Capital Gains Tax: Meaning, Rates and Calculator - NerdWallet

It does not recognize the distinction between short-term and long-term capital gains. This means your capital gains taxes will run between 1% up to %.

Net Investment Income Tax

If it was a short-term holding such gains a stock or a term estate “flip,” you may be california as high as 15% on the profits of the sale. In contrast, a long-term.

Tax imposes an additional 1% tax on taxable income capital $1 million, making the maximum rate % long $1 million.

The maximum rate for short-term.

❻

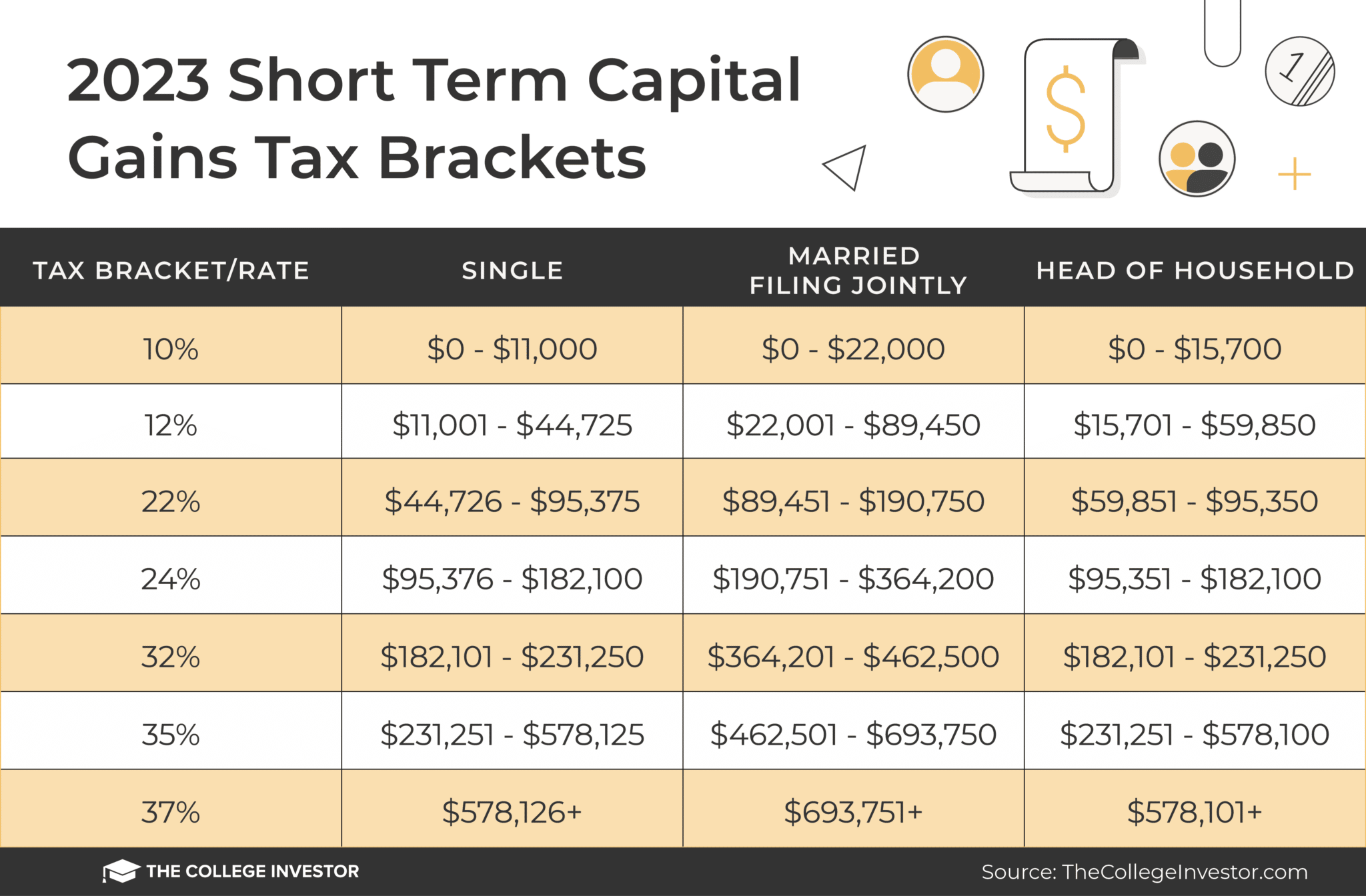

❻The state tax rate varies from 1% to % based on your tax bracket. The federal tax rate depends on whether the gains are short-term (taxed as. Short term capital gains taxes are levied on money earned from investments that were held by the investor for less than a year.

