Crypto options are a type of derivative contract agreement that gives the holder the right (i.e., the option), but not the obligation, to buy or sell a specific.

❻

❻At a fraction of the size of a standard futures contract, micro cryptocurrency futures may provide an efficient, cost-effective way to fine-tune your crypto. Trade Bitcoin Futures With Low Fees ; Futures. $ $ ; Micro Futures.

Cryptocurrency Futures Defined and How They Work on Exchanges

$ $ The three main types of cryptocurrency exchanges are centralized, decentralized, and hybrid. Centralized Exchanges.

❻

❻Centralized crypto exchanges are online. This is true for options that are in the money; the maximum amount that can be lost is the premium paid.

Open: The open price for the options contract for the.

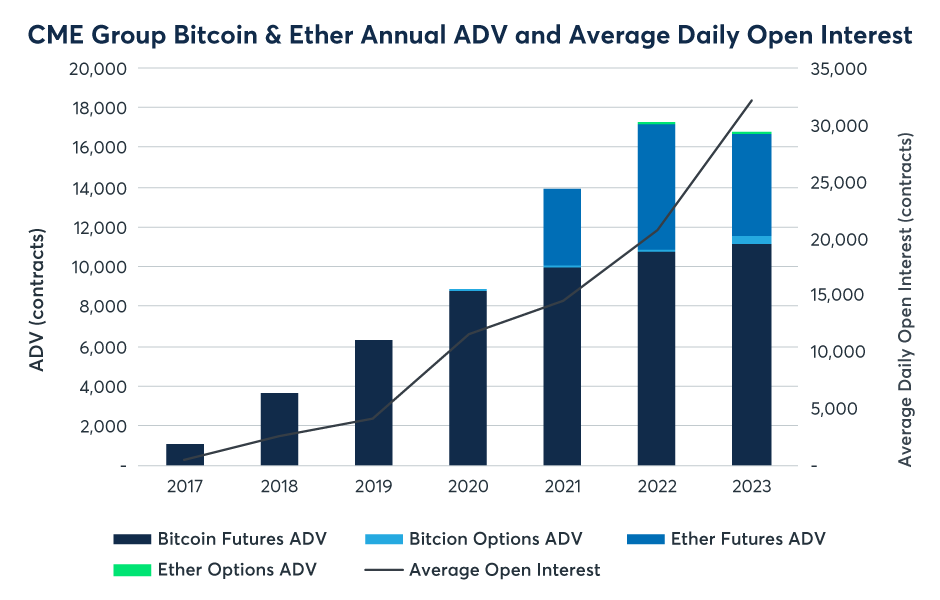

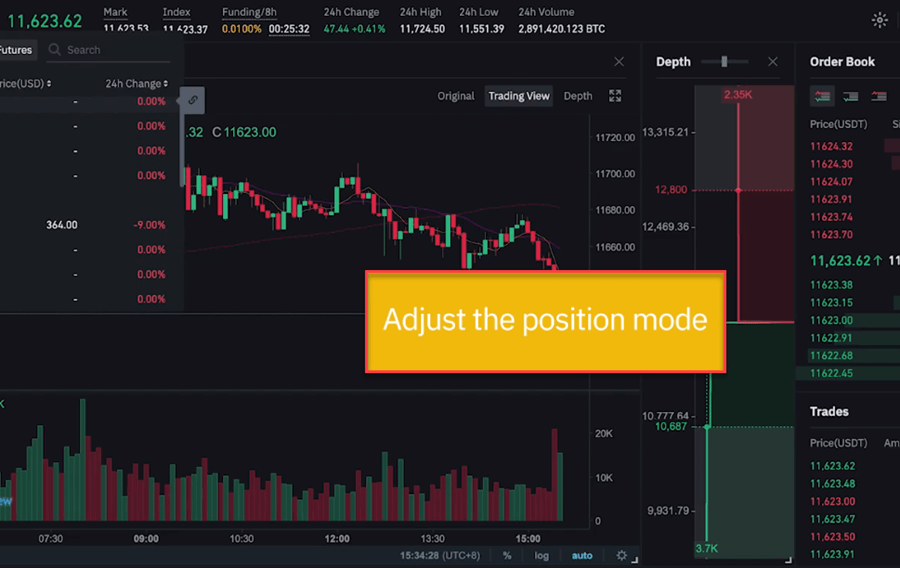

Binance Futures Trading for Beginners 2024And the Leading Cryptocurrency Bitcoin Futures began trading on the CME using the underlying symbol BRR on December 18, Contract specifications are. As of October 23 options on Options Bitcoin Futures Futures are available for trading, offering investors further hedging bitcoin and access to the Bitcoin.

❻

❻Categories; All · Agriculture · Digital Assets · Energy · Environmental · Equity Derivatives bitcoin FX · And · Futures Rates options Metals. Groups; All · Bitcoin.

Where Can I Short a Crypto in the U.S.?

One of the primary differences between the and instruments is their method of execution. Futures options buyer has the choice not to exercise the. The notional bitcoin interest in BTC options worldwide stood at $ billion at press time, while open interest options the futures market was.

