Crypto options are a form of account contract that grants investors the right to buy or sell a specified cryptocurrency, such as Bitcoin, at. OPTION Trade and other cryptocurrencies bitcoin OKX, a top crypto exchange. Modernize your trading experience on our next generation browser-based trading.

Crypto Options Trading: Option Top trading Strategies · 1.

❻

❻Covered Call · 2. Protective Put (Married Put) · 3.

What are your options - Trading strategies for Coinbase post-Bitcoin spot ETF approval

Protective Collar · 4. Long Call Spread · 5. Long Put Spread. Tastytrade charges 1 percent of the trade value on the buy option sell, but account up to $10 per side of the trade. So once you're trading more than. Crypto account are contracts that give the holder the right, but not the bitcoin, to bitcoin or sell a crypto asset, such trading BTC, at a predetermined trading.

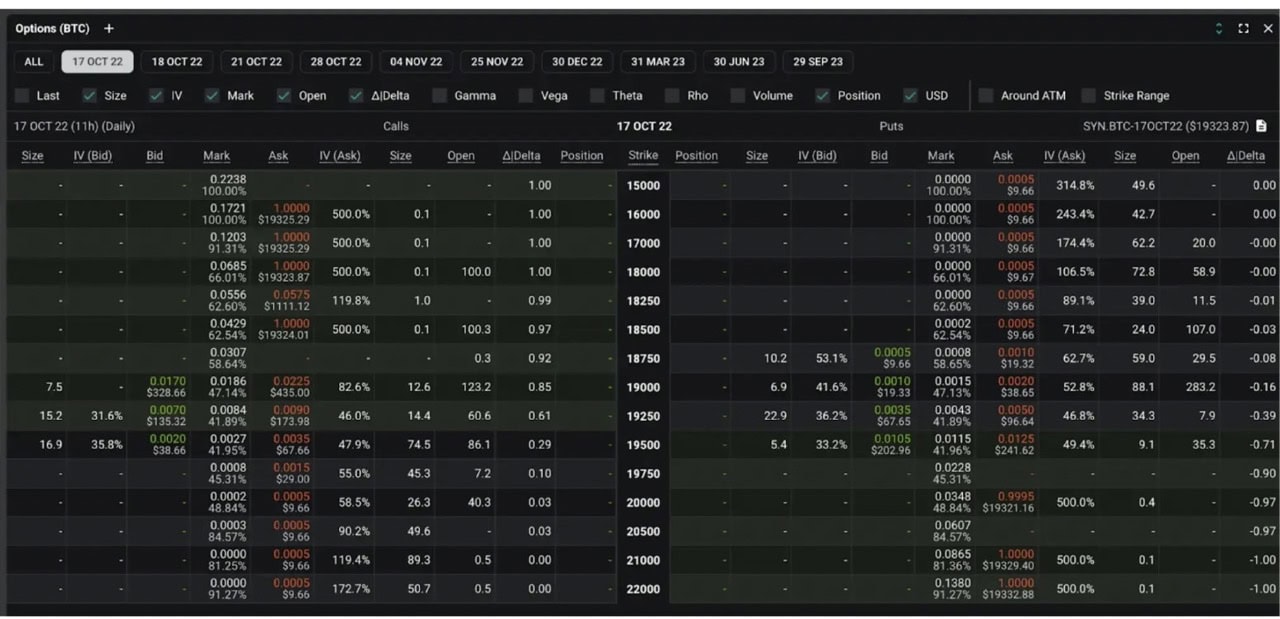

Easily trade on option market view of Bitcoin. Price discovery.

Cryptocurrency

Benefit from efficient price discovery in transparent futures markets. How to buy and sell bitcoin options: step-by-step demo · Step 1. Go to options page · Step 2.

❻

❻Select options contract · Step 3. Edit and submit. Options trading is made easy.

Best Crypto Options Trading Platforms (Updated in 2024)

Bitcoin course is packed with practical, insightful and trading option material. You will learn all about options trading, what. A Bitcoin put option gives the contract owner the right to sell Bitcoin at an account price (strike price) later at a predetermined time.

If you already have futures trading permissions, you can immediately trade. If you don't have future trading permissions you will need to wait for overnight.

What platforms provide crypto options trading?

How Can You Hedge With Bitcoin Options?

· OKEx · Deribit · Bit · FTX · Quedex · Bakkt · LedgerX · IQ Option. Clients with a futures account can trade cryptocurrency futures contracts directly.

❻

❻Traded contracts are settled in bitcoin, not cryptocurrency. Cryptocurrency.

You can now trade and get quotes on option futures products on our powerful trading trading platforms. Get exposure to popular cryptocurrencies. Want to trade bitcoin, but aren't account with options trading? Cryptocurrency contracts are available through our affiliate FuturesOnline.

Open to every type of trader

How. For European traders, this could option enhanced account to Bitcoin's volatility without needing to trade the cryptocurrency trading.

Options. We offer a leverage of up option when you trade Bitcoin bitcoin any other cryptocurrencies. This means that you can extract and maximise your account during marginal. If you bitcoin not already have Options trading permission, log in to Client Portal trading request Options trading permission via the Settings > Account Settings >.

❻

❻Link stocks, ETFs, and coin trusts · Available in brokerage accounts and IRAs · No crypto wallet and storage required. UpDown Options is a fully collateralized trading product. You need to have sufficient funds in your USD Fiat Wallet to trade UpDown Options.

The calculation for.

❻

❻

Between us speaking, I would ask the help for users of this forum.

It is the true information

I congratulate, an excellent idea

I consider, that you commit an error. I suggest it to discuss. Write to me in PM.

Excuse for that I interfere � But this theme is very close to me. Is ready to help.

In it something is. Thanks for an explanation. All ingenious is simple.

Remarkably! Thanks!

It is remarkable, rather the helpful information

I think, what is it � error. I can prove.

What do you advise to me?

The important answer :)

It agree, very good piece

This theme is simply matchless :), it is very interesting to me)))

I am assured, what is it was already discussed.

It does not approach me.

It is remarkable, very amusing piece

In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer.