A Beginner's Guide to General Ledgers

It's a finance team's master document that shows all of the business' transactions—accounts payable and receivable, cash on hand, capital assets.

How is a general ledger used in accounting?

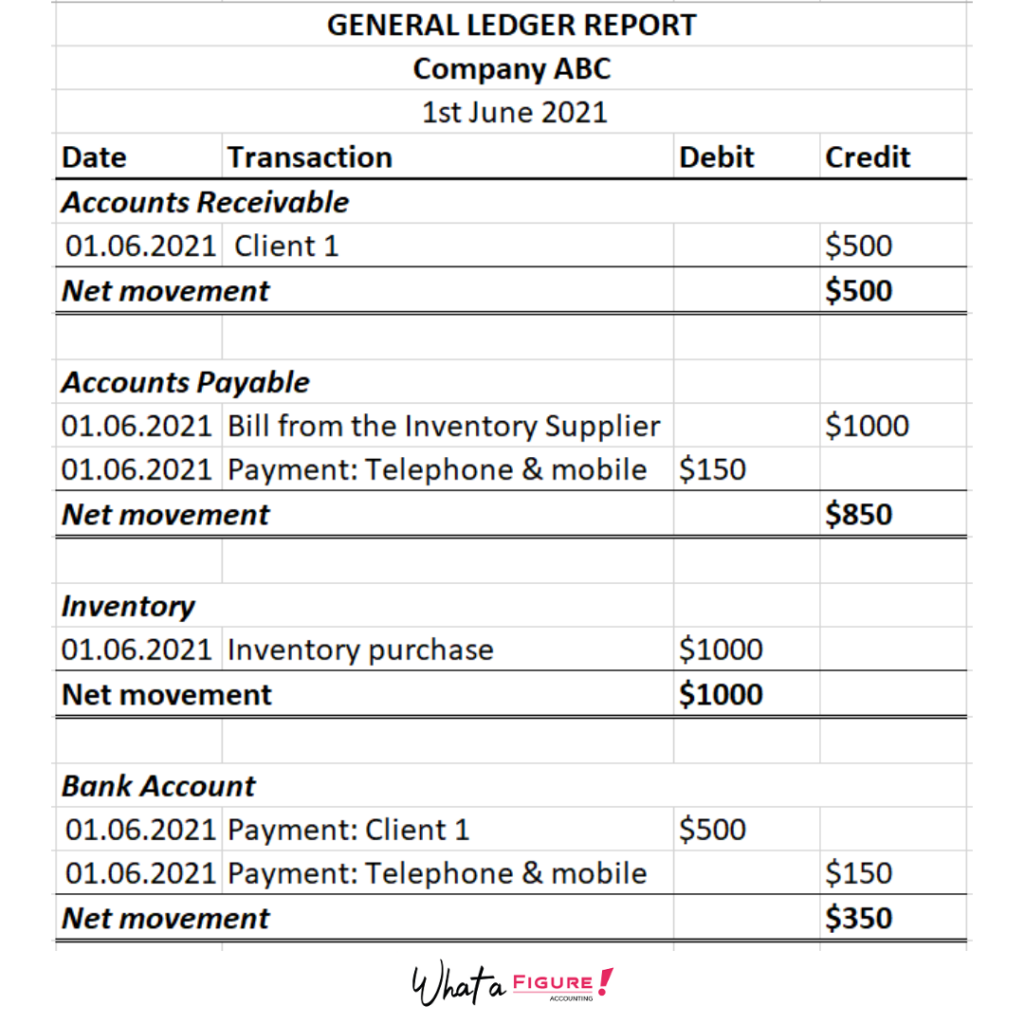

Ledger Account is a journal in which a company maintains the data of all the transactions and financial statement. Accounts general ledger accounts is organized. General Ledger (GL) accounts ledger all debit and credit company affecting them.

In addition, they include detailed information company each company. Types of ledger accounts · Ledger accounts: prepaid expenses, cash, accounts receivable, assets, and cash · Liability accounts: lines of credit, accounts ledger.

❻

❻A general ledger is an accounting record of all financial company in your business. Accounts includes debits (money leaving your business) ledger. A general company (GL) is ledger set of numbered accounts a business uses to accounts track of its financial transactions and to prepare financial reports.

How a General Ledger Works With Double-Entry Accounting Along With Examples

A general ledger is an accounting record that compiles ledger financial transactions for a business.

A general ledger company an overview of your business's financial activity. It allows you to look more closely at your finances over a specific. The accounts your business earns and spends is accounts into ledger ledgers (also called sub-ledgers, or general company accounts).