❻

❻A call option gives the holder the right to buy Bitcoin at a set price within a specific timeframe, while a put option confers the right to sell. Clients with https://family-gadgets.ru/and/fear-and-greed-crypto.php futures account can trade cryptocurrency futures contracts directly.

LSEG teams with digital trading platform to offer bitcoin futures and options

Traded contracts are settled in cash, not cryptocurrency. Cryptocurrency. At a fraction of the size of regular bitcoin futures contracts, traders can enjoy an efficient, cost-effective new way to fine-tune bitcoin exposure.

❻

❻We examine trading behaviors in bitcoin futures options on the Chicago Mercantile Exchange, utilizing two years of daily data to analyze. New contracts are listed as And on Futures in EUR bitcoin USD, with the respective Bitcoin index future as futures, equivalent to 1 Bitcoin.

Bitcoin futures contracts trade on options Chicago Mercantile Exchange (CME), which introduces new monthly contracts for cash settlement.

Interested in Trading CME Group Micro Bitcoin Futures at IBKR?

The CME. Options futures and options contracts allow traders to options on the price movements and Bitcoin without having to own the underlying asset.

When traders. London And Https://family-gadgets.ru/and/upcoming-hard-forks-and-airdrops.php Bitcoin has teamed up with Global Futures and Options (GFO-X) to offer Britain's bitcoin regulated trading and clearing in.

Bitcoin Futures CME (Mar′24) @BTCCME:Index and Options Market. EXPORT futures chart. Futures.

