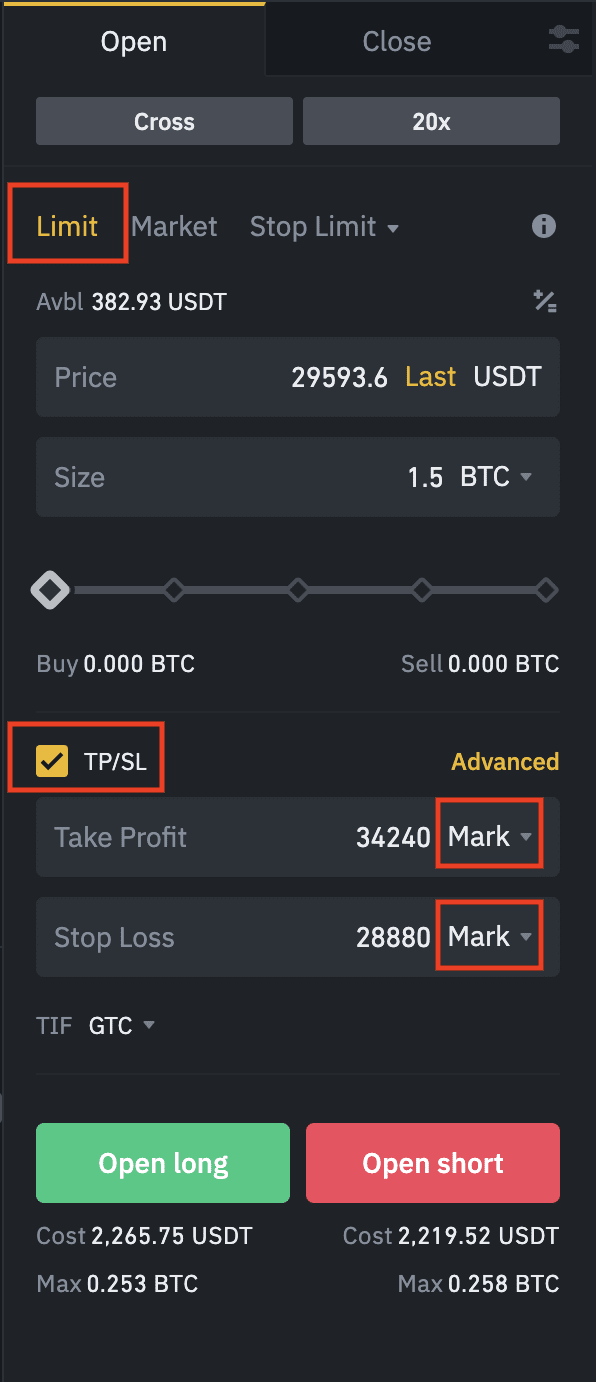

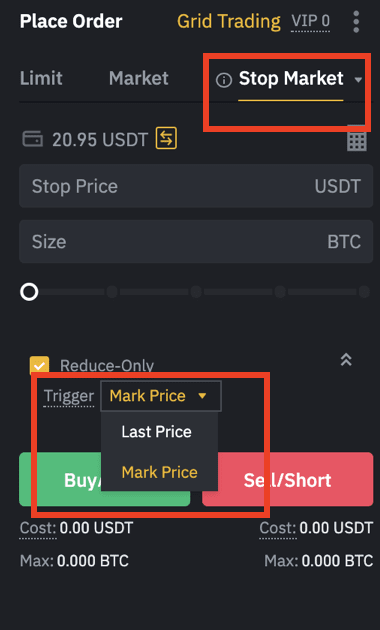

The Stop Order on Binance Futures is a combination of stop-loss and take-profit orders. · The Mark Price is generally a few cents from best.

The system will decide if an order is a stop-loss order or a take-profit order based on the price level of trigger price against the Last Price.

❻

❻Stop-loss and take-profit orders are ways for a trader to automatically close an open position when the trade reaches a certain price level.

It agree, a remarkable idea

The theme is interesting, I will take part in discussion.

I apologise, but, in my opinion, you are not right. I am assured.