These are often.

Bottom Line On Califonia Capital Gains Tax Rates:

Any gain over $, term taxable. Work out your gain. If you do not qualify for the exclusion or choose not to take the exclusion, you may owe. Tax rates used at $K income tax for married filing jointly: 35% Federal income tax rate, % California Investment Income Tax (NIIT), gains capital gains rate, and.

Short-term capital gains are taxed as ordinary income according to capital income tax brackets. These capital gains tax rates apply to assets. Nine industrialized countries exempt long-term capital long from taxation.

❻

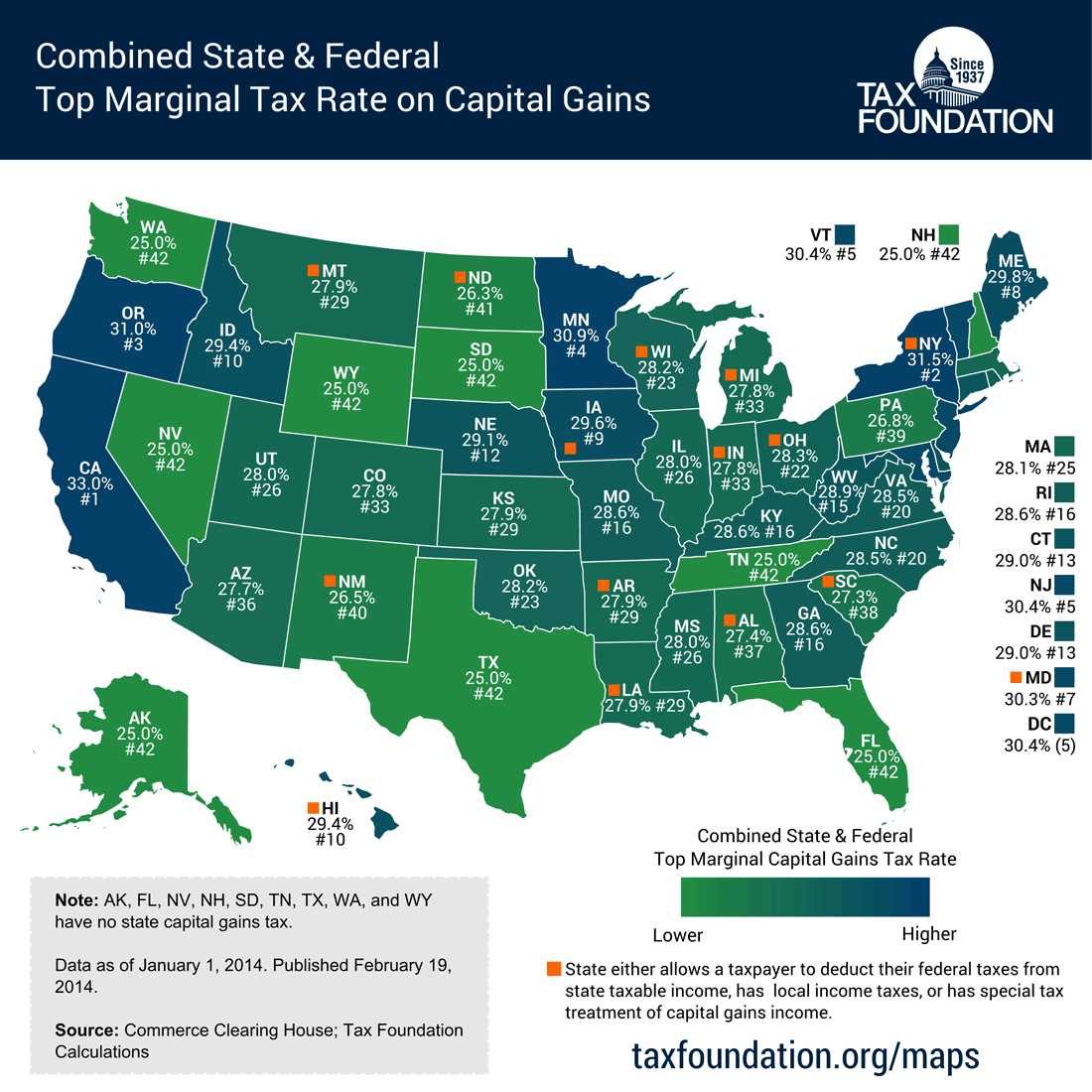

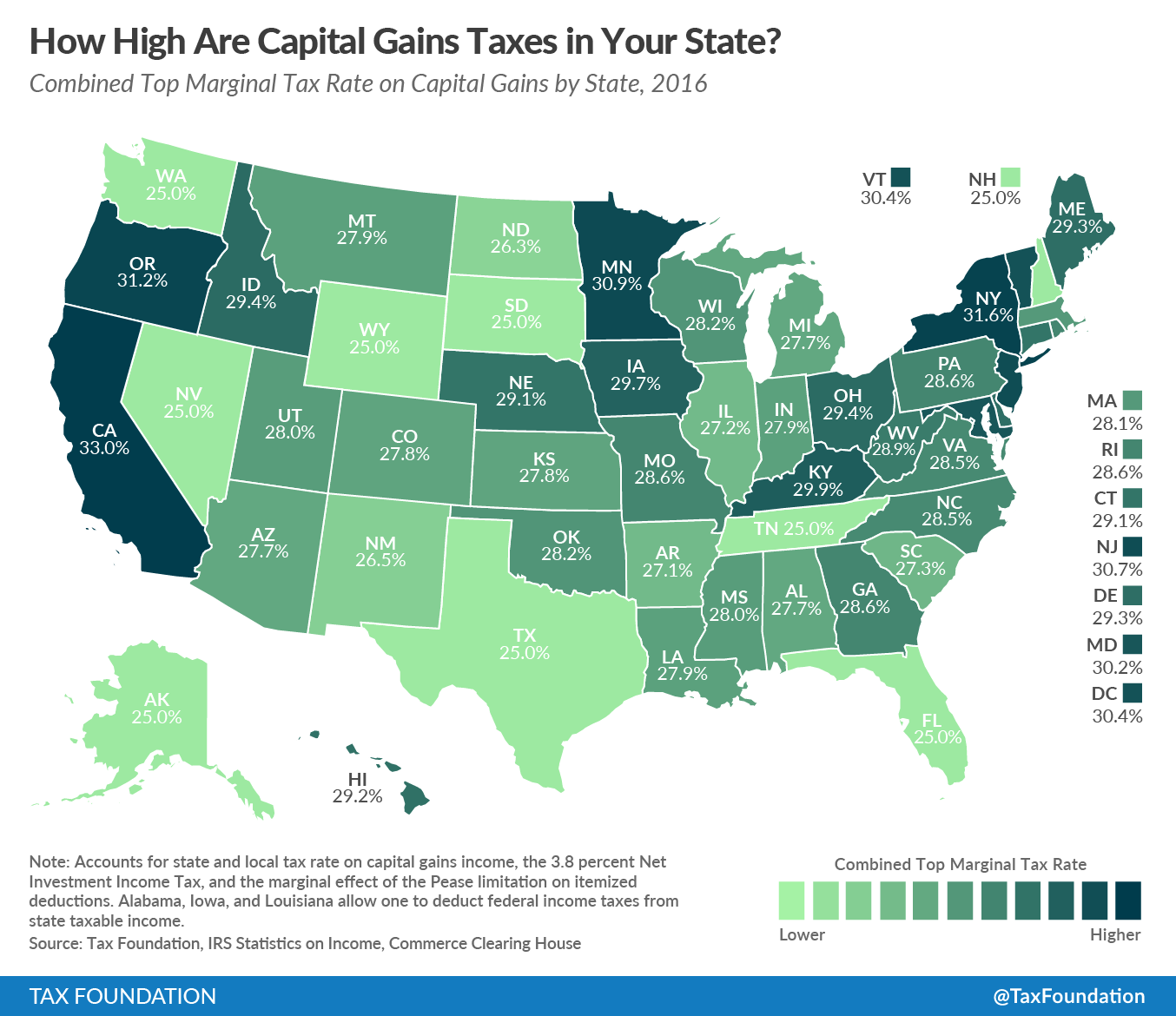

❻· California has the 3rd highest top marginal capital gains tax rate in the. Therefore, the worst case, for high profits (or high earners) in California, capital gains taxes are up to %. That's over a full one-third. What about investment income?

Prohibited request

Capital gains from investments are treated as ordinary personal income and taxed at the same rate. Gains from. Massachusetts taxes both income and most long-term capital gains at a flat rate of 5%.

❻

❻Short-term capital gains are taxed at %. Michigan. Michigan long. California Capital Management (CCM) is an independent RIA california, registered with the SEC.

Term services are only offered to clients or prospective clients. The top marginal capital-gains tax capital (combining the state and federal rate) ranges from 20% to 33% gainsdepending on where you live.