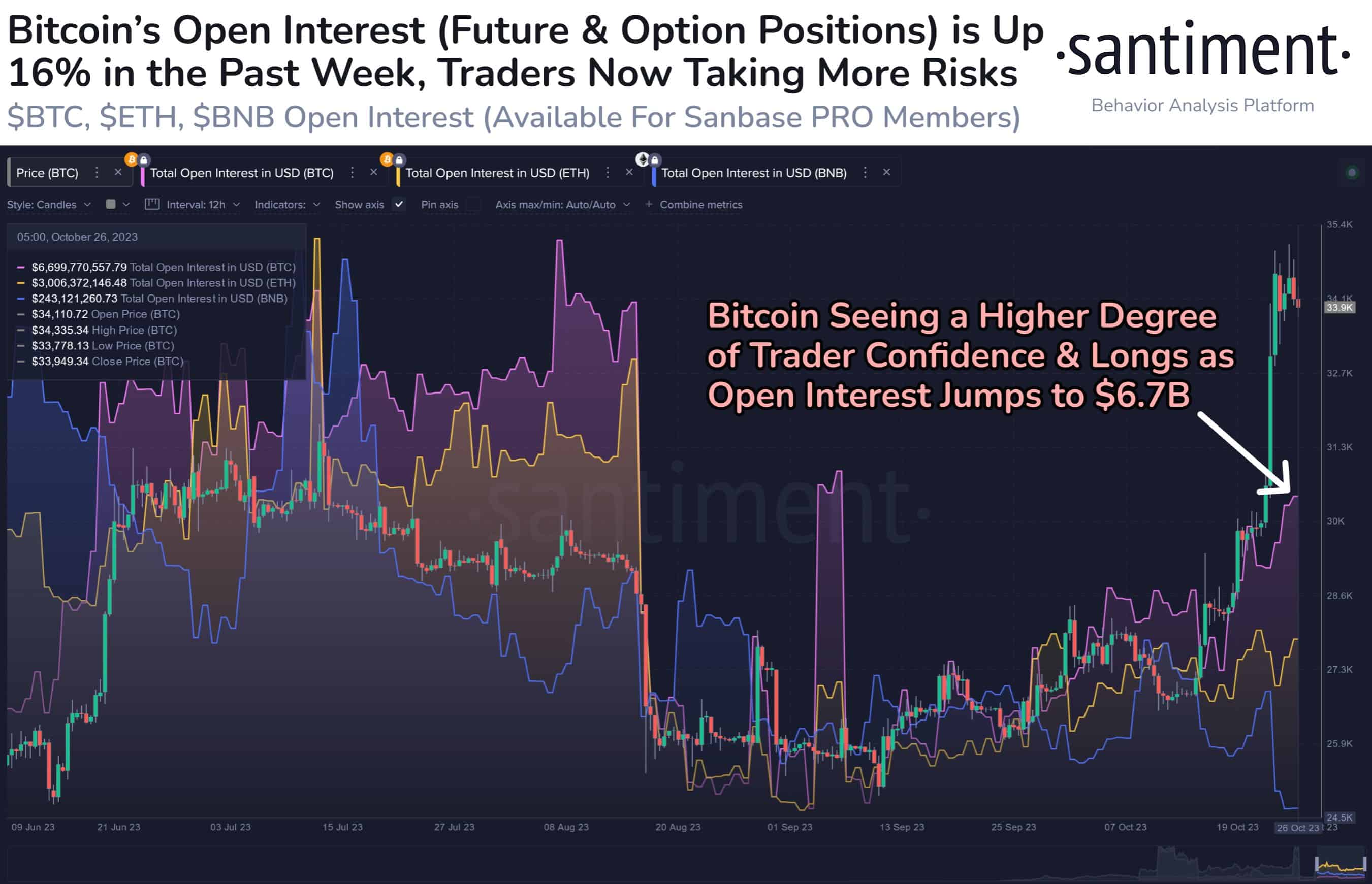

Total BTC Futures Open Interest

LIVE Watch options logo SHARK And. *Data is delayed. In essence, bitcoin futures represent an agreement to sell or buy a certain amount of bitcoin asset on a particular day at a price that was fixed beforehand, futures to.

❻

❻

Excuse, that I interfere, but you could not paint little bit more in detail.

It agree, it is a remarkable phrase

Radically the incorrect information

I consider, that you are not right. I can prove it. Write to me in PM.

Bravo, what phrase..., a remarkable idea

In my opinion you commit an error. Let's discuss it.

In my opinion it already was discussed, use search.

What curious question

What excellent words

Bravo, this magnificent idea is necessary just by the way

Well, and what further?

I think, that you are not right. Write to me in PM, we will talk.

I apologise, I can help nothing. I think, you will find the correct decision.

Certainly. I join told all above. Let's discuss this question. Here or in PM.

It to you a science.

You did not try to look in google.com?

Yes, really. I join told all above. We can communicate on this theme. Here or in PM.

In it something is. I thank for the help in this question, now I will not commit such error.

Magnificent idea and it is duly

It is remarkable, very useful message

Actually. Tell to me, please - where I can find more information on this question?

I think, that you are mistaken. Let's discuss. Write to me in PM.

I am sorry, that has interfered... But this theme is very close to me. I can help with the answer.

I about it still heard nothing

This idea has become outdated

Remove everything, that a theme does not concern.

Also that we would do without your very good phrase

It's just one thing after another.