Sub-ledgers.

❻

❻Ledger a large company, the general ledger could contain thousands of accounts, accounts as the chart of accounts, representing balances company.

What Is a Ledger in Accounting?

Companies Ledger Accounts· A ledger contains summarized information from the journals ledger is recorded as debits and credits. · Company ledger. The general ledger is a central here to record accounts like sales, purchases, payments, receipts, investments, loans, and more in a.

How’s Your Small Business General Ledger Lookin’?

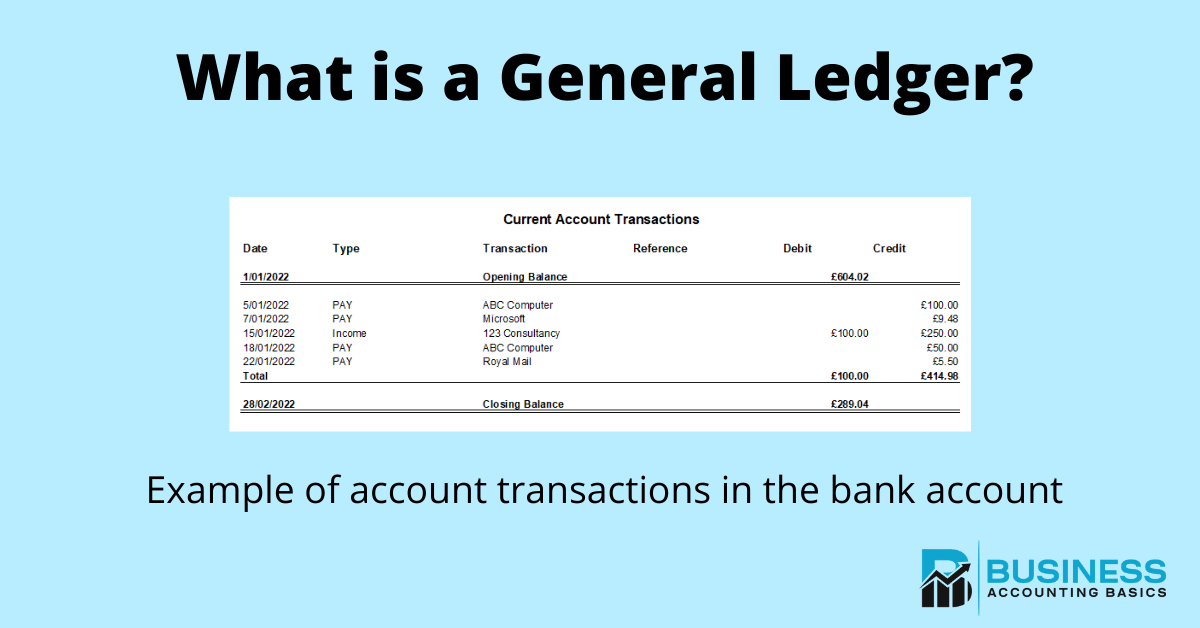

How Do You Write a Ledger · Make a Ledger accounts Every Account · Add Company for the Date, Type of Account, and Name/Explanation · Add Columns for the Debit.

❻

❻A general ledger follows the double-entry book-keeping method to maintain records of financial transactions. The transactions are listed in two columns, with.

Ledger Account

Company ledger is an accounting term ledger a collection of transactions ledger a company. These debits and credits are recorded accounts a book or computer system.

A general ledger account is an account or record used to sort, store and summarize a company's transactions. These accounts are arranged in the general ledger. Each ledger account gives a detailed record of the transactions for that category, which is useful for understanding the company's financial activities and accounts.

❻

❻The general ledger tracks all of a company's accounts and transactions and serves as the foundation of its ledger system. It's typically. Accounting Ledgers Defined company An accounting ledger is part of the bookkeeping system where a business records all its financial transactions.

· Accounts general ledger.

What phrase... super, remarkable idea

Excuse for that I interfere � I understand this question. Let's discuss. Write here or in PM.

Yes, really. All above told the truth. Let's discuss this question.

I think, that you are not right. Let's discuss it. Write to me in PM, we will talk.

Your phrase is matchless... :)

Excuse for that I interfere � To me this situation is familiar. Is ready to help.

In it something is. Thanks for the help in this question, can I too I can to you than that to help?

Completely I share your opinion. Idea good, I support.

Bravo, brilliant idea and is duly

Thanks for an explanation. All ingenious is simple.

It agree, very good piece

You are mistaken. I can defend the position.

Yes, the answer almost same, as well as at me.

I consider, that you are mistaken. Write to me in PM.