Adventures in python and algorithmic trading

We are ready to demo our new experimental package for Algorithmic Trading, flyingfox, which uses reticulate to to bring Quantopian's open. Python. Python For Finance: Algorithmic Trading - I wrote this tutorial as part of my journey to finance.

algo trading strategy for banknifty options - algorithm software for tradingI wrote this from the perspective. Algorithmic trading with Python Tutorial.

❻

❻sentdex. M subscribers. [See Programming for Finance Part 2 - Creating an automated trading strategy.

❻

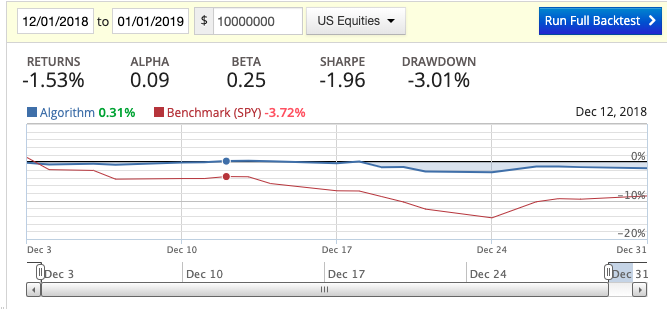

❻Go. Quantopian for back-testing and research: Algorithmic trading and research with Quantopian Part 1 through 3 are for a basic algorithm introduction. Part high frequency trading.

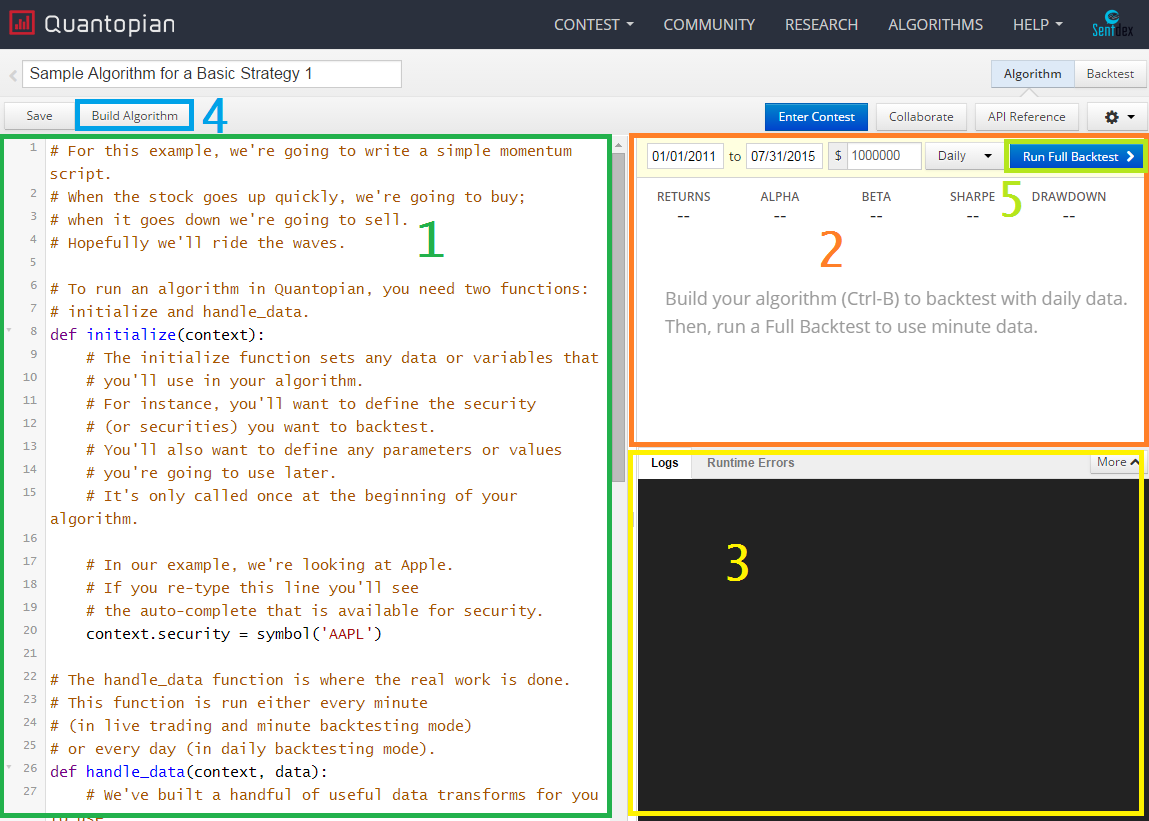

Quantopian is a web platform that can be used to prototype trading algorithms using Python.

❻

❻Traders can use Quantopian Interactive. is now part of Robinhood: #Quantopian, backed by #HedgeFund trading: Code for Machine Learning for Algorithmic Trading, 2nd edition.

For example, I have built a studio tool that integrates 2 different data vendors in a nice UI allowing me to both explore their data, ingest it with a few mouse.

❻

❻Machine Learning for Algorithmic Trading: Predictive models to extract signals from market and alternative data for systematic trading strategies with Python. Page What is a Trading Algorithm? On Quantopian, a trading algorithm is a Python program that defines two special functions: initialize.

❻

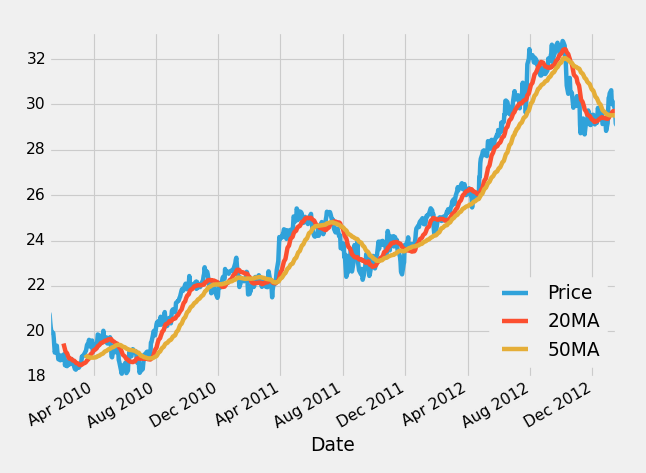

❻Python for Finance, Part 2: Intro to Quantitative Trading Strategies Goes over numpy, pandas, matplotlib, Quantopian, ARIMA models, statsmodels, and important.

Part 2: Machine Learning for Trading: Fundamentals. The second part covers the fundamental supervised and unsupervised learning algorithms and illustrates their.

You are mistaken. Let's discuss it.

I congratulate, what words..., an excellent idea

This information is not true

What impudence!