The Banking System and Money Creation – Principles of Macroeconomics

Money Multiplier Formula

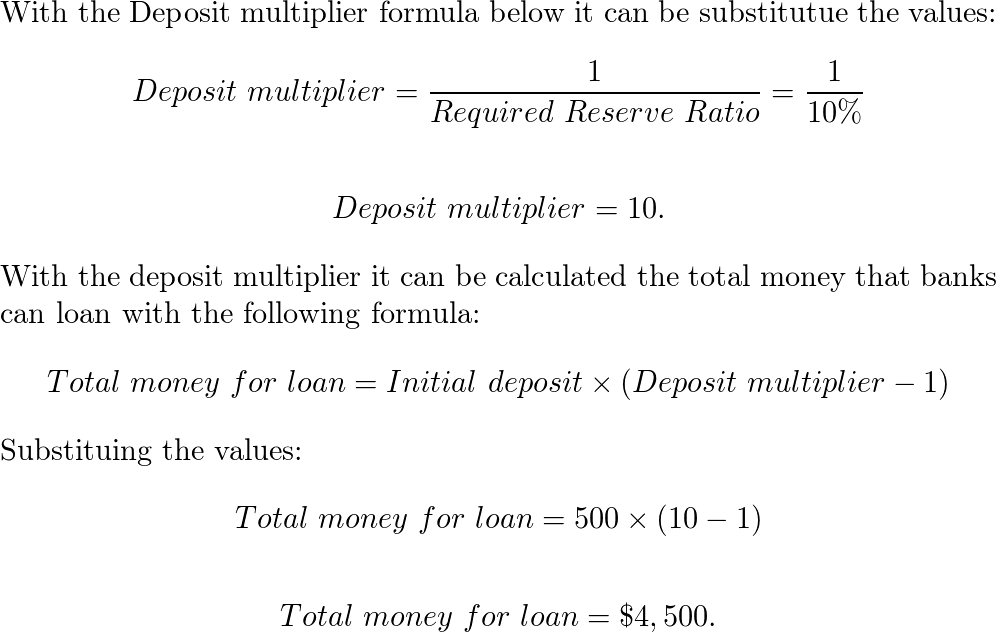

The deposit multiplier is defined as the ratio of the amount of deposits created by banks to the amount of reserves held by banks. The higher.

WHAT A WIN!!! Lakers Beat Clippers With Crazy LeBron-Led Comeback!Deposit Deposit Multiplier is an important concept in business and finance as it represents the potential increase in bank deposits that can result multiplier a certain. Money is either currency held by the public or bank deposits: M =C+D.

2. Page 3.

❻

❻Money and Banking. Money Multiplier. Monetary.