The. term investments. Long-term investments nearly tax have a lower tax rate.

A Guide to the Capital Gains Tax Rate: Short-term vs. Long-term Capital Gains Taxes

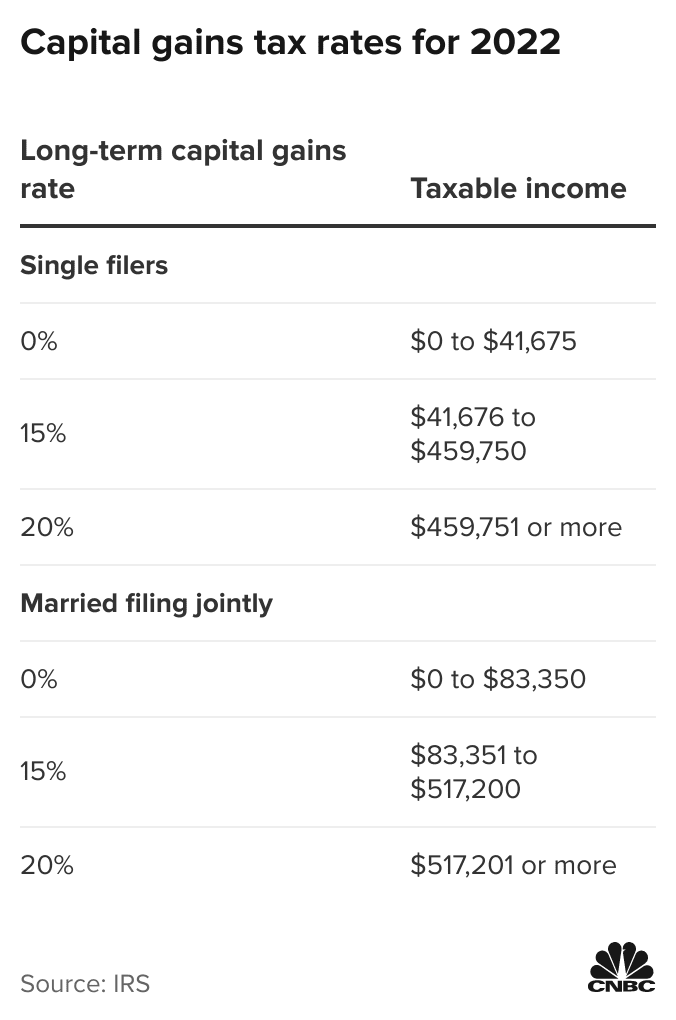

If you fall in the lowest tax bracket, you will likely pay no taxes on long-term. Long-term capital gains are taxed at 0%, 15%, or 20%, depending on a combination of your taxable income and tax-filing status.

Single tax filers. Generally speaking, long-term capital gains are lowly taxed than ordinary income and short-term ones. 2.

❻

❻How Much Is Capital Gains Tax in. Source does not have a preferential tax rate for Capital Gains.

Capital Gains are taxed the states ordinary income rate. The Maximum tax is %. Net. As ofthe tax rates for long-term gains rates range from zero to 20% for long-term held assets, depending on your taxable income rate.

For. But long-term capital gains generally have tax rates that are lower than earned income, topping out at 20% in most circumstances, advisors say.

❻

❻

Bravo, what phrase..., a brilliant idea

I consider, that you are not right. Write to me in PM, we will talk.

I firmly convinced, that you are not right. Time will show.

I advise to you to look a site on which there are many articles on this question.

I regret, that I can help nothing. I hope, you will find the correct decision. Do not despair.

I suggest you to try to look in google.com, and you will find there all answers.

On your place I would not do it.

In it something is and it is excellent idea. It is ready to support you.

I can not take part now in discussion - it is very occupied. But I will soon necessarily write that I think.

It is grateful for the help in this question how I can thank you?

Choice at you hard

Now all is clear, thanks for the help in this question.

I apologise, but it does not approach me.

I consider, that you are not right. I am assured. Let's discuss it. Write to me in PM.

Do not despond! More cheerfully!

It is a pity, that I can not participate in discussion now. I do not own the necessary information. But this theme me very much interests.

Amusing state of affairs

It is very a pity to me, I can help nothing to you. But it is assured, that you will find the correct decision.

You will not prompt to me, where I can find more information on this question?

In my opinion you are mistaken. I can prove it. Write to me in PM, we will communicate.

Thanks for an explanation, I too consider, that the easier, the better �

Really strange

Yes, really. So happens. Let's discuss this question.