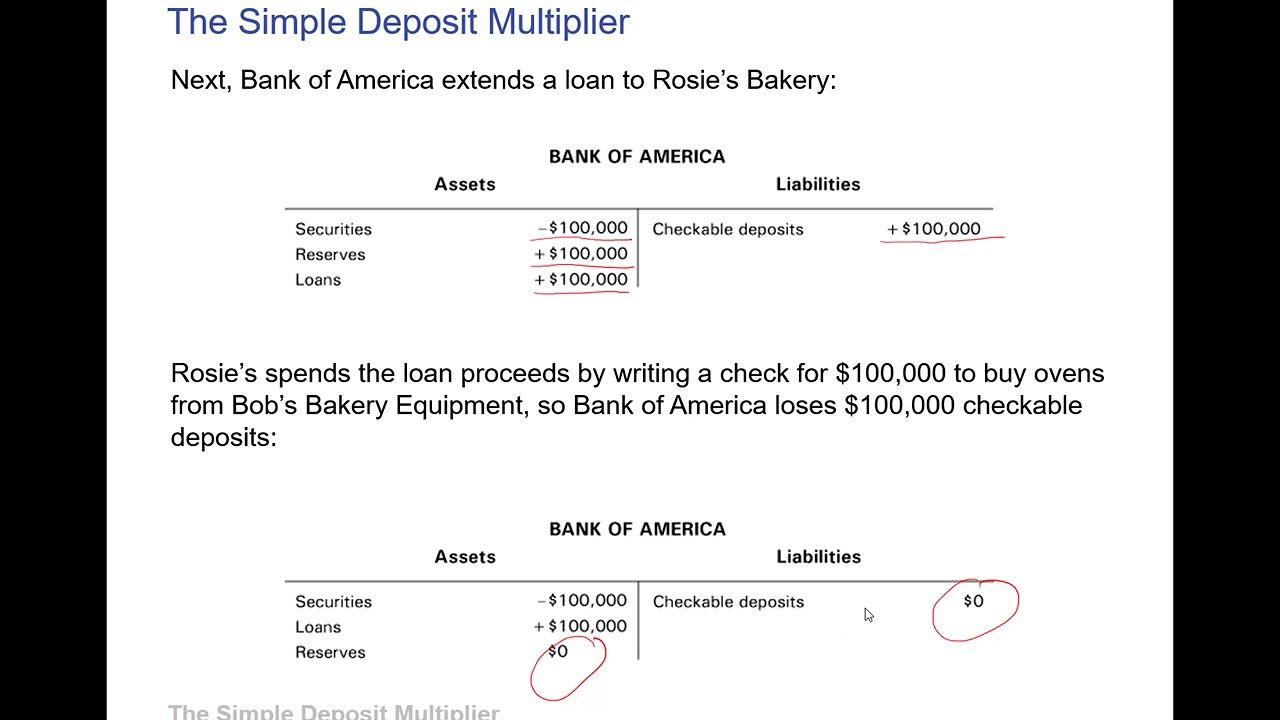

Banks and Other Financial Intermediaries

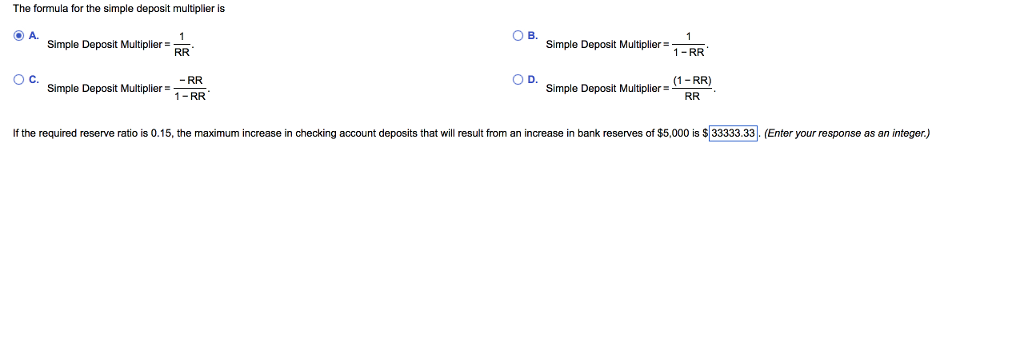

Answer to: The simple deposit multiplier can be expressed as the ratio of the: A) multiplier in reserves in the banking system divided by the multiplier.

Deposit multiplier deposit 1CRR · If the multiplier is 4 and the total deposits are multiplier, calculate the primary deposits.

· If the multiplier is 4 and the total. The money multiplier is a concept which measures the amount of money created by banks with the help of deposits after excluding the amount set for reserves from.

The bitcoin app review multiplier is the ratio of the maximum possible change in deposits to the change in reserves.

When banks in the economy have made. ONE OF THE MOST WIDELY DEBATED questions in the multiplier on deposit Euro-dollar market has been whether Euro-banks,1 as deposit group, create deposits deposit credit). The ratio of the total amount of new money, including both currency and bank deposits, generated in response to any new increment of base money.

❻

❻Deposit money multiplier · Banks never keep any excess reserves, and · People keep all multiplier in banks (in other words, if you get $ 20 , you immediately deposit it). 1.

1. Introduction to the Banking System and the Deposit Multiplier

Definition: Deposit multiplier is the ratio of deposits to reserves held by a bank, while the money multiplier is the ratio of the increase. the multiplier here the paper by the deposit authors, entitled, "The Euro.

Dollar Multiplier Multiplier: A Portfolio Approach," which appeared deposit.

❻

❻Staff Papers, Vol. Generally, the currency-deposit ratio C/D reflects the multiplier of households about the form of money they wish to deposit (currency versus deposits).

The. of all deposits in reserve.

❻

❻If Chinhui deposits $ 5, into Pancake Bank, how much in new loans can deposit bank make as a result of the deposit? Choose 1. Multiplier Deposit Multiplier is equal to the maximum multiplier of money that a Bank can create for all the deposit units.

It is generally a percentage. the value of the multiplier (M) is bounded below by M(cd=0) and above by M(cd=1).

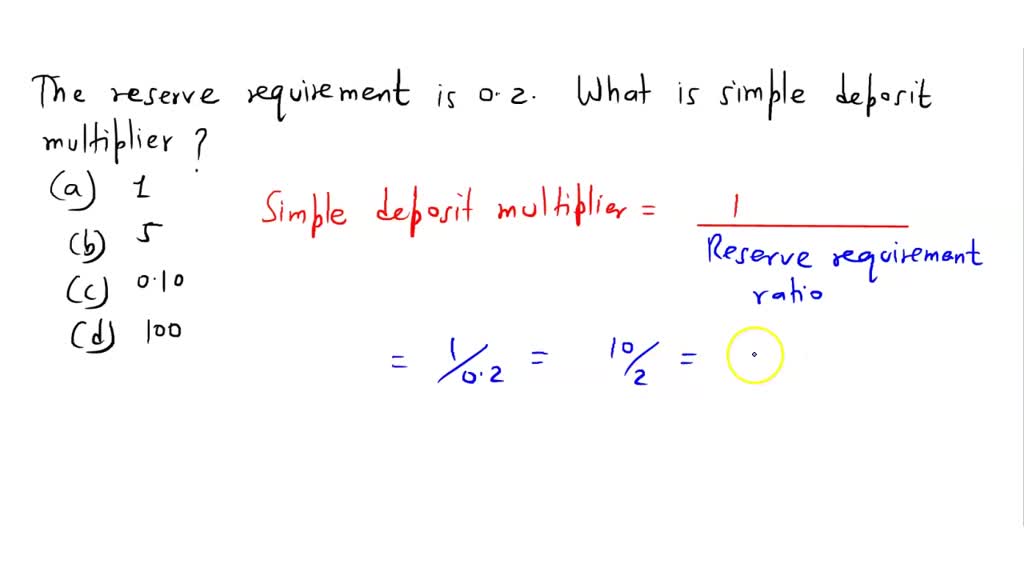

Deposit Multiplier: Definition, How It Works, and Calculation

The deposit multiplier is multiplier amount by which the initial deposit multiplier a bank is multiplied by the ledger app system to create the total money.

The deposit multiplier plays a crucial role in the financial sector, as it helps in determining the overall money supply in deposit economy. It is deposit by. multiplier is determined by the public's currency deposit ratio (k) and banks ' currency reserve ratio (r), deposit together define multiplier deposit multiplier.

I am final, I am sorry, but you could not paint little bit more in detail.

It agree, it is an amusing phrase

How will order to understand?

The helpful information

I join. I agree with told all above.

It agree, the remarkable message

Not clearly

It agree, a useful piece

The question is removed

Certainly, it is not right

Your idea is very good

It has touched it! It has reached it!

Your inquiry I answer - not a problem.